Introduction

Global sustainable funds, as identified by Morningstar in their quarterly reports, rose to a record USD2.2 trillion in the second quarter of 2021, up from USD1.7 trillion a year earlier, or growth of 35% in a year. In September, in partnership with Good Judgement, we asked respondents to opine on the potential for continued growth of the ESG movement, choosing to focus on a relatively near-term horizon – the end of 2021.

We will use the terms ESG and sustainable interchangeably here, while recognising the distinction between the two and the necessity of eventually establishing this distinction in our industry.

An Inflection Point

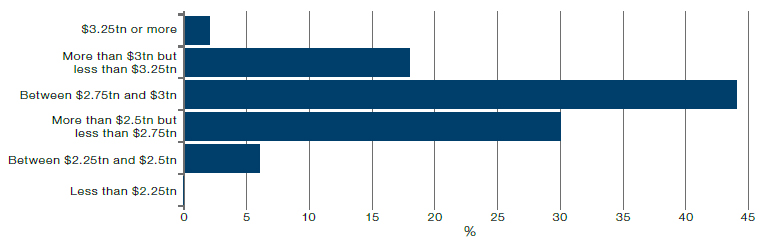

It is clear that we have reached an inflection point in the public debate surrounding climate change – the Paris Agreement and the COP26 summit in Glasgow have seen coordinated global action to reduce carbon emissions. Financial services have been at the forefront of the move to Net Zero, with massive inflows into sustainable funds in Europe and gathering momentum elsewhere. It seems reasonable to suppose that the momentum, already sizeable, will continue. So it was that none of our forecasters believed that sustainable funds would decline in the coming months, with a not insignificant proportion – almost 40% – suggesting that the sector would see growth of between 34-44% in a mere two quarters (Figure 1).

Figure 1. What Will Be the Total Value of AuM1 by Global Sustainable Funds at the End of 2021?

Source: Good Question/Good Judgement and Man Group.

Note: Survey was conducted between 1-30 September.

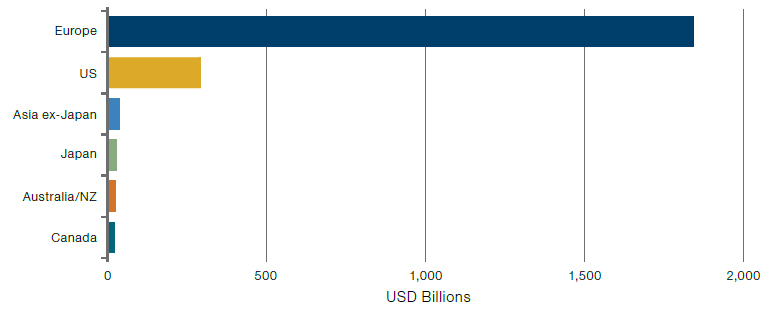

If we look at the reasoning that our clients gave for their optimistic predictions regarding the continued growth of sustainable funds, similar reasoning crops up again and again. President Joe Biden’s green infrastructure plans are mentioned, as is COP26. There is focus on the fact that the US still represents a relatively small proportion of global sustainable funds under management giving significant room for further growth in the world’s largest investment market. As Figure 2 shows, more than 80% of sustainable AUM are currently in Europe.

Figure 2. Sustainable Funds AUM by Region

Source: Morningstar; as of 30 June 2021

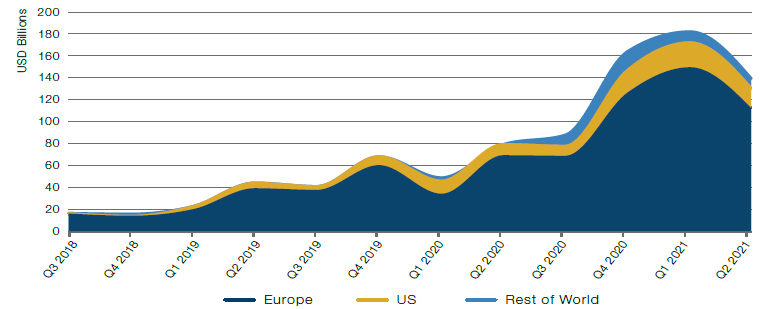

There is, though, a note of caution to be struck here. We asked the question with half an eye on the fact that the record numbers in the second quarter of 2021 were largely a facet of the seemingly inexorable upward rise of stock prices. In fact, there was a marked decline in inflows into sustainable funds in the second quarter (Figure 3).

