The potential delisting of Chinese companies from US exchanges remains a risk for investors even after the recent de-escalation in trade tensions.

The sharp selloff in Chinese American depositary receipts (ADRs) in April underscored their sensitivity to current geopolitical pressures. ADRs without secondary listings in Hong Kong saw the steepest drops, reflecting their heightened exposure to delisting risks. These stocks subsequently rebounded as fears subsided following more tempered rhetoric from the US administration. Nevertheless, volatility remains a concern, as tensions are unlikely to be fully resolved any time soon.

Figure 1. Sharp selloff in April

Source: Bloomberg, as of 13 May 2025.

Problems loading this infographic? - Please click here

We have identified three distinct groups of Chinese ADRs, each carrying varying levels of risk of delisting:

1. ADRs with dual listings in Hong Kong: These face the least exposure to delisting risks, given their access to mainland Chinese and Hong Kong investors via the Southbound Stock Connect programme. This access not only mitigates delisting risks but also enhances liquidity and broadens the investor base by allowing mainland Chinese investors to trade these Hong Kong-listed shares

2. ADRs without dual listings but eligible for listing in Hong Kong: These are in a manageable position, as both the companies and the Hong Kong Stock Exchange (HKEX) have strong incentives to pursue secondary listings

3. ADRs without dual listings and ineligible for Hong Kong listings: This group is most at risk, representing the segment investors should watch most closely

It’s worth noting that the MSCI Emerging Markets (EM) Index only includes names from groups one and two. This means institutional investors tracking the index are largely insulated from the names most at risk of delisting, though active managers may still hold exposure.

From a strategic perspective, this situation will likely accelerate the shift towards Chinese companies listing closer to home. The incentives for firms to deepen ties with domestic investment pools and reduce reliance on US capital markets are growing, a trend that could reshape the global capital-raising landscape over time.

Moody’s downgrade: the last bastion falls

On Friday, after the NYC market closed, Moody’s announced it had downgraded US credit from Aaa to Aa1, its second-highest rating. Moody’s is the last of the big three credit ratings agencies to lower the US’ credit rating. S&P did it in 2011 and Fitch did it in 2023.

Moody’s rationale is rising deficits. The ratings agency explained, “This one-notch downgrade on our 21-notch rating scale reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns.”

It should come as no surprise that Moody’s downgraded US credit. It warned it might do so back in November 2023, and current budget negotiations suggest the US is headed for larger federal deficits.

This downgrade may add momentum to questions around the whether the US deserves a ‘safe harbour premium’ – and specifically whether US Treasuries can be considered a ‘safe haven’ asset class.

We may expect a short-term sell-off in US Treasuries and a short-term sell-off in US stocks. Gold may become more attractive after the credit downgrade as investors seek a 'safe haven.' However, we think that news flow around tariffs is likely to have a much greater impact on US stocks than any credit downgrade.

ESG - the unexpected port in the market storm

After a long, harsh winter for environmental, social and governance (ESG) investing, signs of spring have begun to emerge. Amid April’s stormy markets, this investment theme has proven unexpectedly resilient, demonstrating its defensive qualities while also offering resilient performance.

At the end of April, Clean Energy stocks1 were up 3% year-to-date, Water Resources2 had held steady, and Defence stocks3 continued to deliver strong absolute returns (Figure1). By contrast, the S&P 500 and MSCI World indices ended the month down 5% and 3% respectively, despite the strong rally after the ‘Liberation Day’ market meltdown early in the month. Meanwhile, Global Energy stocks4 slumped 12% in April alone.

ESG factor returns have also shone brightly. The Barra ESG factor was the third best-performing factor year-to-date,5 only trailing Size and Profitability. This resilience is especially striking given the prevailing anti-clean energy and diversity, equity and inclusion (DEI) sentiment in the US.

Figure 2. Year-to-date ESG asset and factor returns versus equity indices

Source: Man Group, Bloomberg, as of 30 April 2025.

