1. Introduction

How do you construct a portfolio with hundreds of strategies across multiple asset classes, each with a different risk/return profile?

Constructing a robust portfolio is not easy. Even if you expect a relatively benign economic and market environment for the next few years, how do you reflect that in a portfolio? Overweight risk assets, perhaps – but which ones and in what proportion? Do you hold any mitigating assets to try to guard against downturns? If you are less confident in your outlook, this question becomes harder, possibly requiring you to reallocate assets as the environment develops.

Multi-strategy portfolio managers contend with these problems on a much larger scale. How do you construct a portfolio with hundreds of strategies across multiple asset classes, each with a different risk/return profile?

In this article, we aim to explain how to construct a multi-strategy portfolio, how managers can enhance the process of allocation and the challenges to be aware of when building such a portfolio.

2. Concepts of Building a Multi-Strategy Portfolio

There are three main concepts in building a multi-strategy portfolio.

Firstly, there is diversification. Allocating across multiple hedge-fund strategies can generate a more diversified return stream.

Secondly, there is risk targeting. It’s important that the overall portfolio reaches the desired level of volatility.

Finally, there is risk management. Sometimes, some strategies behave not as you would predict, perhaps by taking greater exposures than expected or performing poorly. Even when allocating across a wide number of strategies, it is possible for portfolio exposures to add up to levels that are too high. In these cases, it is necessary for appropriate risk-management measures to be in place, such as cutting certain positions or strategy sizes, or executing hedging trades.

Next, we look at each of these concepts in more detail.

2.1. Diversification

Allocating across a range of hedge-fund strategies can build a more diversified portfolio and hence create a steadier return stream.

As we’ve written previously, one of the main aims of allocating to a multi-strategy portfolio is to gain exposure to a diversified set of strategies that in combination can provide the investor with “all weather” capital gains. Just as with a traditional bond/equity portfolio, allocating across a range of hedge-fund strategies can build a more diversified portfolio and hence create a steadier return stream.

There are three steps in building this diversification: strategy selection, strategy group and risk allocation.

Strategy Selection

To build a diversified multi-strategy portfolio, the portfolio manager will need access to a wide range of strategies. This is crucial to achieving the required diversification. For example, if the manager only has access to credit strategies or event-arbitrage strategies, it will struggle to achieve the diversification needed to build a successful multi-strategy portfolio because these have similar return drivers and characteristics. Having access to a breadth of strategies is an important requirement, as is the selection process for these strategies.

To that end, the first step is to analyse the strategies available, understand their characteristics and then select the ones that are suitable. While the list below is by no means exhaustive, we believe managers should pay particular attention to:

Only by having access to a wide variety of strategies will the portfolio manager be able to take return opportunities when they occur while also building a diversified portfolio.

- Track record: An analysis of the track record can help managers understand the statistical properties of the strategy – such as risk versus return, consistency of return generation, or more technical statistics such as skew, kurtosis, etc. Ideally, managers should look for strategies with good Sharpe ratios, a good degree of return consistency and a tendency to produce more positive returns than negative (also referred to as positive skew);

- Liquidity: Illiquid strategies have very beneficial return-generating properties (also known as the ‘illiquidity premium’). However, too much illiquidity can make the portfolio difficult to run as the portfolio manager can’t easily rebalance between strategies and illiquid strategies can become too big in a portfolio if assets flow out. As such, it is important for the manager to understand the liquidity profile of each strategy;

- Factor exposures: If the strategy has a high exposure to traditional or alternative risk factors, it may indicate a lack of alpha. While some factor exposure is acceptable, the focus should be on adding true alpha strategies;

- Qualitative factors: For discretionary strategies, an examination of how a portfolio manager identifies suitable positions, takes the positions in the market and then risk manages them can provide deep insight into how suitable that portfolio manager is for the portfolio.

Most important is to find as wide a set of diversifying strategies as possible. Only by having access to a wide variety of strategies will the portfolio manager be able to take return opportunities when they occur while also building a diversified portfolio.

Strategy Grouping

Yet this should not imply allocating indiscriminately. Even after the strategy-selection process, a manager can still be left with a very high number of strategies from which to select. Allocating across a large number of strategies can prove to be quite challenging: a number of strategies could share similar risk characteristics. If this similarity is not taken into account, it can lead to excessive pockets of risk being created.

