Introduction

The biggest surprise to us in 2023 was the way in which economies shrugged off the most rapid Federal Reserve (Fed) monetary tightening since the 1980s. Furthermore, markets have quickly latched on to the idea of early and aggressive rate cuts in 2024 as inflation normalises. While it is entirely possible that continued consumer strength will result in a soft landing, it is by no means the only potential outcome and we think it is premature for equity and credit markets to price this in with complete certainty, as reflected in the 2023 equity and credit rally.

A good number of questions will be answered in 2024. Where will commercial and residential real estate land? How will the largest global economies land? Will ongoing geopolitical conflicts and China trade policy be resolved? And potentially the most significant – who will win the US presidential election in 2024 and will it be uncontested, and how will corporates refinance a mountain of 2025 and 2026 maturity debt?

Large swathes of credit and equity markets are at eye wateringly expensive levels and we have witnessed very little volatility to get here. We believe 2024 is likely to be forthcoming for volatility and arbitrage-type returns and unlikely to be a good environment for pure credit beta. Investors should be selective and build in some caution to more cyclically oriented parts of the market which price in little premium to more defensive segments. Here, we highlight three themes in credit which we will be watching closely in 2024.

Theme #1: Europe provides a rich hunting ground for credit investors

European credit has historically formed a small proportion of global credit benchmarks and consequently a much smaller component of most global portfolios, but it has some unique and attractive structural and cyclical characteristics.

Turning first to its structural features, the quality of European credit, particularly in the high yield (HY) market, is generally higher. Additionally, when one looks at fundamentals, the level of leverage in European companies tends to be lower than US based counterparts. This can be driven by several factors including the sponsor composition in Europe, which includes a range of family-owned businesses who may choose a more conservative capital structure.

Further, there is a large proportion of index investors in European credit. Index-related approaches can lead to forced selling of individual bonds if an issuer gets downgraded, which can create opportunities for active managers. Until recently we’ve been in an environment where very large, price-insensitive buyers, namely the Bank of England and European Central Bank, have been supporting the market. With those buyers now moving away and their bond purchasing programmes ending, we see a more natural price transmission mechanism across broader parts of the market.1

We are also seeing broad stampedes in and out of the market, generated predominantly by periods of lower liquidity, particularly during times of stress with banks less willing to warehouse risk. Consequently, there can be large moves in the prices of corporate bonds that are very disconnected from fundamentals, thereby creating an attractive opportunity set.

Particularly attractive from a stressed and distressed credit angle, Europe notably does not have a unified bankruptcy code. This lack of commonality creates more complexity challenges for managers, but it also creates structural inefficiencies and thereby opportunities to drive better returns. This compares to the US market where Chapter 11 has been in operation for many years, which has a significant amount of precedence and likely more capital chasing opportunities.

Figure 1. Structural factors favour opportunities in Europe over the US particularly in stressed and distressed opportunities

Source: Man GLG.

Many investors might ask why they should consider Europe. Admittedly, there are a number of risks in this market, namely lack of energy independence, proximity to the war in Ukraine and concerns about growth in several European markets. Those are all known risks and crucially, they are priced into spreads. Looking at the European single-B market, investors are currently being paid close to a 150 basis points (bps) premium for investing in European assets compared to US assets, as shown in Figure 2.

Figure 2. Investors paid a premium for investing in European assets

Problems loading this infographic? - Please click here

Source: Bloomberg, ICE Data Indices, as of 31 December 2023.