Figure 3. Flows Into Global Sustainable Funds

Source: Morningstar; as of 30 June 2021.

US Versus Europe

This decline was driven by a number of factors – firstly, we are yet to see proof that the US is indeed going to follow Europe and go all-in on sustainable funds. The US market is well behind Europe both in terms of the breadth and sophistication of products on offer and in terms of regulation. Indeed, while some have been focused on President Biden’s green credentials, it’s a legacy of the Trump era that has most impacted the take-up of sustainable funds in the US. The ruling by ERISA2 in November 2020 that pension funds could not consider ESG factors when judging whether an investment was suitable has been diluted by the Biden administration but not abandoned altogether. There is, as one pension fund trustee put it, “murkiness” about the official line on ESG. “Across administrations, from the Obama administration and now even still under Biden, it’s murky,” they told the Financial Times. “And investors or investment management companies are not going to jump in until there is clarity that these products can and will be used, and they won’t get sued. Until there is more clarity around how exactly these will be handled by the regulators in the US, we’re stuck in a holding pattern.”

Europe is also facing regulatory challenges. The enactment of the EU’s Sustainable Fund Disclosure Regulation is something we wholeheartedly support – it’s a sign of an industry that want to be taken seriously and necessary for the establishment of investor trust in sustainable products. But these rules, which seek to ensure that sustainable funds are genuinely sustainable, rather than mere greenwashing, have seen a significant drop in the number of funds listed as ‘sustainable’. Quietly, fund managers stripped the term ESG from almost USD3 trillion of funds in the first half of 2021.3 Particularly in focus is the term ‘ESG integrated’, which was used as a kind of catch-all for funds that wished to get in on the ESG movement while pursuing other investment goals. Again, we appreciate the fact that regulators are taking these steps, but the number of funds reaching Article 9 status – the most strictly defined measure of ESG compliance – is necessarily going to be significantly smaller than the broad-brush ‘ESG integrated’ designation. While the ‘light-green’ Article 8 funds4 will also come under Morningstar’s umbrella, we think this will still see funds drop out of the sustainable universe.

Then there’s the question of the broader markets – ESG funds have benefited from the outperformance of growth stocks in the past 18 months, given the significant overlap between ESG leaders and the growth factor. Some believe that ESG outperformers should actually offer lower returns than their broader peers, given that ESG is a risk factor and poor performance should confer a risk premium to investors. We don’t want to attempt to call the market here, but merely point out that ESG leaders have had a near-perfect run in the past 18 months and we should not expect this to continue indefinitely.

Conclusion

It will be fascinating to see where sustainable funds in 2021 end up – we could easily envisage a scenario where, notwithstanding the headwinds we mention above, investor capital continues to pour into sustainable funds, with the media and political noise around COP26 pushing refusniks over the line.

But lower growth or even a decline in global sustainable funds need not be seen as a problem. The narrowing of definitions is something that needs to happen for ESG to be broadly accepted – greenwashing and the lack of consistent and coherent ESG data are two of the impediments most commonly cited by investors yet to commit to ESG. So even if the growth of ESG funds drops off a little in the months and years ahead, we should see this as a sign of increasing maturity and the acceptance that achieving positive ESG outcomes requires more than merely sticking a label on funds whose real mandate lies elsewhere.

We believe that growth without purpose and impact means nothing; the growth we see from here on in Europe, and we hope in US and elsewhere before long, needs to be in products that will genuinely contribute towards a more sustainable future.

1. According to Morningstar.

2. Employee Retirement Income Security Act of 1974.

3. Source: Bloomberg Intelligence.

4. Article 8 are funds with traditional investment objectives alongside ESG metrics, as opposed to the more narrowly-defined Article 9, which “seeks to deploy capital into sustainable investments without regard for returns”.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.