Recorded on 19 August 2020

Magic Money

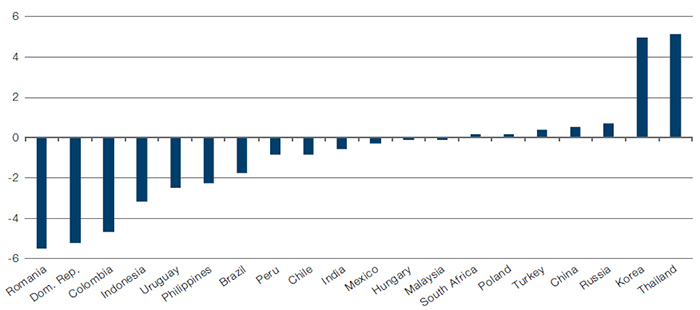

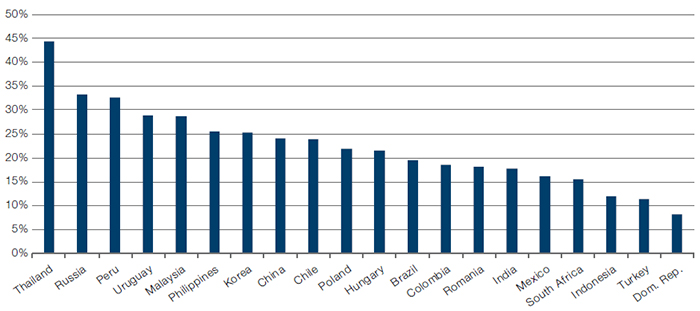

As major central banks embark on another round of bond purchasing programmes, several emerging-market (‘EM’) central bankers have signaled that they stand ready to follow. They argue that the coronavirus pandemic has created unprecedented conditions that allow and require EM central banks to help: inflation pressures have vanished, levels of output and employment collapsed, and many of the largest EM countries have brought current account deficits under control and rebuilt foreign exchange reserves (Figures 1-2). Against this backdrop of vast global liquidity, voices from all sides claim that EM fiscal deficits do not matter and that central banks should finance them via bond purchasing programmes or with the printing press.

Figure 1. Current Account as a % of GDP

Source: Haver Analytics; as of 3 August 2020.

Figure 2. International Reserves as a % of GDP

Source: IMF, Haver Analytics; as of 3 August 2020.

While the pandemic initially helped improve EM political leaders’ approval ratings, these have now taken a turn for the worse. We believe frustration will only grow in the coming months. Even with a vaccine, unemployment is likely to remain elevated throughout EM for a few years. Balance sheet repairing takes time, particularly when there is limited fiscal space to support the private sector during the unparalleled global output collapse.

Our best guess is that balance sheets will continue deteriorating throughout 2021 and that significant repairing may not start until 2023. Political pressure for more spending will be uncontainable despite falling fiscal revenues, and as a result, public debt will have to take a hit. Multilaterals do not have the funding capacity to catalyse these record EM public financing needs. In some cases, IMF financing may do more harm than good, as private credit may be spooked by the seniority imposed on balance sheets with solvency concerns. With debt overhang problems, international capital markets will be reluctant to take the lion’s share of the financing burden. Furthermore, most local markets are not deep enough to absorb the upcoming bond issuance for too long.

Against this backdrop, central banks will probably be called to plug the public funding gaps. In some instances, this would undoubtedly be the right call. For others, it may be a risk worth taking. For a few, risks may outweigh the benefits. Investors will look at weak leadership and fragile balance sheets with concern, as gambling for resurrection is a common political response in EM. Siren’s song will tempt political leaders into QE and central banks will be pressured to take risk. Depending on the case, the right dose may support the long-term value of the currency. In excess, it may trigger a currency run.

So, when is QE worth the risk?

Consolidating Public Balance Sheets

Let’s start with an example of a central bank that embarks on a bond purchasing programme. In most cases, these central banks operate under an explicit or implicit inflation-targeting regime, with rates currently standing above the zero lower bound. When the central bank buys bonds, it floods the market with local currency. To avoid downward pressure on the central bank target rate, which is independently set a level consistent with their monetary objectives on output and inflation, the central bank has to absorb the liquidity by borrowing the excess overnight. Otherwise, the target rate would collapse from the level considered appropriate to reach its monetary objectives.

