Introduction

In July 2021, the EU set out its intention to becoming climate neutral by 2050. Little over a year later, as Russia cut gas supplies in response to sanctions imposed on the country, tens of billions of euros was spent by EU commissioners on fossil fuel infrastructure and supplies.

These sort of geopolitical situations over the past year have led to concerns around ESG – will it fade away from market consciousness or is it here to stay?

We believe that in addition to the economic realities such as the one described above, there are four additional themes that will impact ESG in fixed income for the year(s) ahead: regulatory frameworks; climate adaptation; biodiversity; and emerging markets, especially in Asia.

Theme 1: Regulation Evolution

Despite regulators pushing to enforce order, guidelines are still incomplete, leaving companies and investors to fill in the gaps the best they can.

2023 is a big year for ESG regulatory frameworks.

In Europe, the EU Taxonomy revenue alignment disclosure and the Sustainable Finance Disclosure Regulation (‘SFDR’) Level 2 will come into force, which will require funds to provide detailed sustainability-related disclosure obligations. Across the Pond, the story is similar: the Securities and Exchange Commission (‘SEC’) is due to publish a slew of disclosure rules on climate, cyber security and human capital. Even Asian markets – which have been considered laggards when it comes to ESG – have started the process of standardising sustainability disclosures. For example, the China Enterprise Reform and Development society, a state-backed think tank, published the first China-focused ESG disclosure standard.1

However, despite regulators pushing to enforce order, guidelines are still incomplete, leaving companies and investors to fill in the gaps the best they can.

For example, regulators are making clear what they think sustainability is with new thresholds and criteria. While positive, this can cause challenges for ESG funds that were established prior to these guidelines.

Additionally, various frameworks have different ways of defining sustainability. For example, the SFDR defines sustainable investments at a holding level, whereas Morningstar considers the fund’s investment objective. Without a commonly agreed upon definition of what ‘sustainable’ is, companies have taken it on themselves to determine the criteria. For example, ESG funds representing more than $1 trillion in assets were stripped of their sustainable tag by Morningstar2 as many funds – which were originally within its sustainable universe – were removed due to not having high enough hurdles, simply relying on exclusions or consider ESG factors in a non-binding way.3 Similarly, about 307 Article 9 funds were downgraded to Article 8 in 2022 by the recent declaration from the SFDR that such funds can only hold sustainable investments (excluding cash and hedging instruments).4

Overall, our view is that not only will we see more regulatory pressure, but that we will also continue to see fund managers grapple with the classifications of their ESG fund thanks to the various interpretations, lack of guidance on how to calculate fund sustainable exposure, and the tightening of the guidelines themselves.

Time to Deliver

In the past, companies were given points for how much they disclosed. The more the better, and if the data had been verified by a third-party – even better! Ambitious promises were also viewed favourably, as it allowed for holdings to screen well from an ESG perspective.

While we agree that disclosure of quality data is critical, the time has come for management to prove that they can achieve those targets as well. As a result of the ‘more is better’ mentality, companies made numerous promises to investors, which will inevitably need to be measured. In the coming years, near-term net zero targets for many corporates are due for assessment. Additionally, the SEC’s ‘Pay vs Performance’ disclosure rule – that requires public companies to disclose the actual relationship between executive compensation and company’s financial performance – will allow deeper scrutiny from investors.

Our Key Takeaways

In fixed income, we expect investors to increase scrutiny on Key Performance Indicators associated with Sustainability-Linked Bonds.

In fixed income, we expect investors to increase scrutiny on Key Performance Indicators (‘KPIs’) associated with Sustainability-Linked Bonds (‘SLB’). An SLB is a bond whose characteristics are based on whether a company meets its sustainability KPIs within a given time frame. Should the issuer not meet its goals, they are penalised in the form of a step up in the coupon paid to bondholders. Unlike green bonds, its proceeds are not earmarked specifically for sustainable activities and can be used to finance any corporate activities. This allows less-than-green companies to access the sustainable debt market as it doesn’t require heavy capital spending on green areas such as sustainable buildings and renewable energy. For example, a pharmaceutical company issued $5 billion worth of SLBs in November 2021. However, it was discovered that the company would use the proceeds to largely repay other outstanding debt. Despite failing to achieve its KPIs, the coupon step-up only amounted to less than $10 million in additional interest on the full amount of debt. After the disastrous issuance of these SLBs – which only saw mild consequences if the company falls short of their sustainable objectives – investors are becoming more aware of greenwashing within the space. Helpfully, the International Capital Market Association (‘ICMA’) has published a KPI registry to help identify the most material sustainability theme per sector.

