With contribution from Adam Singleton and Jens Foehrenbach

Introduction

Multi-strategy funds have become ever-more popular over recent years. But what exactly is a multi-strategy fund? Why are more investors turning to them as a solution, and how do they differ from conventional hedge fund strategies?

This primer will seek to explain how a multi-strategy portfolio works, what solutions it can offer investors and the challenges to be aware of.

What Is a Multi-Strategy Portfolio?

As the name suggests, a multi-strategy portfolio is one which employs more than one type of investment strategy, typically across many different asset classes. Instead of seeking returns by investing in a single strategy (such as equity long-short value investing, merger arbitrage or futures trend-following), a multi-strategy portfolio seeks to generate returns by combining a series of individual strategies. Returns can be sought from a wide variety of sources, with risk managed through broad diversification. Strategies are typically selected for their positive track record, liquidity, leverage characteristics and volatility, and their lack of correlation to other strategies in the portfolio.

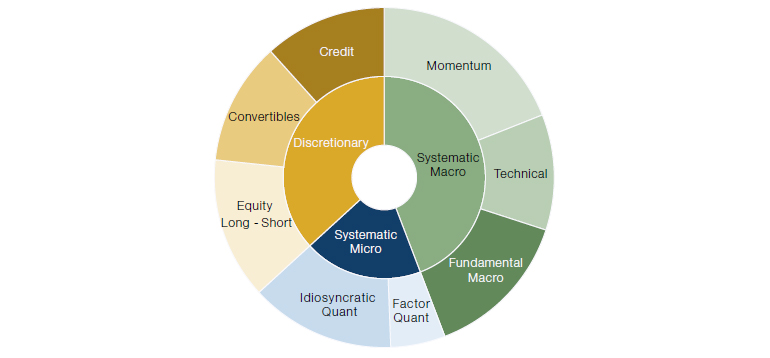

Figure 1. A Hypothetical Multi-Strategy Allocation

Source: Man Group. For illustrative purposes only.

Why Invest in a Multi-Strategy Portfolio?

A multi-strategy portfolio acknowledges that different strategies perform at different times, and allows the portfolio (in theory, at least) to generate a more consistent stream of returns.

The main advantage of investing in a multi-strategy portfolio is the steadier, less volatile, return profile that it can deliver, due to the diversification it benefits from internally. Different strategies tend to outperform at different points in the business or economic cycle: for example, a high volatility environment may be good for statistical arbitrage, but not so much so for long-short equity strategies with a Value bias. Similarly, inflationary periods may benefit commodity trend-following strategies which can position for price rises while reducing costly fixed income exposure. A multistrategy portfolio acknowledges that different strategies perform at different times, and allows the portfolio (in theory, at least) to generate a more consistent stream of returns than any individual strategy, under different macroeconomic conditions, and weathering unexpected shocks.

Since most investors should already be aware of the benefits of good portfolio diversification, a second benefit to multi-strategy funds is that they significantly reduce the complexity of managing such an array of investments. This simplicity can be achieved across different asset classes, while improving the overall efficiency of implementation. If multiple individual strategies are accessed via different managers, or even the same manager, then it will be down to the allocator to rebalance the portfolio (including the management of any cashflows), understand and combine risks across the portfolio (often from very distinct risk reports); all while paying fees on multiple accounts. Several advantages arise by housing all the strategies under one roof:

- Allocation efficiency: A multi-strategy fund can ensure that re-allocation of risk is a lot more efficient, potentially through fully systematic processes, avoiding the often-inefficient process of redeeming from and then subscribing to multiple different managers;

- Risk management: Multi-strategy funds should be able to operate one central risk-management process, so that a single view of all the disparate risks can be accurately reported. This gives investors a much clearer view of their full portfolio risk and allows them to make more informed decisions accordingly. Furthermore, investors can lean on the in-house expertise of a dedicated central risk-management team, benefitting from the knowledge and experience that they may not have themselves;

- Strategy access: Multi-strategy funds may offer a framework to allow investors access to new strategies more quickly, potentially reducing the need for time consuming due diligence;

- Reduced implementation costs: With centralised trading and portfolio management, a multi-strategy portfolio should be able to significantly reduce trading costs when compared with separate strategies spread across different managers;

- One-stop shop: The ‘single-roof’ concept reduces the need for investors to maintain multiple relationships across different firms, and makes streamlining communication easier. This can be of key importance, especially during times of increased volatility.

A multi-strategy fund can benefit enormously from the netting of risks and margins required for trading with its key counterparties and brokers.

Furthermore, by combining uncorrelated strategies within a single legal entity, a multi-strategy fund can benefit enormously from the netting of risks and margins required for trading with its key counterparties and brokers. This typically enables the fund to be able to take greater overall exposure for the same amount of risk as each individual strategy.

Finally, this efficiency likewise can apply to fees. When performance fees are treated in the aggregate rather than at a book level, it is likely that multi-strategy portfolios offer lower overall fees to end investors, since they rely on diversification as a riskmanagement tool. It is probable that as one strategy performs well, another is experiencing a period of underperformance. If an investor holds both strategies independently, they are likely to pay performance fees on one part of the portfolio, even if the overall return would not normally be high enough to clear a hurdle rate. Conversely, with a multi-strategy portfolio, the overall return should be the only figure subject to a performance fee. If one strategy fires and the other doesn’t, leading to a lower average return, then the investor would avoid performance fees – and thus improve the portfolio’s net performance.

