Introduction

In an earlier article, we wrote about our expectations that the monetary policy path would continue to be restrictive and that rates would remain higher for longer, which is now playing out and we are seeing the market grappling with this new reality. This is likely to create pressure points, particularly in the more cyclical parts of the credit market, such as those issuers with low margins or less pricing power, as well as debt that comes with floating rates. An important factor that has generally been missed, but highlighted in surveys such as the US SLO, is the likely potential for tightening of credit availability which should put pressure on cyclical spreads at the very minimum and increase dispersion more broadly.

Figure 1. Credit conditions index: Historical series1

Source: American Bankers Association, as of 26 September 2023. Available here: credit-conditions-index-q3-2023.pdf (aba.com).

Assessing value on an absolute basis

Looking at the credit market in aggregate masks the dispersion we are seeing across geographies and sectors. Focusing on the high yield (HY) index, 64% of its constituents trade at spreads at first quartile levels (394 bps) while 13.7% of the market trades at spreads at fourth quartile levels (645 bps). A similar dynamic is visible in the emerging market HY corporate market. In global investment grade (IG), we are seeing more opportunities in credits offering elevated spreads and reflecting potential recessionary conditions. Opportunity exists for the more discerning investor, but it is almost certainly not a beta or passive opportunity, particularly in the HY or EM markets.

Figure 2. Time to be selective, not to own the entire market

Problems loading this infographic? - Please click here

Source: Bloomberg, ICE BofA, as of 29 September 2023.

The phenomenon is notable given the deteriorating fundamental backdrop. A rise in interest costs and weakening earnings has led to a drop in interest coverage and higher leverage ratios. It may take a few more quarters, but we do think that aggregate spreads will need to reflect this fundamental deterioration as well as the rise in overall bankruptcies which has been trending up over the past few quarters.

Figure 3. Q2 2023 credit fundamental summary

Source: Bloomberg, S&P Capital IQ, Morgan Stanley Research, as of 30 June 2023.

On a yield basis, investors continue to be handsomely rewarded relative to history with percentiles still at the upper end of the spectrum.

Figure 4. Yields: Investors continue to be handsomely rewarded relative to history

Source: Bloomberg, ICE BofA, JP Morgan, as of 29 September 2023.

Additionally, investors can enjoy a substantial margin of safety with break-even levels remaining elevated across many markets providing significant protection against a widening spreads or higher yield environment.

In terms of opportunities elsewhere, there has been an uptick in convertible bond issuance, while issuance also remains healthy in HY and loans – offering opportunities for buyers. However, the competition for banks to fight back against the growth in private lending may lead to further deterioration in fundamentals, so a healthy dose of caution is warranted.

In addition, there is a growing opportunity set in shorter duration credit which is trading at dislocated prices, where there is some uncertainty from the market regarding the ability to refinance. This can lead to attractive opportunities, particularly in asset-heavy companies, but requires extensive due diligence, particularly in relation to the sponsors. This can also be a fertile hunting ground for issuers likely moving into distressed territory in the next few years and which could benefit from a right sizing of their capital structure and/or other flexible capital solutions.

Figure 5. Global HY market – Over $500 billion matures in less than three years

Source: Bloomberg, ICE BofA, as of 29 September 2023.

Q4 2023 Outlook

At Man, we have one overriding principle: we have no house view. As such, portfolio managers are free to execute their strategies as they see fit within pre-agreed risk limits. Keeping that in mind, the outlooks below are from the different credit teams at Man.

Global Investment Grade:

With all in yields remaining high, we think investors can continue to benefit from an allocation to IG credit. Inflation is trending lower, which will remove a significant amount of pressure from central banks and ultimately should make owning duration a key component of an investor’s asset allocation. We continue to keep a wary eye on the US as bank fragilities are likely to increase the chances of a hard landing. At the same time, valuations in the US remain more expensive than in Europe.

Whilst we are constructive on the broader market, we believe dispersion between sectors, geographies and single names has created deep value opportunities for bottom-up investors to generate strong excess returns over the medium term. We continue to see value in Europe, with a focus on financial companies, which are in a robust position compared to their US counterparts. Although value has started to emerge, we continue to take a more cautious view on non-financial cyclicals. As growth slows, we believe a higher risk premium will need to be attached to these sectors as demand slows and profitability weakens. All in all, we see dispersion increasing as growth slows and believe the backdrop creates an attractive opportunity set for high conviction and active fund managers.

Global High Yield:

In many ways our outlook has not changed from prior quarters. The consequence of tighter monetary policy will be slower growth and we have yet to see a recessionary premium in cyclical parts of the market. Looking forward, we expect dispersion to accelerate and create more opportunities for investors. We maintain a strong preference for first lien and secured exposures and will be guided by bottom-up fundamentals in terms of where value resides. This is pointing us towards senior financials, gaming, consumer staples and special situations in real estate and business services.

