While the post-Liberation Day snapback has rewarded risk-taking and the AI boom has pushed equity markets to new highs, we saw last week that it doesn’t take much for volatility to spike again. The renewed flare-up in US-China trade tensions prompted the biggest selloff since April on Friday, only for markets to bounce back after the weekend.

We believe a backdrop of ongoing smouldering geopolitical and trade uncertainty as well as the risks around AI-driven market concentration, demands a fresh look at defensive equity strategies. Many of the traditional hedges don’t appear to work when investors need them most, according to our latest research.

We have analysed traditional defensive strategies like Low-Volatility, Quality, and Large-Cap to identify their weaknesses during downturns, then gone on to test which targeted modifications can improve their effectiveness.

The findings reveal that during a market downturn, Large Caps offer minimal protection, raw Quality factors often take several weeks to demonstrate defensive characteristics, and Low-Volatility can fail during severe market stress. However, bias-adjusted Quality strategies and tail-risk-managed Low-Volatility approaches perform materially better.

The stakes are higher

One of the key motivations for the research was that the stakes are getting higher. We outlined earlier this year that over the past 20 years, market cycles have lengthened, with bull and bear runs roughly doubling in duration.

This creates a double challenge for investors: longer bear markets mean extended periods of relying on defensive protection, while extended bull markets amplify the opportunity cost of strategies that sacrifice too much upside for safety.

You can find the full paper, with its comprehensive analytical framework, using submergence density (which measures how long strategies remain under water)1 and Monte Carlo simulations to test how Low-Volatility strategies perform across a statistically significant set of market scenarios, here.

The limitations of traditional approaches

Low-Volatility strategies typically lose 60% of what markets lose during downturns. The problem emerges during markets' worst days. In the bottom 1% of trading days, these strategies lose an additional 1% on average compared to the broader market, due in part to severe market concentration that prevents typical diversification benefits.

Quality strategies rely heavily on balance sheet metrics like return-on-equity and debt levels. This narrow approach limits performance in rising markets and frequently leads to anti-growth positioning.

Targeted improvements that work

Building Low-Volatility portfolios with a focus on extreme market movements and faster risk mitigation reduces downside capture to approximately 46%. Adjusting Quality strategies for anti-growth biases meaningfully improves upside performance whilst maintaining defensive characteristics.