Overall, management should brace for a new wave of pressure from investors when it comes to their ESG credentials.

ESG investing will mature further as regulations and scrutiny from investors becomes more intense. This is a positive development, in our view, and necessary to prevent greenwashing. However, there are still questions around guidelines and implementations. To stay ahead of the regulatory curve, we believe investors should have good practices such as benchmarking companies towards peers and documenting the history and progress of engagement.

Theme 2: Economic Reality Hits

Rising borrowing costs, the Russian/Ukraine war and a string of climate disasters (such as Hurricane Ian, the European drought and the flooding in Australia and Pakistan, to name a few) in the last year has highlighted the vulnerability of our supply chains and infrastructure.

Despite the increasing costs of climate-related disasters such as wildfires and floods, climate change is a difficult issue for electoral politics to address when its benefits extend beyond the usual 4-year election cycles. The result is that governments opt for short-term solutions to please their electorates over investing in longer-term structural solutions. Companies may follow suit, pulling back on shorter-term ESG initiatives to protect margins. However, despite the effects of climate change becoming even more apparent than ever before, we believe that crisis management will take precedence over climate change. Indeed, we saw how quickly Europe pivoted back to coal as soon as its supply of gas was cut off during the Russian invasion of Ukraine. Germany’s financial regulator BaFin even shelved planned rules for classifying investment funds as sustainable amid the energy shock.

However, it’s not all doom and gloom. The longer-term macroeconomic drivers for ESG still persist. The end of easy Russian gas has delivered the necessary jolt for Europe to rethink their energy policies. Accordingly, European nations have drawn up their REPowerEU plan to reduce dependence on Russian gas and accelerate the green transition.5

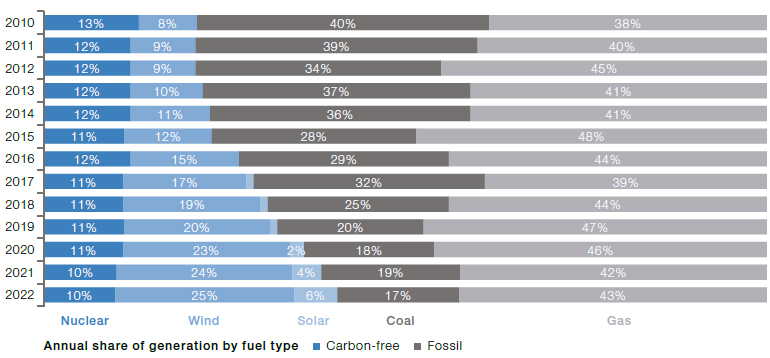

Is the US, ESG-focused investing has become increasingly politically fraught. The Biden administration, for example, has passed the Inflation Reduction Act, earmarking $396 billion for clean energy and sustainable projects.6 At the same time, several conservative states have recently passed or proposed legislation that discourages state entities from working with companies and funds that practice ESG-focused investing. Still, long-term tailwinds persist. Tellingly, Texas – the most aggressive state in reigning in ESG ‘mania’ – has seen incredible growth in their renewables mix (Figure 1).

Figure 1. More Than 40% of Texas Power Was Carbon-Free in 2022

Source: ERCOT; as of December 2022.

Will S Rise?

Workforce-related issues, such as executive pay gap and gender pay gap, inevitably leads to an increased focus on the ‘S’ within ESG when assessing companies.

Besides putting crisis management onto the agenda, we also expect other changes in the ESG landscape to come as the result of the current economic environment of high inflation and stagnant wages – specifically workers’ rights. The tight labour market and the cost-of-living crisis has created a potent mix of unsatisfied workers with significant negotiating power.