Problems loading this infographic? - Please click here

Strong defensive traits

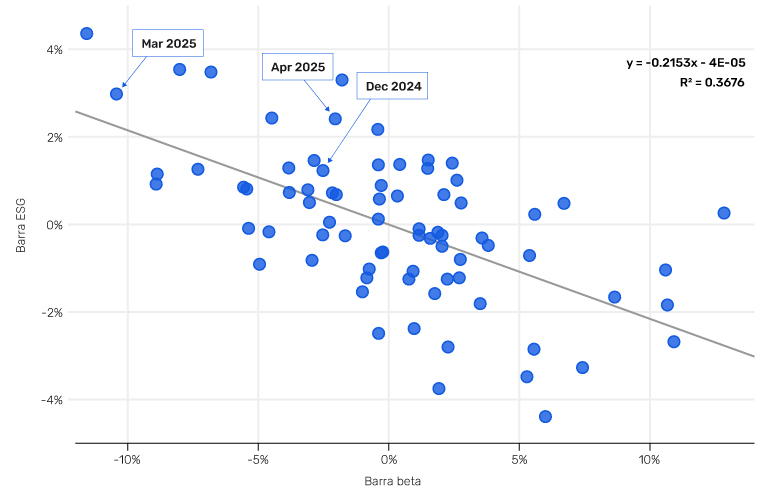

April’s selloff also reaffirmed a strongly defensive character to the ESG factor. Figure 2 shows that in weak markets like March/April 2025 and December 2024 (as proxied by the return to Barra Beta), the ESG factor exhibits positive returns. These defensive characteristics may benefit portfolios in stormy times and offer a ray of light for ESG investing. We continue to monitor these correlations closely, including within our proprietary ESG alpha model, where we see ongoing opportunities to pursue alpha for investors committed to ESG strategies.

Figure 3. ESG and Beta factor correlations

Source: Man Group using MSCI Barra monthly returns (December 2018-April 2025).

After a dismal 2024, all the signs were pointing to ESG’s bleak winter continuing into 2025.

Much of last year’s weak performance was fuelled by the growing political backlash, with critics targeting ESG investments and corporate sustainability initiatives. In 2025, the new US administration intensified these pressures with its ‘drill-baby-drill’ agenda, threats to dismantle key clean energy policies like the Inflation Reduction Act, and an executive order to roll back corporate DEI programmes. Adding to the strain, new tariffs are expected to increase the cost of renewable energy manufacturing (over two thirds of US lithium-ion battery imports come from China, for example).

So, as actual winter fades away, why have ESG’s fortunes unexpectedly brightened?

ESG blooms just in time for spring

The reality is that despite the backlash, the long-term structural drivers of ESG remain intact and investors seem to be nurturing the green shoots. Corporations remain committed to the clean energy transition, with major global companies from the technology and energy sectors investing significantly in decarbonisation efforts, alongside AI’s insatiable need for power.

Meanwhile, our own experience is that ESG-oriented clients, especially outside the US, continue to demonstrate strong interest in decarbonisation, transition and adaptation, supporting the long-term viability of the space.

Our recent paper Climate Investing: A Hierarchical Approach outlines how trillions of dollars of investment are expected to be required to support the transition to the green economy.

While one swallow does not make a summer, a key takeaway from the ‘Liberation Day’ market selloff episode is that we are starting to see the resilient nature of responsible investing.

All data sourced from Bloomberg unless otherwise stated.

With contributions from Ziang Fang, Senior Portfolio Manager at Man Numeric,Kristina Hooper, Chief Market Strategist at Man Group, Robert Furdak, Chief Investment Officer for Responsible Investment at Man Group and Chris Pyper, Head of Business Management for Responsible Investment at Man Group.

1.As represented by the iShares Global Clean Energy ETF (ICLN).

2.As represented by the Invesco Water Resources ETF (PHO).

3 As represented by the VanEck Defense ETF (DFNS).

4 As represented by the iShares Global Energy ETF (IXC).

5.As of 30 April 2025.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.