Consolidating government and central bank balance sheets helps to understand the impact of QE. The central government expands its liability by issuing bonds. The central bank increases its assets with those purchased bonds and boosts its liability by borrowing overnight, after the sterilisation takes place. When both balance sheets are blended together in one ‘public balance sheet’, the bonds financing disappears from the aggregated public balance sheet and only the overnight borrowing remains in the consolidated accounts.

In other words, a central government bond issuance programme supported by QE is broadly equivalent to a central government simply borrowing overnight. Because the slope of the yield curve across emerging markets is positive, this may bring some relief to the country’s budget. In practice, the government pays the long-dated bond rates, while the central bank receives these long rates and pays the overnight, profiting on the spread. Operationally, the central bank rebates those profits back to the Treasury, typical after the fiscal year ends. Thus, the central government ends up effectively only paying the overnight rate.

Two issues distinguish QE from the alternative, where the government borrows directly overnight. The first is that the market may feel safer funding the central bank versus the government overnight, favouring QE. After all, the central bank can print currency if markets decided not to roll, while the government cannot. It is unclear whether this issue cannot be handled were the central bank to commit to extend sizable funding at the overnight rate at the government’s request.1 The second issue relates to accounting. Under QE, the government accounts would display a larger interest bill than if borrowing directly overnight, as long as its yield curve slope is positive. This may be important from a political perspective in times of a pandemic, as some may argue that governments are spending an unproportionally large share of fiscal revenues on interest payments, a particularly sensitive issue in EM.

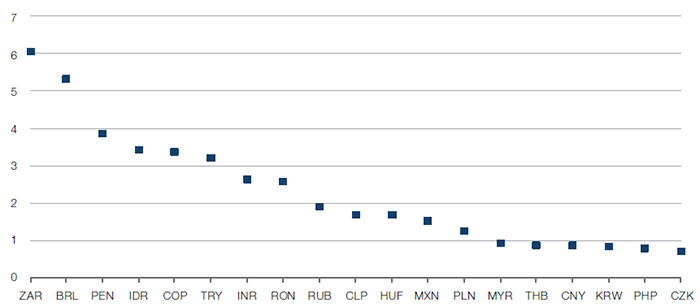

The slope of the local yield curve would tell us which countries would potentially be tempted by QE. Figure 3 shows the ranking of the spread between a 10-year local currency bond yield versus the overnight rate. A country like South Africa is paying more than 600 basis points of term premia for issuing a 10-year bond versus getting funding overnight via QE. Together with Turkey, Brazil, Peru, Indonesia and Colombia, this suggests QE could bring significant budget relief to some.

Figure 3. Spread Between 10-Year Local Currency Bond Yield Versus Overnight Rate (%)

Source: Bloomberg; as of 3 August 2020.

Risks of QE

However, QE comes with risks. Because QE shortens the duration of the consolidated public state, the funding may become susceptible to rollover risk. A robust international reserve position will act as a deterrent (Figure 2). While the central bank can print its currency in times of stress, it can’t do that for too long. Printing currency in times of shortages is welcomed as it avoids unwarranted tightening. Printing more money than the public is willing to hold is not. If the latter, the currency exchange rate will quickly tell. If the fiscal deficit becomes unsustainable and the central bank is perceived to be committed to fund it, a currency run will start.

Extremes

First, take the case of an inflation-targeting central bank of a solvent country that is already at the zero lower bound and, importantly, that is expected to be there for the indefinite future. The European Central Bank and Bank of Japan are probably the best examples. This backdrop implies that aggregate demand is insufficient to meet supply in the foreseeable future. QE would be costless because, as mentioned, it is equivalent to funding the consolidated public balance sheet at the overnight zero rate. In this case, it is optimal to finance deficits because the cost of such policies is zero, and the benefits in terms of employment, activity and welfare are large. Unfortunately, we don’t have any pure examples like this in EM.

Now, take the case of a central bank in a solvent country that is expected to be only temporarily at the zero lower bound, which is the case in the more advanced EM countries. In this case, QE is also costless today because deficits would be financed at or near the zero rate. However, if the economy is expected to improve in the future, a judgement must be made on whether to increase fiscal spending and finance it with QE. This is when the size of the dose begins to matter.