European and US banks are a world apart

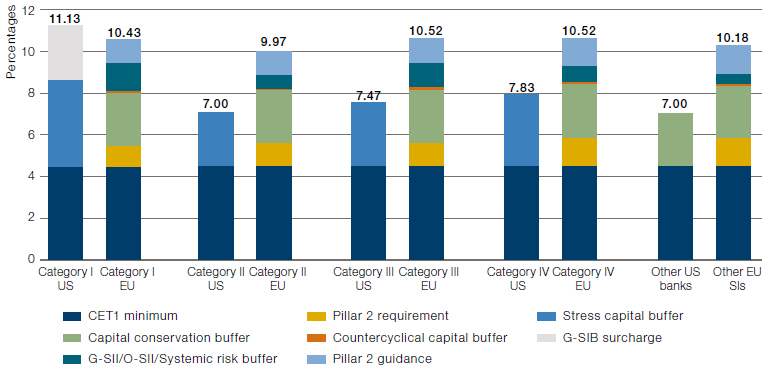

Banks came under significant stress in early 2023. US regional bank Silicon Valley Bank collapsed while Credit Suisse had to be rescued by UBS in a deal brokered by the Swiss government and the Swiss Financial Market Supervisory Authority. While we believed it was localised with a small number of banks, the market implied that the entire banking sector would undergo stress. Crucially, the regulatory backdrop in Europe is far more stringent compared to the US. Figure 2 shows the capital requirements for both large and small banks in the US compared to Europe and clearly shows that there is little deviation between the requirements for large and small banks in the European market, whereas in the US, the capital requirements for regional banks are much lower.

Figure 3. Europe provides a rich hunting ground for credit investors

Source: ECB, as at 30 November 2023.

US regional banks will likely remain challenged, predominantly because the pressure to raise interest rates for depositors will reduce profitability for several players. At the same time, many have a heavy exposure to commercial real estate (CRE), which could lead to further markdowns going forward. In contrast, senior and tier two banks in Europe appear less challenged and are offering attractive yields.

Real estate provides opportunities for the nimble

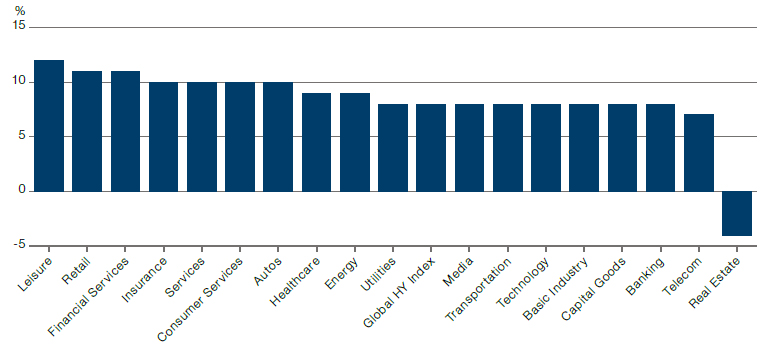

Honing in on real estate for a moment, it is the one cyclical sector that continues to remain under pressure. It was the first sector to reprice in 2022 as the impact of higher interest rates led to significantly lower profitability as funding costs increased. Couple this with declining valuations, particularly in the CRE space, and it is becoming quickly apparent that some firms are simply unable to operate in a more normalised yield environment. It is no real surprise then that real estate was the only area within high yield that suffered negative excess returns in 2023. We believe that opportunities exist in the sector post the sell-off across investment grade (IG), high yield and structured credit.

Figure 4. Real estate was the one area within HY that suffered negative excess returns in 2023

Source: Bloomberg, ICE Data Indices, as of 31 December 2023. Chart shows excess returns from 1 January to 31 December 2023.

Supply and spreads in credit risk transfer market close to decade highs

A secondary opportunity we see related to European banks (as well as US banks) is credit risk transfer. In a higher yield environment, banks want to be more prudent in terms of how they deploy capital and are thereby increasingly utilising credit risk transfers. Consequently, we have seen a very strong amount of supply and spreads in the credit risk transfer market remain close to decade highs, implying yields in mid double-digit territory. This market is likely to remain vibrant into 2024 and it is possible that we will see diversification of issuance from Europe, as well as in the US.

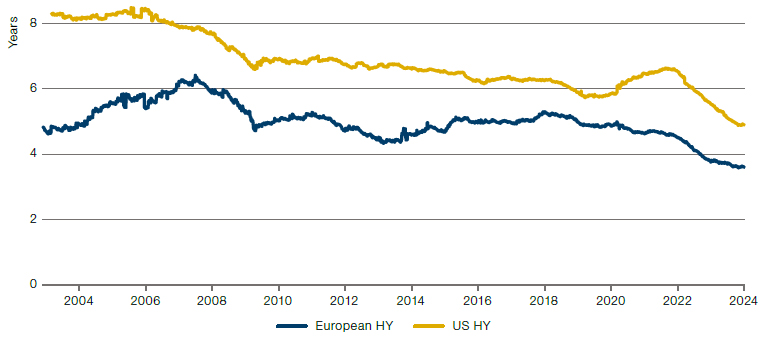

Theme #2: Upcoming maturity walls are a risk and an opportunity

The upcoming maturity walls represent an opportunity as well as a risk. Those companies which were established on the basis that rates would be close to zero for longer, and which are unable to refinance at current rates, may be challenged, creating opportunities in both stressed and distressed credit.