One way to handle this complexity is to create strategy groups. Strategy grouping can be done in several ways:

- Qualitative assessment of the strategies’ style;

- Correlation among the strategies;

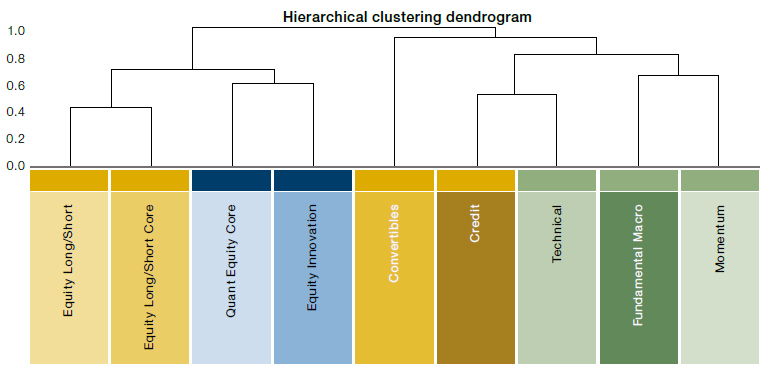

- Clustering, i.e. using advanced mathematical techniques to group strategies together in a risk hierarchy (Figure 1). If a hierarchical clustering method is used for the strategy grouping, then each step of the risk-allocation process will be repeated through any sub-groupings and then to the individual strategies.

Figure 1. Hierarchical Clustering Within a Hypothetical Portfolio

Source: Man Group; June 2022. For illustrative purposes only. Clustering based on correlations of five-day market returns since 2016.

For example, suppose we have two Value strategies (the ‘Value group’), an event strategy and a trend strategy. If equal amounts of risk are allocated to each strategy (25% of risk to each strategy), the portfolio can end up with 50% of the risk in Value – which may be too high. Instead, by allocating across the three distinct strategy groups, we end up with 33% in each of the three strategy types, possibly building a more diversified portfolio.

Regardless of what approach is followed, creating these strategy groups is an important step in simplifying the overall allocation problem. It also helps ensure that risk is appropriately allocated, as discussed in more detail below.

Risk Allocation

Once strategy groups have been determined, risk needs to be allocated across them. Generally we believe that it is easiest to allocate risk across these higher-level groups first, as it is a simpler problem with which to start.

When it comes to building multi-strategy portfolios, our approach is to target diversification.

Managers may take different approaches on how to allocate risk depending on their own backgrounds and preferences. This could be done by allocating out equal amounts of risk, using quantitative techniques such as optimisation or running a purely discretionary view.

When it comes to building multi-strategy portfolios, our approach is to target diversification. This approach is usually more robust as it does not rely on forecasted returns, which are noisier, but rather puts greater emphasis on the more stationary risk forecast.

In addition, we believe managers should ask themselves the following questions when allocating risk:

- Is there a particular view on a strategy? For example, following a dislocation, there may be very good opportunities in one strategy that could justify the portfolio manager running an over-allocation to a group;

- Do factor characteristics add up to make the portfolio unattractive? For example, allocating risk to certain groups of strategies may lead to a portfolio with an equity beta that is too high;

- What is the liquidity profile? Certain strategies may be a lot less liquid. As such, having too large an allocation to an illiquid strategy may lead to a liquidity mismatch at the portfolio level;

- Is there a bias to allocating to a certain area? For example, does the manager have particular strengths in trading equities over credit that may lead them to over-allocate to stocks?

As mentioned above, there is no ‘correct’ way to allocate risk and the process will generally depend upon the portfolio manager’s background and beliefs. What is important, however, is to have a disciplined and well-organised process for the risk-allocation step to be successful.

2.2. Risk Targeting

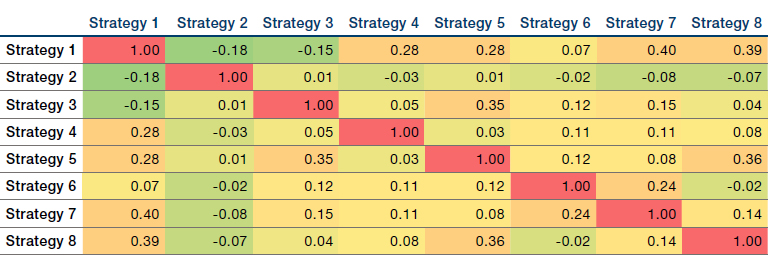

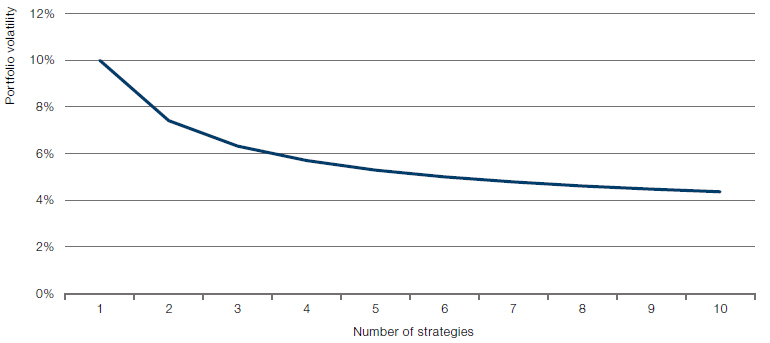

In our previous article, we wrote about how the main advantage of investing in a multi-strategy portfolio is the steadier, less volatile, return profile that it can deliver, due to the low correlation among strategies (Figure 2). This low level of correlation can not only potentially lead to attractive diversification properties; it can also lead to low levels of portfolio volatility (Figure 3).