In these cases, the decision to pursue a fiscal expansion should be judged against the alternative. The central bank injection of money will have to be reversed at a cost, given that interest rates will rise in the future as the economy improves. The decision will hinge on whether the fiscal expansion would propel the economy towards its potential faster than otherwise, and whether the extra fiscal revenues produced by the stronger economy justify the added future costs of mopping the added liquidity once the economy has reached full capacity, at a higher cost.

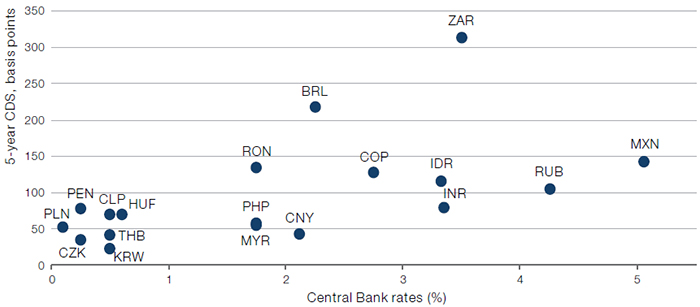

Figure 4 shows the current stance of policy rates in EM on the horizontal axis. Countries like Chile, Thailand, South Korea, Peru, Czech Republic and Poland are effectively at the zero lower bound. With 5-year credit default swaps (‘CDS’) trading below 75bp in all these cases, it suggests that markets consider solvency risks as fairly low, pointing to ample fiscal room (vertical axis). However, the gains from financing a fiscal expansion with QE are not significant because, at least for now, local yield curves are pretty flat. While Mexico has higher overnight rates, the curve is also fairly flat and therefore we don’t see the benefits of QE. In other words, the savings of doing QE over the alternative are very small. One exception is Peru, where the overnight is technically at the zero lower bound and where the curve is indeed steep, indicating that QE could potential bring budget relief. We delve further into this case below.2

Figure 4. Fiscal Space and Overnight Rates

Source: Bloomberg; as of 3 August 2020.

When Does QE Do More Harm Than Good?

Because QE is like financing fiscal deficits overnight, the main issue with QE is the rollover risk. While the central bank can bridge funding shortages for short periods of time, it can’t keep printing money when money demand is collapsing without impacting the foreign exchange. The precondition for stability is the perception of solvency of the consolidated public sector. Else, the public will anticipate that large money printing is not the exception but the rule, triggering a currency run.

In other words, countries deemed to be at risk of insolvency should not attempt QE. Turkey’s 5-year CDS is currently priced at around 600bp,3 suggesting that QE would be a bad idea, as adding overnight liabilities would only add rollover risk to an already vulnerable case with low reserves (Figure 2). The recent case of Argentina is a testament of a run from central bank local short-term liabilities when the perception of solvency of the consolidated public sector fades.

Calibrating the Dose

While any of the other cases could handle some QE, the right size of each programme would hinge on the rollover risk. The case of Brazil is enlightening because two factors advise against pursuing QE. First, the gross general government debt currently stands at 85.5% of GDP, while 66% of GDP is in the hands of the public. Debt dynamics suggest that gross public debt will be at 100% of GDP in 2021 with an unclear path for primary deficits ahead, elevating solvency and rollover risks. Second, Brazil came into this pandemic with significant portions of its public liabilities in short maturities.