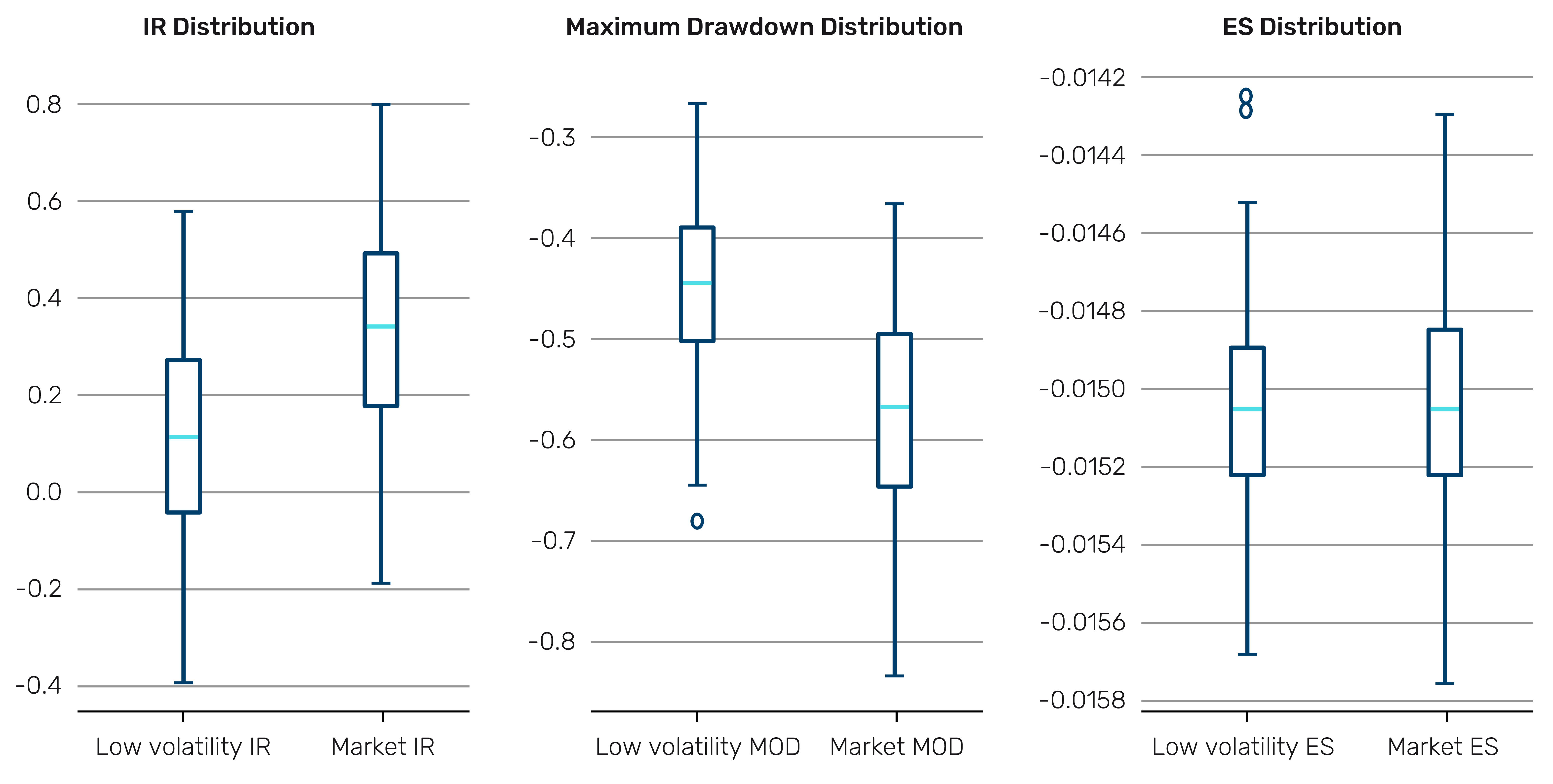

When we adjust for beta exposure to isolate true alpha performance, these targeted strategies deliver stronger information ratios, reduced drawdowns, and better performance during the worst market periods. Monte Carlo simulations reinforce this: 94% of regenerated Low-Volatility portfolios demonstrated better volatility-adjusted drawdowns, with average savings of 13%.

Figure 1. Improved drawdown and worse IR of regenerated low-volatility portfolios

Source: Man Numeric calculations, using Refinitiv, S&P and Bloomberg data, as of 30 April 2025.

When strategies work matters as much as whether they work

This year has highlighted how quickly defensive strategy performance can shift. Our analysis of all major downturns since 2005 reveals consistent patterns:

- Raw Quality strategies take around 40 days to show defensive benefits and start to lead around two to three months into the downturn

- Large-Cap strategies generally deteriorate throughout the drawdown. In the first five days of any crisis, predicting which approach will lead is nearly impossible

- Tail-risk managed Low-Volatility strategies deliver their greatest value in the first 10-20 days when volatility is highest

Expanding the defensive toolkit

Beyond Quality, some traditional factors within the value and momentum families deliver positive returns in down markets. Stronger signals produce returns of over 1% during down months compared to an average market decline of approximately 3%.

Figure 2: Individual defensive factor performance in up and down markets

Source: Man Numeric calculations using Bloomberg, Refinitiv, Trucost, Worldscope/Compustat and MSCI Barra data from 1 May 2006 to 31 August 2025.

Problems loading this infographic? - Please click here

Diversifying across momentum approaches and removing unwanted biases captures significant downside savings whilst reducing drag in up markets.

Recovery time also matters. Defensive alpha strategies differ significantly in how long they remain underwater and how quickly they recover.

The strength lies in diversification

Predicting which defensive strategies will perform best at a crisis's onset remains difficult, as early performance depends on specific economic triggers. Our analysis shows that alpha-driven and risk-based approaches have diversifying safety mechanisms, thus there is reason for making room for both in any equities portfolio.

Ultimately, the strength of defensive equity investing lies in diversification. Combining risk-based and alpha-driven approaches reduces exposure to specific biases and improves long-term portfolio stability.

Author: Tracey Nilsen-Ames, Associate Portfolio Manager at Man Numeric.

Past performance is not indicative of future results.

All data sourced from Bloomberg unless otherwise stated.

1. Rook, Dane and Golosovker, Dan and Monk, Ashby, Submergence = Drawdown Plus Recovery (February 3, 2023). Available at SSRN: https://ssrn.com/abstract=4346463 or http://dx.doi.org/10.2139/ssrn.4346463

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.