Figure 5. Maturity wall: Average life of HY indices at lowest levels since the early 2000s as companies delay refinancing

Source: Bloomberg, Deutsche Bank as of 31 December 2023. Based on Bloomberg US Corporate High Yield Total Return Index and Bloomberg Pan European High Yield Total Return Index.

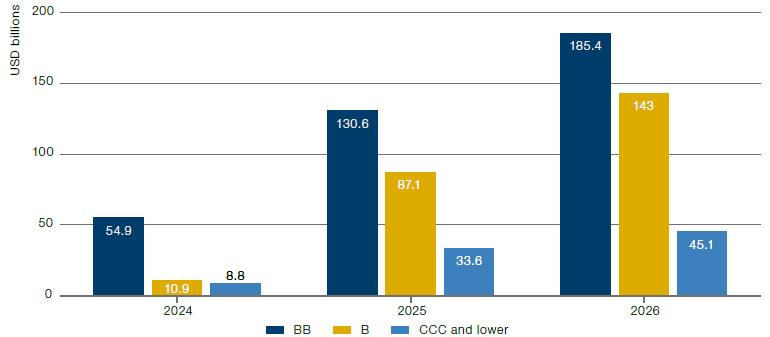

53% of the USD 700 billion which is due to mature by 2026 is high quality, BB-rated risk. A further 34% is single B and only a small 12.5% is CCC risk. Consequently, although debt will come at a much higher cost, many of these companies are likely to eventually be able to refinance at or close to par. The average price of bonds in this part of the market remains at 93 and trades with a yield-to-worst of 13%, implying attractive return potential as bonds pull to par.2 This will also form an attractive hunting ground for stressed/distressed opportunities for companies which may face difficulties in refinancing and which may require more complex capital solutions.

Figure 6. Less than three-year maturity segment offers significant total return opportunities

Source: Bloomberg, as of 31 December 2023. Data includes holdings within the Bloomberg Global High Yield Index, the Bloomberg US High Yield 0-1 Year Index and the Bloomberg Euro HY 0-1 Year Index.

Theme #3: Convertible bonds provide a release valve to deal with refinancing pressure

There are other pathways for companies to deal with refinancing risk. One option is private credit, which has seen significant growth. Another option is the convertible bond market. In the early 2000s, the size of the convertible bond market was comparable to the global high yield bond market. However, in a low yield environment, many companies chose to issue debt in the leveraged finance market, leading it to grow to more than USD 4 trillion in size (across both loans and high yield bonds).

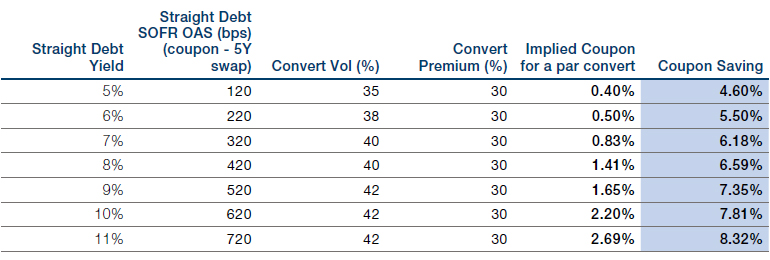

With companies now facing the consequences of higher interest rates, convertible bonds offer an attractive route for companies looking for financing given the potential interest cost savings (see figure 7 below). This activity started to pick up during the tail end of 2023 as we saw large issues from Uber and PG&E, with the proceeds used to refinance leverage loans with significantly higher interest costs. We therefore expect issuance in the convertible bond marketplace to grow. We saw a pickup in issuance in 2023 across a broad range of sectors beyond Healthcare and Technology, but expect this to accelerate in 2024. Increased convertible issuance has historically been positively correlated with better convert return years. As volume increases, secondary prices fluctuate more, and new issue cheapness contributes to alpha, particularly for arbitrage managers.

Figure 7. Potential interest cost savings from refinancing using convertible bonds

Source: Bloomberg, Barclays Research. Assumes 5Y SOFR swap at 3.8%.

Q1 2024 Outlook

At Man, we have one overriding principle: we have no house view. As such, portfolio managers are free to execute their strategies as they see fit within pre-agreed risk limits. Keeping that in mind, the outlooks below are from the different credit teams at Man.

