Introduction

“Oh dear! Oh dear! I shall be late!” So the rabbit introduces itself in Alice’s Adventures in Wonderland. As we enter the Year of the Rabbit, we don’t think investors need be so anxious about tardiness in Asian emerging-market (‘EM’) equities despite their strong start to 2023. We believe there is more to come as a Federal Reserve policy pivot becomes more likely and Asian macro fundamentals look healthy.

We have not always been positive on the opportunity set, and indeed were negative on regional beta until late last year. But in October, we turned bullish. At the time, we believed that 2022 would mark the bottom of the earnings downgrade cycle for Asia – driven by lower inflation, the reopening of the Chinese economy and macro stability – which would result in both positive absolute and relative returns for the region in 2023. Since then, Asian markets have outperformed global equities.1

In this article, we set out the reasons for our continued confidence in the region – while highlighting one area of potential near-term disappointment that emphasises the need for active management.

Marking the Bottom of the Earnings Downgrade Cycle for Asian Emerging Markets

Regular readers will know that we place significant importance on identifying relative earnings revisions (‘ERR’), which have proven to be the most pertinent source of alpha in emerging Asia over the cycle for two reasons: (1) share prices in the region historically revert to fundamentals; and (2) a high correlation exists between earnings revisions and P/E ratios (Figure 1).

Figure 1. A High Correlation Exists Between Earnings Revisions and P/E Ratios in Emerging Asia

Problems loading this infographic? - Please click here

Source: Man Group; as at 31 December 2022.

Note: ERR is an Earnings Revisions Factor designed by Man GLG, using IBES estimates data, constructed off a bespoke Asia Ex Japan Universe - pre-costs.

For the first time in over 18 months, both 2022 and 2023 EPS have recently bottomed for Asia ex-Japan.

Earnings revisions, measured by our 3-month ERR signal (the blue line in Figure 1), dramatically derated from mid-2021, primarily driven by challenges in China (such as a property crisis, household deleveraging, and Covid restrictions). We seem to have passed the worst of it: measures have been introduced to support incomplete housing starts, including lifting equity financing channels for developers, which should prevent builders defaulting on mortgage-holders; the credit impulse has rebounded from multi-period lows; and most importantly, we are witnessing gradual steps towards a return to normality, following months of strict lockdowns. Earnings now look achievable and the revisions potential is turning positive in certain parts of the market.

Indeed, for the first time in over 18 months, both 2022 and 2023 EPS have recently bottomed for Asia ex-Japan. The big turnaround supporting this trend has been China, where forward EPS estimates have started to stabilise after 20% negative revisions (Figure 2).

Figure 2. 2022, 2023 EPS Have Bottomed for Asia ex-Japan

Problems loading this infographic? - Please click here

Source: Man GLG, Bloomberg; as of 6 December 2022.

Note: Chart shows 12-month forward EPS in local currency terms, which captures both EPS growth and revisions momentum. Earnings revisions measured using Bloomberg EPS Estimates (BEst EPS) for country and GICS sector sub-indices of MSCI Asia ex Japan since 15 October 2020, rebased to 100.

Fed Pivot on the Horizon?

A weakening dollar environment has historically been supportive for the outperformance of Asian equities.

In addition, there are telling signs that we are moving closer to peak Fed policy, which should benefit Asian EM equities.

US inflation was 6.5% over the 12 months to the end of December, the sixth straight month of yearly declines.2 Importantly, this softer print was driven by disinflation in core CPI items, providing a powerful justification for the Fed to slow the pace of rate hikes and making the prospect of a policy pivot more likely.

Policy expectations have also repriced in markets: the US dollar has weakened by nearly 8.5% since its peak at the end of September and terminal rates appear set to follow (Figure 3).

A weakening dollar environment has historically been supportive for the outperformance of Asian equities (Figure 4).

Figure 3. US Dollar Has Weakened, Terminal Rates Appear Set to Follow

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 1 February 2023.

Figure 4. Weakening USD Has Been Supportive for Asian Equities

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 10 February 2023.

Regional Policy Flexibility

A benign interest-rate environment in Asia provides policymakers with greater independence to stimulate economies once the Fed pivots.

Another reason for our growing optimism is that policymakers in China have reopened the economy against a unique backdrop of regional policy flexibility.