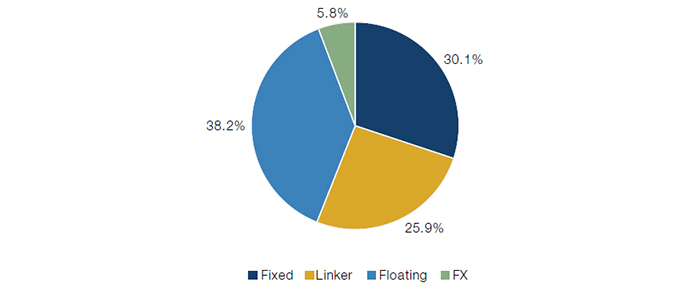

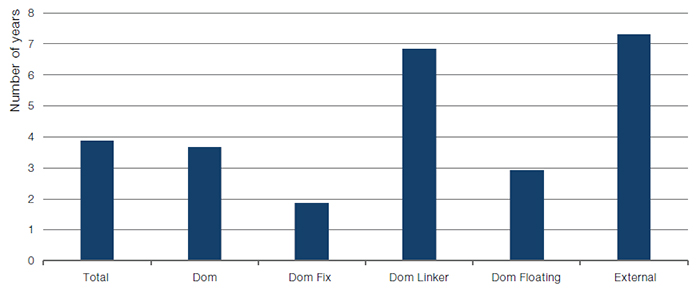

Figures 5-6 show Brazil’s debt composition (floating, fixed, inflation-linked, and FX-denominated debt) and their average maturity by type, respectively. Fixed-interest rate debt accounts for 30% of the total held by the public, while its average maturity is only 1.88 years. Public debt linked to a floating rate accounts for 38.2% of what is held by the public, and its average maturity is just 2.93 years. In our view, adding short-term liabilities to this balance sheet could only expose the Brazilian real to meltdown risks. While the large portion of the domestic debt held in floating rates or with short maturity has brought fiscal relief as interest rate dropped, hiking rates to fend off a currency meltdown may place fiscal dynamics on an explosive path. Unlike the case of Turkey, Brazil could not afford to embark on significant rate hikes to contain its currency without sending fiscal dynamics into disarray, a phenomenon known as fiscal dominance.

Figure 5. Types of Brazilian Debt Held by the Public

Source: Haver Analytics; as of 3 August 2020.

Figure 6. Average Duration of Brazil’s Debt

Source: Haver Analytics; as of 3 August 2020.

South Africa also presents challenging fiscal dynamics, but we believe there is significant room for QE. According to Absa Research, gross government debt will reach 97.4% of GDP by 2023/2024 from 56.5% of GDP in 2018/2019.4 These fiscal dynamics are unsustainable and need to be addressed, which is the reason for the 600bp spread between a 10-year South African government bond (‘SAGB’) and the overnight rate.

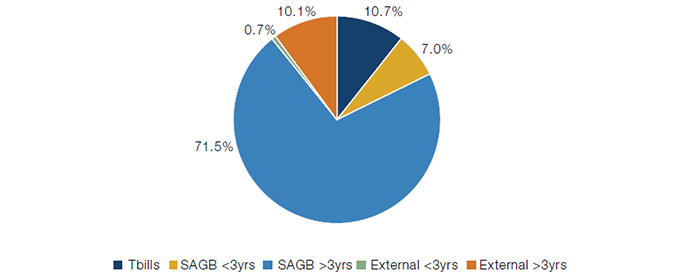

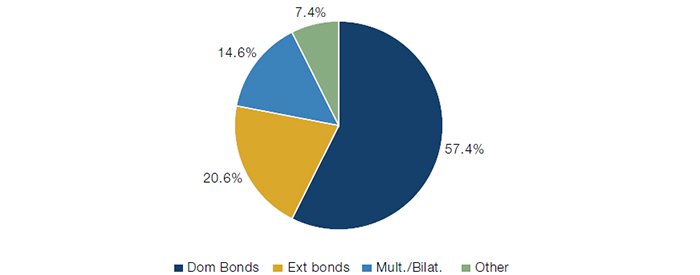

However, South Africa went into this pandemic with a very comfortable debt duration profile, making the country robust against rollover risks and, therefore, suitable for QE. Figure 7 shows that local currency bonds with maturities of more than three years account for 71.5% of the total outstanding debt. The external debt profile is almost entirely maturing in 2024 and beyond (with the exception of 0.7% of the total public debt). Bills, with maturity of less than 12 months, account for just 10.7% of the total public debt and is almost exclusively held by banks. Finally, SAGBs with maturity less than three years only account for 10.1%, making this debt profile one of the longest in EM. While the governor of the South African Reserve Bank remains reluctant to sponsor a large QE programme, we believe the benefits of such policy greatly outweigh the risks, even with such low levels of international reserves.5 A precondition is a sustainable fiscal plan, which is missing. More market pressure may be necessary, but solutions are, at least, still within reach.

Figure 7. South African Debt – Composition by Maturity

Source: Haver Analytics; as of 31 July 2020.