Across the globe, hundreds of thousands of workers – from widespread industrial unrest in Britain to Amazon staff – have been holding a series of labour strikes over pay and conditions. While companies have increased wages, the CEO-to-worker compensation ratio remains at a high of 398 times (Figure 2), suggesting there is more scope for labour unrest.7 Despite a looming recession, longer-term drivers such as an ageing population ensures that the tilt of power towards workers will persist. With more strikes on the horizon, this will also garner interest in workforce-related issues such as executive pay gap and gender pay gap, inevitably leading to an increased focus on the ‘S’ within ESG when assessing companies. Simply put, companies with better working conditions have happier employees and will therefore be less prone to labour and supply-chain issues.

Figure 2. Realised CEO-to-Worker Compensation Ratio

Problems loading this infographic? - Please click here

Source: Economic Policy Institute; as of December 2021.

While there has been increased attention on social pillars, we believe that it will not overtake the dominance of the ‘E’ factor simply because social values are ultimately more subjective and less easy to measure.

Indeed, the politisation of ESG in the US has, in our opinion, shown how wildly subjective the S factor of ESG is. For example, an American investing firm that aims to only invest in companies that align with Christian values would deem in vitro fertilisation and covering travel for reproductive health as negatives, while firearm companies would screen positively.8

That being said, we are not arguing against the social pillar itself. In fact, we think it is a critical part in assessing any company. However, its subjectiveness does make it a difficult factor to standardise versus less controversial metrics such as carbon emissions.

Our Key Takeaways

In our opinion, a good ESG investor should not disregard social characteristics or use it as a simple check-mark exercise, but instead consider it within the context of their individual holdings and fund mandate. For example, do social indicators such as gender diversity affect the performance of the company, do they produce the ESG impact that investors want to see when they invest in that company?

Theme 3: Adapt to Survive

The frequency and costs of climate-related disasters will present growth opportunities, especially in the insurance sector.

As the frequency and costs of climate-related disasters increase, we expect climate adaptation to come to the forefront. Near-term annual adaptation gaps, defined as the difference between actually implemented adaptation and resource limitations, are estimated to be between $160 billion and $340 billion.9 Overall, we believe this will present growth opportunities, especially in the insurance sector.

The cost of extreme weather has increased nearly eight times globally since the 1970s (inflation adjusted)10 and we believe this will provide growth opportunities for insurance companies which are climate adaptation enablers. The insurance sector itself also has several regulatory tailwinds – the recent COP27 Loss and Damage fund (which provides insurance for developing economies) gives the industry an opportunity to gain access to previously inaccessible markets. Additionally, insurance is one of the only sectors that will receive revenue credit under the EU Taxonomy per the climate change adaptation environmental objective.11 Within the insurance space, we believe that cyber insurance provides an interesting opportunity set as most corporates still lack a cyber policy and premiums are increasing.12 Surprisingly, despite the tailwinds, ESG funds are generally underweight the insurance sector13 – but not for long.

Our Key Takeaways

The economic reality of higher interest rates and increasing climate disasters inevitably means a focus on climate adaptation. This, in our view, will bring about a whole new opportunity set for ESG investors. As stated above, while social pillars are getting more attention, we believe that the subjective nature of ‘S’ will mean that ‘E’ in ESG will still dominate.

Theme 4: Biodiversity Is the New Buzzword

Following COP15 and the ratification of the Global Diversity Framework, we believe that biodiversity will increasingly be a part of an ESG investor’s agenda. We’ve previously written about how biodiversity is undeniably crucial to the function of the global economy. Indeed, more than 50% of commercially available drugs are synthesized from compounds extracted from non-human species.14

The annual investment needed to halt global biodiversity loss is $967 billion while the current global financing for biodiversity is $124-$143 billion.15 As such, there is a significant investment gap. We believe that biodiversity investment has three areas of consideration:

- Direct impact: Under direct impact, investors look to invest in companies that have a first-order effect on biodiversity. These are usually companies whose primary business comes from resource extraction but are using methods that restores and regenerates the natural resources they use to sustain their business;

- Facilitation: Facilitation refers to biodiversity enablers that provide solutions to the preservation or rehabilitation of biodiversity via their end products. For example, tech companies that create geo-mapping software will fall under facilitation;

- Risk management: From a risk-management perspective, investors should consider how biodiversity can impact the credit-worthiness of a sovereign or a corporate, particularly if they have a heavy reliance on natural resources.

