This article was originally published in Forbes on 25 March, 2021.

Introduction

Inflation, like bankruptcy, tends to happen in two stages: gradually, then suddenly. Right now, markets are jumpier than they have been for a while, and inflation is the spectre on the horizon. Hedging against inflation, though, may require investors to take up different tools this time around. The inflation of the 2020s will have a distinctly green tint to it with sustainability and the ESG (environmental, social, governance) movement taking centre stage in the narrative. ESG leaders – those that score highly on non-financial metrics – have already seen share prices rise precipitously in recent years. It could be that the driver of further momentum in these stocks comes from their potential to provide a hedge against inflation.

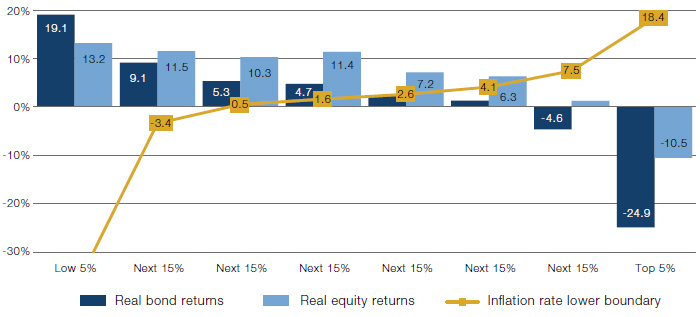

Very high inflation is bad news for both stocks and bonds, something that’s obvious from Figure 1 (from Credit Suisse’s superb Investment Returns Yearbook) but which only more seasoned investors will have experienced first-hand. We’ve lived through three decades of disinflation/low inflation driven by a constellation of factors, from central bank stimulus and low rates to demographics and globalisation. That may all be about to change.

Figure 1. Real Bond and Equity Returns Versus Inflation, 1900-2020

Source: Credit Suisse; as of 31 December 2020.

The first thing to state is that some level of inflation is to be welcomed; it is only at the hyperinflationary extreme that it is problematic. Indeed, many of the social and political issues that we are facing currently, from extremism to populism, would likely be at least somewhat mitigated by a dose of inflation. Those asking if inflation will be good or bad for the ESG movement are missing the point; the two are inextricably linked as ESG is inherently inflationary. We might even call this next regime greenflation.

Bill Gates and the Greenium

To understand this new inflationary pressure, you could do worse than starting with Bill Gates’s presentation of the ‘green premium’ in his book How to Avoid a Climate Disaster. This premium (or ‘greenium’) is, in Gates’s terms, the “difference in cost between a product that involves emitting carbon and an alternative that doesn’t”. Phasing out coal, oil and gas and replacing them with renewable energy will be expensive; rolling out electric vehicles will be expensive; insulating homes and offices will be expensive. So, in short, the greenium is inherently inflationary: we must accept that, in the short term at least, we are going to have to pay more to meet zero-carbon goals, and this will cause prices to rise.

Borrowing to Build Back Better

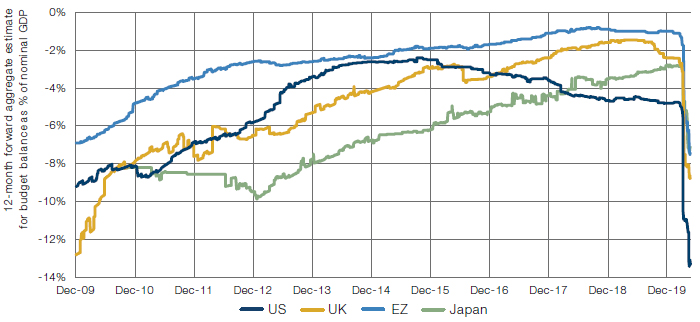

The bulk of the cost of the move to a zero-carbon economy is going to be met by deficit spending from governments, who have used the coronavirus pandemic to take the handbrake off budgetary responsibility and embrace fiscal, alongside existing monetary, stimulus. Figure 2, put together by Man Solutions, shows how swiftly we have moved from governments pursuing austerity and balanced books to a period of dramatic budget deficits.

Figure 2. Budget Balance Estimates as % of GDP

Source: Man Solutions, Bloomberg; as of 5 March 2021.

Data aggregated by the Man DNA team.

It’s important to recognise, though, the way that sustainability has shaped this new world of fiscal stimulus. The EUR750 billion Next Generation EU fund agreed in July 2020 has a clear green mandate, closely aligned with the bloc’s Green Deal framework. While Joe Biden is yet to embrace the Green New Deal proposed by some Democrats, his USD2 trillion Build Back Better Plan seeks to tackle both unemployment and the climate crisis by undertaking green infrastructure spending.

Oil Prices Respond to Capex Drought

Here’s another way in which the rise of ESG will drive inflation higher. Recent weeks have seen a spike in the oil price, from just over USD50 at the end of January to around USD65 currently. What’s striking is that this increase in price has not been met with any meaningful increase in US production, particularly at controversial shale sites. Exploration and production capex is down dramatically among the oil majors, with resources being concentrated on transitioning to renewable energies. This will likely lead to sustained upward pressure on oil prices over the near term as economic recovery and increased demand for oil is met by little new supply and a renewables network not yet sufficiently developed to pick up the slack.

We might also think about a future in which we roll back some of the more expansive networks of globalisation in the recognition that transporting goods vast distances using energy-intensive aircraft, shipping and road freight is not sustainable in a climate-conscious world. Again, this crosses into the social side of ESG, but the kind of de-globalisation that is driven by both environmental concerns and a wish to level up left-behind communities is, again, inflationary, in that it is no longer prioritising low prices over other more ethical/political concerns.

Climate Crisis Gives Green Credentials to Spending Splurge

The key point here is that the significant momentum that has emerged behind the drive to tackle climate change has given ethical authority to fiscal stimulus. And while some will believe that governments are acting irresponsibly in embracing debt-fueled spending, inflation is still relatively low compared with the majority of the post-war period and, again, it is only hyper-inflation that ought truly to worry us. I’m no MMT-acolyte (the movement championed by Stephanie Kelton that suggests that government spending is theoretically limitless), but I do believe that this green fiscal stimulus is worth any subsequent upward tick in prices. The alternative is a very different kind of inflation.

The Network for a Greener Financial System (‘NGFS’) put out a report last year highlighting the potential impact of climate change on the global economy. The picture is unsurprisingly bleak. In particular, the authors point towards the potential for volatile and uncontrolled food price inflation driven by increasing extreme weather events. Not to mention spikes in the cost of everything from housing to insurance that would accompany that dystopian future. The point here is that the coming decades will see higher inflation whichever path we take; I believe that we should recognise that some limited inflation, especially when it’s the right kind of inflation and brought about for the right reasons, isn’t necessarily the worst thing in the world.

A New Way of Thinking About Inflation Investing

What does this mean for the markets? Traditionally, investors have hedged themselves against inflation through commodities, TIPS and other inflation-sensitive investments; we can now consider the possibility of adding selected ESG leaders to that mix, given the tight interlinkage between ESG and inflation. This move to a new regime of green-tinted inflation may well instigate the next stage in the evolution of a market divided between those who have embraced the demands of a zero-carbon future, and those who have not. And while there has already been a significant run-up in ESG leader valuations, this may merely be a reflection of a new paradigm where, in a world of greenflation, stock prices are driven as much by ethical concerns as economic ones.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.