With all in yields remaining high, we think investors can continue to benefit from an allocation to IG credit. The duration of the asset class has proven a strong tailwind for total returns although a significant amount of rate cuts have already been priced in and therefore we would need to see materially lower growth to price in further cuts.

However, given the sharp rally over the past quarter, we do have to deal with spreads that are at median levels in Europe and the UK and first quartile levels in the US. The US remains wholly unappetising to us.

It is not a time to buy the entire market and we believe dispersion between sectors, geographies and single names has created deep value opportunities for bottom-up investors to generate strong excess returns over the medium term. We continue to see value in Europe, with a focus on financial companies, which are in a robust position compared to their US counterparts. Although value has started to emerge, we continue to take a more cautious view on non-financial cyclicals. As growth slows, we believe a higher risk premium will need to be attached to these sectors as demand slows and profitability weakens.

The credit cycle’s turn feels slightly elusive, akin to Waiting for Godot. Despite stringent financial conditions and reduced credit availability, the broad economy remains strong and risk assets continue to perform well. This resilience, we think, stems largely from the consumer savings accumulated post-Covid and the government’s fiscal largesse. Both of these factors are undergoing significant shifts, potentially leading to more tailwinds in the future.

These conditions are already being factored into certain market segments. For example, real estate, now trading at an average spread of 746 bps, is essentially pricing in a recession. Additionally, CCC assets in Europe have underperformed their US counterparts due to greater recessionary risks being factored into European assets.3

These dynamics present opportunities for active and unconstrained investors, particularly in the real estate sector and in Europe where opportunities abound. As we begin 2024, we anticipate increased dispersion, which should create additional investment opportunities.

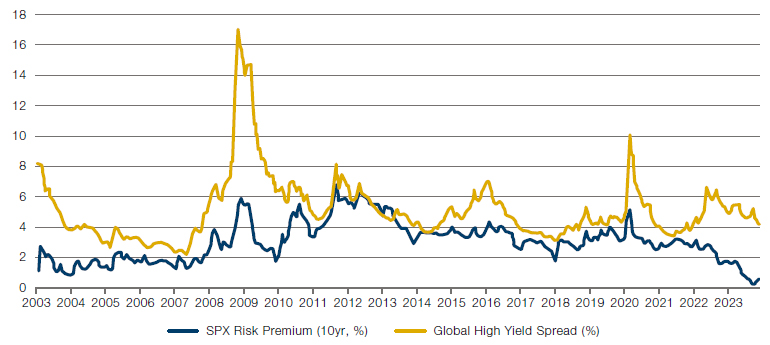

Yields on high yield credit remain enticing, particularly when compared to equity markets. However, with overall index spreads moving below median levels, selectivity continues to be vital.

Figure 8. Global HY spread versus equity risk premium

Source: S&P, Bloomberg as of 31 December 2023.

With rate hikes appearing to be in our rear view mirror, we believe that fixed rate high yield offers significant attraction over floating coupon leveraged loans. Additionally, the better credit quality in high yield compared with stronger fundamentals should mean that high yield suffers fewer potential defaults than leveraged loans in 2024 and beyond.

The maturity wall in the global high yield market brings both risks and opportunities for investors. The risks lie in the fact that some companies, conceived in a zero-rate environment, may struggle to refinance, necessitating alternative capital solutions. This could lead to attractive stressed/distressed investment opportunities.

However, more than 50% of the impending maturity wall is BB risk, a segment of the market that we believe has a higher probability of successful refinancing. For investors, this presents a chance to invest in assets with cash prices ranging from 60-85 cents on the dollar. The resulting ‘pull to par’ for these performing credits over the next two years could yield considerable returns.

3. Source: Bloomberg, ICE Data Indices, as of 31 Dec 2023. Based on ICE BofA Global High Yield Index.

Over the past year, we have argued that liquidity dynamics have been the main driver of financial asset fluctuations, overshadowing fundamental developments. In our view, the abundance of liquidity, both in terms of flows and stock, has been the key factor impacting prices.

Anticipating diminished liquidity support and provided there are no sudden panic-driven quantitative easing activities, we would expect a more accurate risk pricing going forward. This would imply a resumption of the negative correlation between equities and bonds, where decreasing yields would coincide with a decrease in equities, rather than yields decreasing while equities increase.