Our Key Takeaways

Thanks to regulatory tailwinds, we will see biodiversity come into focus on the global stage, bringing along significant investment opportunities.

There are several metrics on the market that aim to quantify biodiversity, such as Mean Species Abundance (‘MSA’) and Environmental Profit and Loss (‘EP&L’). However, these metrics fail to create a three-dimensional picture of the issue. For example, EP&L has a strong element of subjectivity as financial costs can be manipulated to reflect better numbers. We thus recommend that investors be aware of the dependencies of their corporates on natural resources, and push management to be on top of their supply chain traceability whilst incorporating biodiversity targets across its entire value chain. It is our opinion that a bottom-up perspective is still the best way to go. A good ESG investor should look at the whole value chain versus just simple metrics.

Theme 5: ESG Everywhere, All at Once

Europe has generally been the leader of the when it comes to ESG. In contrast, emerging markets (‘EM’) have been the laggards.

The desire for a uniform ESG framework and carbon markets in Asia implies that there is appetite for ESG among EM investors.

However, there has been some promising developments in EM, particularly in Asia, with India and Indonesia submitting new and improved carbon targets and China moving towards closer alignment between its domestic green bond standards and international standards. We are also seeing renewed momentum for regional carbon markets in Asia with several national carbon exchanges under development in countries like Malaysia and Singapore.16 While there is no unified reporting structure in Asia, sovereigns are also adopting internationally recognised standards such as the Task Force on Climate-related Financial Disclosures (‘TCFD’).17 The desire for a uniform ESG framework and carbon markets in Asia implies that there is appetite for ESG among EM investors.

Our Key Takeaways

Asia is moving up the ESG learning curve and making significant progress in targets and reforms. We believe that this will open up a whole new pool of opportunities for investors particularly with higher-quality corporates.

Conclusion

Tail risk events like the European energy crises triggered by the war in Ukraine will continue to underline the need to create a more sustainable economy – as will the increased likelihood of severe natural disasters caused by the changing climate especially if action isn’t taken fast enough.

New and exciting opportunities within fixed income mean that investors can assist and benefit from regulatory change, the rapid transition to renewable energy and being at the forefront of environmental investment considerations, such as the increasing importance of biodiversity. Creating a global sustainable economy is not possible without emerging markets closing the ‘ESG gap’. However, there is compelling evidence this is already occurring, which will open up another avenue of investment opportunities.

Despite geopolitical or economic headwinds, our view is that the longer-term drivers will ensure that ESG is here to stay.

1. www.thomsonreuters.com/en-us/posts/news-and-media/china-esg-reporting/

2. www.bloomberg.com/news/articles/2022-02-10/funds-managing-1-trillion-stripped-ofesg-tag-by-morningstar

3. Source: Bank of America; ‘Morningstar’s view on what qualifies as a Sustainable Fund’

4. www.reuters.com/business/sustainable-business/moreeu-green-funds-re-badged-amid-regulatory-drive-morningstar-2023-01-26/

5. ec.europa.eu/commission/presscorner/detail/en/ip_22_3131

6. Inflation Reduction Act Guidebook - Clean Energy - The White House

7. www.epi.org/publication/ceo-pay-in-2021/

8. https://www.bloomberg.com/news/articles/2022-09-21/evangelical-investor-s-2-billion-fund-for-faith-based-stocks?leadSource=uverify%20wall

9. Source: UNEP.

10. Source: Barclays; ‘Gloomy Forecast: The economic costs of extreme weather’

11. Source: Goldman Sachs; ‘An Undepreciated Climate Adaptation and EU Taxonomy Opportunity’.

12. Source: Barclays; Digital Security: Exploring Opportunities in Cyber-protection.

13. Source: Goldman Sachs.

14. Source: ‘Biodiversity, traditional medicine and public health: where do they meet?’; Alves, Romulo and Rosa, Lerece; Journal of Ethnobiology and Ethnomedicine; 2007

15. www.paulsoninstitute.org/conservation/financingnature-report/

16. Asian Bourses Join Billion Dollar Race to Tap Carbon Offset Boom - Bloomberg

17. Source: Bank of America; Five themes for the year (or years) ahead.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.