Typically, Asia has a very high beta to the global cycle. Specifically, towards the end of market cycles, economies tend to overheat, inflation becomes ingrained in the system, and policymakers are required to tighten harshly to cool prices. By contrast, Covid-related issues across the region, concerns around China, and tight developed-market (‘DM’) policy mean there has been modest growth and very little misallocation of capital or inflation. Most notably, labour markets are slack and wage growth remains below pre-Covid levels.3

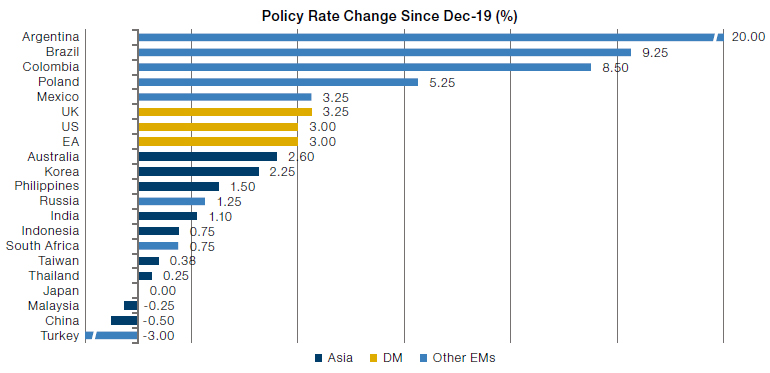

This has contributed to a much more benign interest-rate environment in Asia (as depicted by the grey bars in Figure 5), providing policymakers with greater independence to stimulate economies once the Fed pivots.

The key beneficiaries from this trend, in our view, are the South/Southeast Asian nations, such as Indonesia, where real rates are currently positive, debt-levels are low and domestic demand is robust despite a peak USD environment.

Figure 5. A Benign Interest-Rate Environment in Asia

Source: Various central banks.

Note: Policy rate data as of 7 February 2023, 8pm HK time.

China Reopening

Of course, we can’t really talk about Asian EM without mentioning China.

In recent weeks, the speed at which policymakers in China have lifted Covid restrictions and reopened the economy has surprised markets. Indeed, we expected the route out of Covid to be in the form of a gradual easing of restrictions over time; however, the steps taken recently suggest that a full reopening is likely to happen quicker than anticipated (and without a mass vaccination programme).

The consensus view is that mobility restrictions have stifled consumption, leading to elevated levels of household deposits, which could pave the way for a reopening consumption splurge and drive a broad economic recovery. Central to this thesis is the 5.6 trillion yuan ($836 billion)4 in excess savings that Chinese consumers have built up during the pandemic.

China is likely to face a narrow-and-shallow consumption recovery this year, meaning the broad consumption-related stocks are likely to disappoint against rising expectations.

In reality, the main reason behind the increase in household deposits is the reduction in property and wealth management exposure, which has migrated into long-term deposits, and in fact began pre-Covid. In DM, excess savings led to rebound spending, driven by stable income and reduced expenditure over lockdown plus interest cuts that spurred property prices and associated wealth creation. This is unlikely to be the case in China, where the housing stock has been under significant pressure from the fallout of the real estate crisis and where excess savings appear to be a structural change in the preference of certain financial assets.

As result, we still believe China is likely to face a narrow-and-shallow consumption recovery this year, meaning the broad consumption-related stocks are likely to disappoint against rising expectations.

While the growth trajectory of the world’s second-largest economy is clear, the scale of the recovery is up for debate, with important trends likely to emerge in the weeks post-Chinese New Year. Indeed, we still expect some virus-related disruption in the early months of 2023, particularly given the close proximity between the Christmas holidays and Chinese New Year. Our view is that infections are likely to rise further as restrictions are lifted and people look to travel. As such, corporate earnings in the first quarter may still be challenged if sentiment and mobility is impacted by voluntary isolation or more severe case numbers.

Conclusion

2022 delivered a challenging backdrop for Asian EM equities, with a higher-for-longer Fed hiking path, slowing global growth environment, and the impact of China’s Covid restrictions being just a few factors that have put pressure on price multiples and EPS revisions.

For 2023, we hold a constructive view on the asset class, as a Fed policy pivot becomes more likely and Asian macro fundamentals look healthy.

1. Measured by MSCI Asia ex Japan Net Total Return USD Index relative to MSCI World Net Total Return USD Index.

2. Source: Bureau of Labor Statistics; as of 12 January 2023.

3. Source: CEIC, Morgan Stanley Research; as of 6 July 2022.

4. China Reopening Could Boost 2023 Global Economy - Bloomberg.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.