Specifically, we believe the senior unsecured credit of European financials offers attractive value. Our focus is on mortgage lenders rather than banks that are more exposed to SME lending or investment banking. We also believe Europe provides a much more promising backdrop relative to the US given the latter’s less stringent regulations for regional banks. In Europe, capital ratios must be kept at elevated levels across large and smaller banks which has resulted in less vulnerability across Europe. In the US, deposit outflows and significant lending into the commercial real estate (CRE) market implies a stretched capital position.

Figure 6. Required CET1 risk-based capital ratios for banking union Significant Institutions and US banks, compared by US bank category size, as of Q4 2022

Source: ECB, as of 31 December 2022. Available here: Banking supervision beyond capital (europa.eu).

The current backdrop remains promising for both global dislocation and special situations investments with monetisation timelines of between one and three years as bonds approach maturity dates. 29% of the global HY market has a maturity date within the next three years, totalling more than $590 billion. This segment of the market has an average option-adjusted spread of 752 bps, yield-to-worst of 12.0% and an average price of $90.2 We are focussing primarily on performing dislocations where bonds offer a material discount to par with the aim of capturing par by the end of the reinvestment period in 2026.

Emerging Market Debt:

The outlook for EM is challenging due to declining global liquidity and higher core yields, which may not be absorbed by low-risk premia in hard currency (HC) and local currency (LC) markets. Additionally, market positioning is still extended.

In HC, both the J.P. Morgan Emerging Market Bond Index (EMBIG) Investment Grade and EMBIG (excluding CCC credits) are trading at levels lower than their 10-year average by more than one standard deviation. Therefore, there may be limited room for further tightening, while spreads could significantly widen due to continued monetary tightening. Distressed names may offer case-by-case opportunities, but selectivity is crucial, especially after a strong rally this year.

In LC markets, interest carry and price return have driven performance year to date, but there are hurdles for future gains, including higher core yields, and the easing cycles that have started for some EM central banks. Additionally, the EM inflation outlook is becoming less certain, in contrast to the broad-based disinflation trend of the past four to five months. The underwhelming growth outlook in China is likely to add vulnerability to commodity-exporting currencies. Lastly, market positioning remains extended.

Emerging Market Corporate Bonds:

We believe that valuations in the EM corporate bond space remain fair - and in fact tight in a few pockets at an index level once China HY is stripped out. With that said, we are positive about the opportunity set going forward, with dispersion likely to remain high due to uncertainty over the future pathway of growth.

We remain sceptical that China’s fiscal policy will come to the rescue of growth and believe there is still some downside risk to real estate in this market. The market remains fixated on what the next China fiscal policy measure might be and while this might support growth, homeowners and certain real estate projects, we are doubtful that this will be a bailout of offshore creditors. We prefer to play China’s recovery selectively via some industrials and Macau’s gaming sector.

Outside of China, we see opportunities in India, mainly geared towards short-dated paper of high-quality credits in a variety of sectors, as well as special situations in Indonesian HY. In Turkey, we see opportunities in companies that are net cash and retain strong fundamentals with limited downside risks related to currency devaluation and in Latin America, we are becoming emboldened by opportunities in Mexican banks, Brazilian oil field services and within Brazilian special situations.

We expect the primary market to become more active in the coming months after a long period of hibernation and we aim to selectively capitalise on opportunities in this space, though we retain a degree of caution given the difficult macro conditions still percolating in both developed and emerging markets.

Convertible Bonds:

We have recently seen signs that rates will remain higher for longer than expected, with some investors now of the belief that rate hikes have further to run. Such a move would be negative for traditional fixed income assets with their higher duration (5.8 for IG, 3.5 for HY and 7.2 for government bonds). Conversely, global convertibles have a duration of just 2.1. Higher rates also lower the probability that economies can avoid a hard landing.

The current set-up for convertibles remains favourable for those required to be invested in equity markets. As has been well documented, equity market strength has been driven by a small handful of mega-cap tech names that are not represented in the convertibles space. Conversely, many convertible bond issuers remain oversold and provide attractive opportunities on the upside. While deltas (equity sensitivity) remain low versus historical levels, this also provides strong downside protection in the event that markets move lower. The positive convexity feature of convertibles means deltas will expand on a move higher in markets, however.

The higher for longer rates environment, as well as an upcoming maturity wall, bode well for new issue volumes in the convertible bond space as firms seek to reduce their financing costs and capitalise on strength in equity prices.

Convertible Bond Arbitrage:

We believe Europe offers better value than the US and Asia in this space. European realised volatility continues to remain near recent lows and implied volatilities have continued to grind lower as a result. This overall cheapening has been exacerbated by a combination of increased primary in Asia and the US, prompting a rebalancing from the EU to the US and Asia, as well as continued redemptions from long only participants. This cheapening has been most pronounced in balance and lower delta, in particular, in longer duration convertibles. The cheapness should also be taken in the context of the more normalised rate environment which makes the equivalent cheapness look even more attractive compared to recent points like March 2020 and July 2022. These valuation lows would however rely on the European Central Bank (ECB) cutting rates or intervening in a broader risk off move. If rates continue to remain elevated and there is no wider market shock that prompts the ECB to cut rates, a 2% cheap universe still presents an attractive entry point to opportunistically scale in, in our view.