However, this last point is not always the case, as many multi-strategy funds operate what is known as a ‘pass-through’ model. In this case, performance fees for individual strategies, usually operated by different individual portfolio managers, are indeed passed up to the end investor, effectively compounding hidden fees on the overall portfolio. Some investors may be comfortable with this approach, if the end returns outweigh the higher fees. However, investors should be careful to ask about, and properly understand, the fee model being applied.

There is also the potential in some instances for multi-strategy portfolios to offer the option of customisation. Within the key concept of diversification, a multi-strategy portfolio can still be used to express an overall macro outlook. As we’ve written above, different strategies have varying returns under different macro environments. By overweighting at an asset class or strategy level, investors can express a macro view, while maintaining the benefits of a diversified portfolio. This can potentially allow for fully customised portfolios which suits the needs of an individual client. This option is only usually available with sophisticated managers with robust internal platforms and infrastructure to support multiple instances of bespoke portfolios.

Challenges of a Multi-Strategy Portfolio

For all the advantages multi-strategy offers, there are a few challenges to be aware of when running such a portfolio.

Constructing and managing a multi-strategy portfolio is not trivial, as a full-scale portfolio can deal with hundreds of different assets across multiple strategies. This raises significant operational challenges: managers must be able to monitor risks within the portfolio, adjust risk levels to the appropriate target, be able to trade and value many positions efficiently and accurately, manage margins on positions, and take action on issues in a timely fashion. This requires a significant operational platform – one that only the most sophisticated of managers can provide.

Additionally, multi-strategy funds are unlikely to be the best-performing over any individual short time period. The whole idea behind a multi-strategy fund is that its diversification can provide consistent returns over economic and/or business cycles. This diversification can inevitably water down the returns of a single strategy during a very ‘hot’ period e.g., a statistical arbitrage fund could offer exceptional results during periods of high volatility. However, for a multi-strategy portfolio that holds both a statistical arbitrage fund and an equity-long-short fund with a Value tilt, the returns are likely to be more balanced.

Finally, choosing the strategies that will make up a multi-strategy portfolio is no mean task. A major challenge is gaining access to the talent required to run differentiated strategies. A successful multi-strategy manager should look to provide a good home for both systematic and discretionary strategies, and have a strong track record of attracting talent. At the same time, the manager must have the skills to continuously assess whether strategies are performing to the required standard.

Running a high-quality platform is a skill in itself, and one that cannot be done well without expertise and investment. To access the best strategies, investors will therefore need to consider who has the best platform, as over the long term, the platform is likely to dictate where talent chooses to reside.

Combining Systematic and Discretionary Strategies in a Multi-Strategy Portfolio

A portfolio that combines both systematic and discretionary strategies tends to behave very differently during tail events when compared with purely discretionary or systematic approaches.

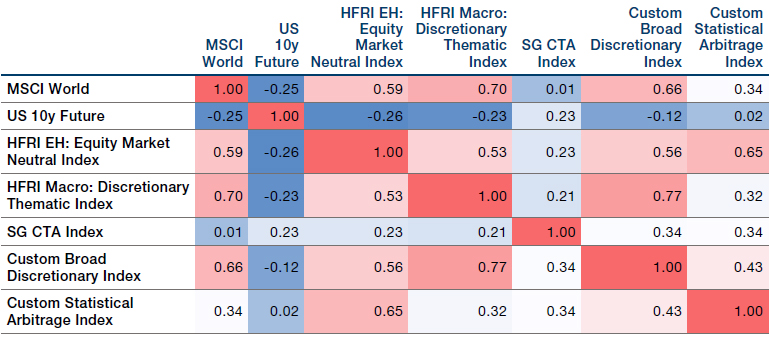

A key benefit of some multi-strategy portfolios is their ability to offer a mix of both discretionary and systematic strategies. This offers a significant potential diversification benefit to an investor as returns correlation between discretionary and systematic strategies is low (Figure 2). It is this lack of correlation – particularly during tail events, which tend to have an outsized impact on markets – that makes the multi-strategy portfolio such an important weapon within an investor’s arsenal.

Even more importantly, a portfolio that combines both systematic and discretionary strategies tends to behave very differently during tail events when compared with purely discretionary or systematic approaches. Systematic trend followers, for instance, can benefit as market selloffs accelerate, but may have to wait for a clear reversal to change positioning. In contrast, discretionary managers are often quicker to add risk when they perceive a market has bottomed out. Both of these can positively affect the return properties of multi-strategy portfolios during tail events.

Figure 2. Return Correlations – Systematic and Discretionary Strategies

Source: Man FRM; between 1 January 2000 and 31 January 2022.

Note: Data for the HFRI Macro Discretionary Thematic Index from 1 January 2008; correlations calculated on the maximum overlapping period. The Custom Broad Discretionary Index contains any manager in the HFR universe with an event-driven, relative value, macro or equity hedge strategy classification that is not in the multi-strategy, equity market neutral, quantitative directional or systematic diversified sub-strategy and contains ‘Discretionary’ in the strategy description. The index is then a simple average across all managers where 10 or more are available. The Custom Statistical Arbitrage Index contains any manager in the HFR universe with an equity market neutral sub-strategy classification that contains the phase ‘statistical arbitrage’ or ‘statistical’ in the strategy description. This is complemented with the propriety Man FRM Statistical Arbitrage Peer Group. The index is then a simple average across all managers where 10 or more are available.

Conclusion

Investors should see a multi-strategy portfolio as a potential solution to an old problem: that of achieving consistent portfolio returns at scale. By choosing uncorrelated strategies, multi-strat can enhance a portfolio, improving risk-adjusted returns through diversification, avoiding capacity issues and even potentially offering investors the ability to customise their allocation.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.