We believe that the likelihood of a soft landing in the US has increased, but the possibility of it being a false dawn or leading to a recession justifies a more defensive approach especially as emerging market (EM) risk premiums appear comparatively low.

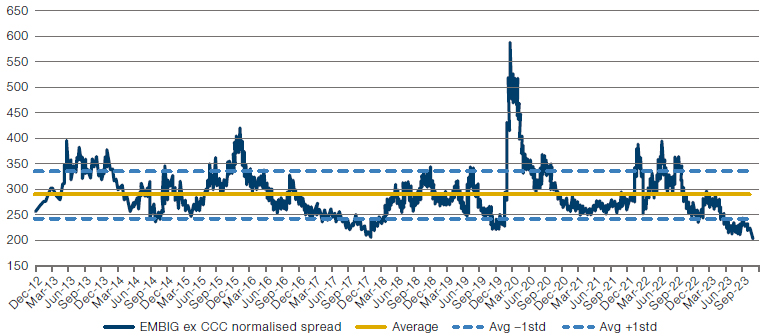

EM credit has exhibited relatively better performance compared to developed market credit in recent times. When examining the EM asset class, it is more insightful to focus on spreads excluding CCC-rated and defaulted countries. Figure 9 below indicates that spreads are currently at their narrowest levels since the early 2010s. Unfortunately, the available data is incomplete to conduct a similar analysis further back in time. However, we believe that the only period when EM spreads were tighter on average (excluding CCC-rated and defaulted countries) was around 2005/2006, when these countries experienced structural improvements following the restructurings of the 1990s and benefited from positive developments in China. It is worth noting that the current environment is significantly different from that period.

Figure 9. EM hard currency sovereign spread over Treasuries (excluding CCCs)

Source: JP Morgan and Man GLG calculations, as of 15 December 2023.

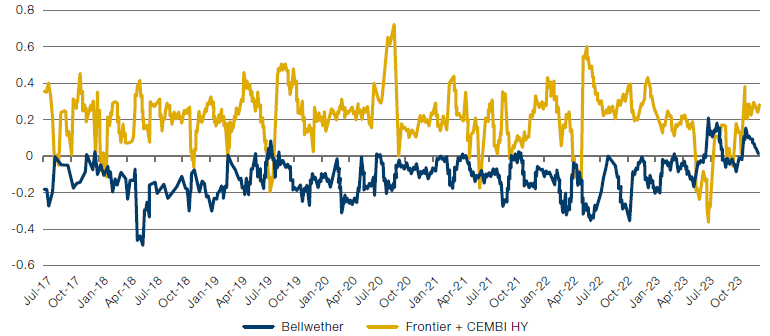

Our positioning analysis primarily focuses on indicators that directly correlate with positions held in mutual fund portfolios, as observed through daily returns and futures markets. Figure 10 below illustrates the excess exposure of EM hard currency benchmarked mutual funds compared to their respective benchmarks. Historically, these managers have typically allocated more weight to higher yielding frontier countries and corporate credit, while underweighting higher quality countries. This approach allows them to generate a surplus yield relative to the benchmark and strive for an excess return as the yield accumulates. Notably, the exposure to lower quality credits is currently at the upper end of the historical range. What is intriguing is that, for the first time in this sample, managers are also exhibiting overexposure to higher quality countries to maximise overall exposure.

Figure 10. EM hard currency fund average beta overweight/underweight to high yield and high quality countries

Source: Bloomberg and Man GLG calculations, as of 19 December 2023.

As 2023 ended, markets fully factored in a soft landing scenario and an upcoming significant cycle of rate cuts. While this remains a plausible scenario, it is not the only potential outcome. Given the 45% surge in the Nasdaq, double-digit returns in several areas of credit and credit spreads currently far below median levels, we believe it is prudent to infuse a level of caution into asset allocations.

The present conditions for convertible securities are advantageous for investors obligated to participate in equity markets. It is widely understood that the strength of the equity market has been propelled by a select few mega-cap tech companies, which do not feature in the convertible securities sector. In contrast, many convertible bond issuers are undervalued, offering appealing growth opportunities.

Convertible bond investors can gain exposure to these undervalued equities via convertibles that have attractive risk/reward profiles. While at an overall asset class level average deltas are below historical averages, much of this is driven by the large volume of 2020/21 deals that remain well out-of-the money but offer attractive yields. Outside of these busted convertibles, investors can access balanced convertibles that continue to offer decent upside participation while also retaining strong downside protection.