We anticipate significant opportunities in the event driven space for idiosyncratic selection, driven by factors such as buybacks, M&A and other market prospects. We also believe the rise in stress and dislocation will create more credit specific opportunities.

Residential Mortgage-Backed Securities (RMBS):

US housing has been characterised by some interesting market dynamics as we have moved through 2023. Nationally, home prices have rebounded above the 2022 peak despite previous forecasts of impending doom. Most analysts now project that national home prices will be flat to slightly up in the coming years, range-bound due to competing push-pull forces of supply/demand and unaffordability pressures. Near-record low inventory and homeowners incentivised to stay in place to protect their historically low 30-year fixed rate mortgages, have combined with high demand driven by household formations to protect against a price correction despite a run up in mortgage rates to north of 7%. This stabilised and relatively healthy market contrasts with many CRE sectors, where negative leverage and refinance risk (borrowing costs in excess of investment yields) and underlying fundamental deterioration has led to falling asset values. Adding to this differential in price/valuation is the fact that residential houses are valued by the homeowner bid for a primary residence, whereas CRE properties are valued by ‘cap rates’.

Against this backdrop, we are seeing compelling opportunities in residential credit. Investor loans continue to offer attractive risk-adjusted returns, with relative value available in RMBS as spreads on more liquid investments have widened faster than the underlying loans. We are also seeing growing opportunities to invest in home equity loans (HELs), which can deliver structurally levered and diversified exposure with significant equity buffer. This opportunity follows the long-term home price appreciation experienced in the US, where homeowner equity is near historical highs ($30+ trillion3) and HELs allow homeowners to release equity from their homes without refinancing their existing first lien mortgage (from <3% to >7%). Specialist investors can aggregate and finance HELs and acquire and finance IG HEL bonds from banks and non-bank lenders, and volume is expected to grow significantly in the coming years.

Leveraged Loans:

Loans have had a very good year, up close to double digits and outpacing the returns of HY and IG markets. Although the floating rate aspect of loans is the main driver of outperformance, loans have also outperformed HY on an excess return basis. Additionally, lower quality corners of the market have delivered the best returns as the market largely pays no heed to fears over incoming recessionary conditions.

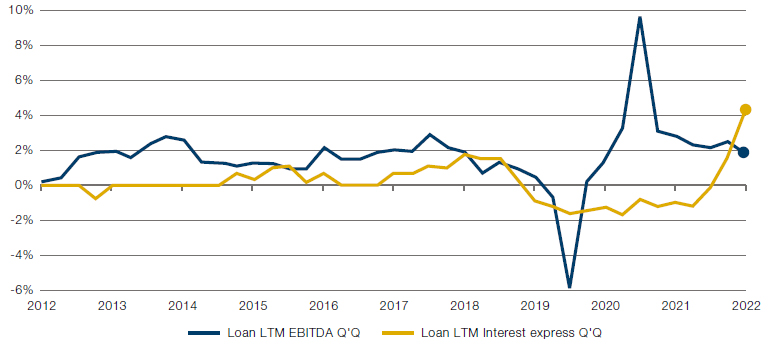

The moves year to date are seeming to shrug off the recent deterioration in fundamentals that we highlighted in Figure 3. We expect this to continue as higher interest costs and slowing growth start to impact the market (see Figure 7).

Figure 7. Interest expenses rose more than 2% faster than EBITDA for the median loan borrower in 4Q22

Source: Morgan Stanley Research, as at 31 December 2023.

Credit Risk Sharing (CRS):

One of the priorities of the EU Capital Markets Union is to revive the EU securitisation market. If we were to use notional significant risk transfer (SRT) issued as a proxy for revitalisation, then 2022 was a very healthy year indeed. With over 30 banks issuing 118 SRT securitisations worth over EUR 170 billion in notional value (up from approximately EUR 130 billion in 2019), issuances are expected to creep past EUR 200 billion by year-end. The diffusion of credit exposures continues to garner broad support from macroprudential supervisors as a means of promoting financial stability. The expansion in funding potential brought about by SRT is another acknowledged benefit, and one of particular pertinence as governments attempt to rouse decelerating economies. These factors play into the observed robustness of the SRT market, having weathered more than 20 turbulent years, delivering investors stable and predictable cash flows throughout. As SRT spreads sit at their widest for over a decade, the opportunity for investors to gain exposure to a diversified pool of high-quality loans is as compelling as ever, in our view.

1. The EAC credit market outlook was conducted twice a year (Q1 and Q3) until 2020, at which point the frequency was increased to quarterly.

2. Source: ICE BofA, as of 29 September 2023.

3. Source: Man GPM, Board of Governors of the Federal Reserve System, data through to April 2023.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.