Figure 2. Low Correlation Among Strategies

Source: Man Group; based on analysis of strategies from 1 July 2006 to 30 June 2022. Each strategy refers to a different category of investment approach, such as momentum or low beta. For illustrative purposes only.

Figure 3. Diversification Brings Down Volatility at Portfolio Level

Source: Man Group; June 2022. For illustrative purposes only.

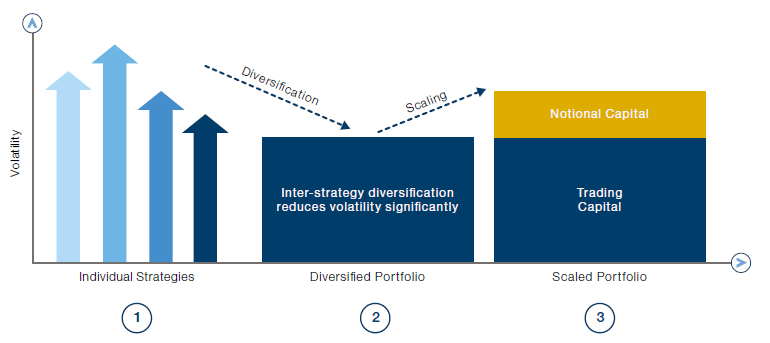

This can have the unintended consequence of running a portfolio with too little risk – with the result that insufficient risk is taken to meet return targets. To avoid this, the portfolio manager can raise the target risk of each strategy to a level where the desired level of portfolio risk is achieved.

Another example of the importance of risk targeting is illustrated by the use of margin. Hedge-fund strategies typically trade on margin. This means that for every USD100 of investor capital, only a small amount may be needed to support the strategies’ trading. For example, about USD20 may be used as margin for the strategy, while the remaining USD80 will sit in cash. How can this remaining excess cash be used? A portfolio manager could invest it in cash – which is likely to generate low returns. Alternatively, this excess cash could be reinvested in the strategies, increasing the overall exposure and volatility of the portfolio to achieve the desired target risk levels (Figure 4).

Figure 4. Use of Scaling to Reach Volatility Target

Source: Man Group; June 2022. For illustrative purposes only.

This process of risk targeting is a very important part of constructing a multi-strategy portfolio, and requires considerable skill and operational expertise to implement.

2.3. Risk Management

With so many strategies and the use of advanced financing techniques, building a multi-strategy portfolio also requires excellent risk management.

With so many strategies and the use of advanced financing techniques, building a multi-strategy portfolio also requires excellent risk management.

For example, if a strategy experiences a sharp or prolonged drawdown, risk managers may need to step in to cut risk to prevent outsized losses. Similarly, although risks in each individual strategy may be small, certain positions may add up across numerous strategies to form a sizable risk exposure, which needs to be acted upon and managed.

Importantly, managers need to keep a very close eye on the financing of the positions in the portfolio. To continue with our margin example above, from a risk-management perspective, the portfolio manager needs to carefully balance the required risk exposure versus the cash available to support the portfolio. If too much cash is allocated to margin, there may be insufficient cash to pay brokers additional margin in the event of losses. Alternatively, if too little is allocated, then target risk levels may not be met.

This risk-management step is just as important as risk targeting and building diversification. Without this step, portfolios can take exposures that are not expected and not perform in line with expectations. Given the overall complexity of the portfolio, the number of strategies involved and the breadth of strategies involved it requires a significant amount of experience and technology capability.

3. Challenges of Constructing a Multi-Strategy Portfolio

As with all types of portfolio construction, there are some challenges to be aware of when putting together a multi-strategy fund.

There is a constant need to monitor the overall factor risk of the portfolio, as well as counterparty risk and liquidity management.

Some of these relate to strategies themselves. For example, how do you handle strategies with short track records? For quantitative managers, a back-tested track record could be used, while for discretionary managers, qualitative assessments are more helpful. Similarly, a process to handle strategies with limited capacity needs to be created – this can often be worked around by allocating more to a different but highly correlated strategy.

There are also other more operationally focused issues. For example, there is a constant need to monitor the overall factor risk of the portfolio, as well as counterparty risk and liquidity management. This requires a huge operational infrastructure to enable the overall portfolio manager to have all the information they require to perform their role.

4. Conclusion

There are three main principles of constructing a multi-strategy portfolio: using a diverse set of strategies to increase expected returns, ensuring that appropriate levels of risk are targeted, and managing the risk.

Indeed, constructing and managing a multi-strategy portfolio is not trivial, as a well diversified portfolio has to deal with hundreds of different assets across multiple strategies. This raises significant challenges: managers must be able to monitor risks within the portfolio, adjust risk levels to the appropriate target, manage margins on positions, and take action on issues in a timely fashion. This requires a significant technological and operational platform – one that only the most sophisticated of managers can provide. If a manager can provide this level of expertise across all these areas, then multi-strategy investments can be an attractive investment for investors who want to benefit from having exposure to a steadier return profile than a single-strategy fund.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.