The positive convexity of convertibles suggests that deltas, or equity sensitivity, will increase if markets rise. In fact, since 2019, convertible bonds across all sectors have captured more of their underlying stock’s upside performance than their downside performance.4

The strong consensus is that central banks will start to cut rates in 2024 with the higher-for-longer narrative collapsing in late 2023. As a result, after lagging during the rising rate environment earlier in the year, longer duration credit assets have already seen a large benefit from this change in rate expectations. If these aggressive expectations do not materialise then we believe long duration assets will materially underperform shorter duration credit, including convertibles.

We also see an attractive backdrop for new issuance in the convertible bond space with many banks calling for a 20% increase in issuance over 2023. The appeal is easy to see as low interest costs make convertible bonds a more palatable place to issue debt compared to high yield or leveraged loans where interest costs remain in double digit territory. The large deals announced by Uber and PG&E in the US in Q4 2023 are likely a sign of more to come. Active managers should benefit through taking advantage of new deal discounts. We also expect convertible bond issuers will be looking to refinance to get ahead of looming maturity walls. Take-outs typically occur at current prices providing significant potential upside.

4. Source: Bank of America.

We had hoped for greater convertible bond issuance in 2023 as corporates ponder the 2025 maturity wall. However, it seems many are waiting until the last minute (less than 12 months to maturity) to address their debt, which means refi issuance will begin in earnest in 2024. We think the cost savings available to convertible issuers over traditional high yield will lead to an increase in convertible issuance, with Barclays forecasting totals approaching US$100 billion in 2024. Increased convertible issuance has historically been positively correlated with better convert return years as volume increases, secondary prices fluctuate more and new issue cheapness contributes to alpha.

With leverage finance maturity walls at all-time highs and deteriorating fundamentals, we expect defaults to materially pick up which is currently not captured by credit spreads or prices in the high yield or loan market, respectively. Additionally, valuations in the US high yield space remain expensive and offer a good opportunity to maintain credit hedges and further reduce credit beta.

In addition to refinancing activity, the potential for M&A activity or exchanges can lead to substantial upside from current pricing. Attractive opportunities also exist where investors can go long distressed convertible bonds and hedge out default risk to zero through equity puts. The position benefits if the company refinances, offering 10-20 points of upside if the company pays par. In a default scenario, investors can benefit from a non-zero recovery where equity puts pay off and the position is profitable if the recovery exceeds zero.

In summary, we expect 2024 and 2025 to be active and potentially turbulent transition years with defaults rising, resolution of the soft landing question, and higher equity volatility and volume in convert trading as the market normalises back to higher dollar paper. These three events should lead to a very compelling near-term opportunity set for convert investors.

The Fed meeting in December resulted in market expectations of a soft landing, causing bond yields and spreads to fall and propelling 30-year mortgage rates down from 7.1% to 6.6%. Cuts in 2024 and further falls in mortgage rates could begin to loosen up the housing market, meaning increased transaction activity and mortgage origination volume. After reaching another new record high (the latest Case Shiller print sees home price appreciation at +3.9% year-on-year), we believe national home prices are likely to moderate to flat to slightly up in 2024. Amid this backdrop, we see a plentiful opportunity for private real estate lenders given the “de-banking” of the sector. We favour senior secured lending at conservative leverage and the relative attractiveness of residential collateral versus CRE.

2023 was a very active year for CRS as we saw robust issuance across Europe, as well as activity in the US and Canada. There were notable highlights across the macroeconomic environment, banking regulations, increased issuance, record absolute yields and increased investor appetite. The macroeconomic environment created tailwinds for credit in general and specifically for CRS, as investors sought to move up in credit quality and seniority. We expect this theme to continue to play out through 2024 as higher rates impact corporate balance sheets and add stress to lower parts of the credit markets. Banking regulators remained vigilant and committed to providing a mechanism for credit risk transfer to further reduce risk in the global banking system. Preparations for the end of Basel III, the implementation of Basel IV and the Fed establishing a framework to allow for more programmatic issuance in the US will very likely lead to record CRS issuance throughout 2024, coupled with investor appetite for the exposure.

1. Asset Purchase Facility: Bank of England concludes corporate bond sales programme – Market Notice 6 June 2023 | Bank of England

2. Source: Bloomberg, ICE Data Indices, as of 31 December 2023.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.