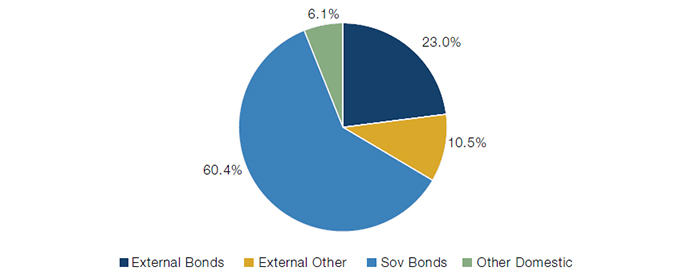

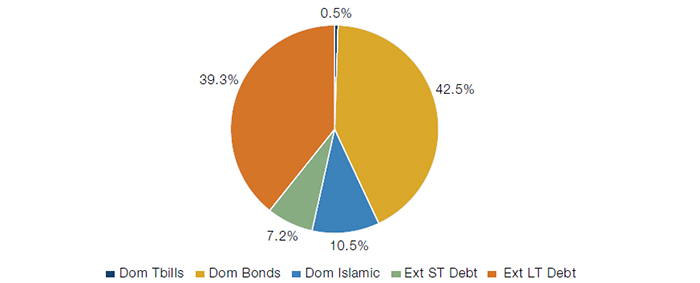

While its conservative central bank is unlikely to pursue QE, Peru exhibits a combination of ample fiscal room and low rollover risk, making it a perfect case for QE to save 370bp on funding the pandemic. GDP is expected to contract by 9% points of GDP in 2020 and its budget balance to deteriorate to -9.2% of GDP, but the country came into this pandemic with a public debt of just 26.2% of GDP. Moreover, the overnight rate currently stands at 0.25%, technically at the zero lower bound, and therefore a large fiscal expansion seems highly appropriate given the potential low cost if funded via QE. Figure 8 shows the broad composition of the public debt, with marketable securities in domestic and external debt accounting for 23% and 60.4% of the total, each with average durations of 7.6 and 8.3 years, respectively. Together with abundant international reserves, this profile shows robustness against rollover risks.

Figure 8. Composition of Peru’s Debt

Source: BCRP; as of 31 March 2020.

With the 10-year rate trading around 300bp more than the overnight rate, Colombia would also benefit from significant savings of embarking in QE. However, give its shorter domestic debt profile and a more limited fiscal space, we believe the risks outweighs the cost. Public debt stood at 51% of GDP at the beginning of the year, while fiscal balance for 2020 is expected to land at around -7% of GDP. Importantly, around 30% of the domestic public debt, which accounts for 57% of the total, matures before year-end 2023 (Figure 10). The rollover risks of adding short-term liabilities via QE seem excessive.

Figure 9. Composition of Colombia’s Public Debt

Source: Banco de la Republica; as of 31 July 2020.

Finally, Indonesia’s public debt stands at 37.7% of GDP, pointing to ample fiscal space to navigate the pandemic. Figure 11 also shows that only a small fraction of the domestic debt accounts for T-bills, while the bulk of domestic debt is almost entirely in fixed coupon with an average maturity of 9.1 years, suggesting rollover risks of QE should be fairly contained. However, while there is room for QE, an undeveloped private pension system, limited international reserves, and a 36% foreign participation in Indonesia government bond securities holdings pose some vulnerabilities on rollover risks. Bank Indonesia has participated in secondary bond purchases and announced it stands ready to upsize QE in the coming months. The bond purchase programme looks manageable because of its initial size, although not free of risk. A history of capital controls also presents a heavy legacy against larger scale QE.

Figure 10. Composition of Indonesia’s Public Debt

Source: Bank Indonesia; as of 3 August 2020.

It’s also worth keeping in mind that rollover risks are affected by many factors, from reputation, external vulnerabilities, private-sector balance sheets, contingent liabilities, sponsoring allies/geopolitics and market structure, to mention a few.

The latter is relevant these days. Local pension funds have been a significant sponsor of the development of local markets and financing for many of these EM governments in recent years, with great macroeconomics benefits induced by the advantage of borrowing in their own currencies. Recent changes allowing for early withdrawal from pension funds in a few of these countries may dent the sponsorship on long dated government yields. This may put even more pressure on central banks to take risks and step on QE.

1. Much like the ECB’s long-term refinancing operations for financial institutions, except geared towards the central government.

2. We ignore the case of Hungary because, through its interest rate swap operations, it is already deep into absorbing dollar duration from the market via interest rates swaps with banks, which has a similar impact than a QE programme.

3. Source: Haver Analytics; as of 3 August, 2020.

4. Source: Absa Research; No easy road to recovery; 3 August, 2020.

5. Source: Speech by Lesetja Kganyago, Governor of the South African Reserve Bank, titled “The coronavirus shock, and the age of magic money”; as of 18 June, 2020.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.