The market turmoil over the last two months has left investors scrambling for ways to protect their equity portfolios. Our ongoing research into how different defensive strategies perform during various macroeconomic environments helps explain some of the patterns we're seeing. We share some early insights here.

In the first week of April, when US President Donald Trump's 'Liberation Day' tariffs shook the globe, low volatility strategies limited their decline to 4.5% as global stocks tumbled and briefly reached bear market territory. On the week, the MSCI World was down 8.3%. Understanding how these strategies behave across different macroeconomic conditions is crucial for portfolio protection.

Bull and bear cycles are running for longer

Over the past 40 years, equity markets have cycled through dynamic bull and bear runs. In the second half of this period, cycles have roughly doubled in length for both rallies and downturns, excluding two outliers. Figure 1 highlights these patterns in the S&P 500, showing bear markets as drawdowns of more than 10% and bull markets as recoveries from troughs to new peaks.

One possible factor contributing to these changes is the increasing dominance of passive investing over the past decade which may be amplifying corrections and reshaping market behaviour.

Figure 1. S&P 500 bull and bear cycles over time

Source: Bloomberg and Man Numeric, as at 8 April 2025.

The last two months have renewed the focus on defensive strategy behaviour under pressure, emphasising the need to understand how market conditions shape portfolio construction. Analysing past performance alongside macro conditions can help investors navigate the current environment.

The three hallmark defensive strategies

When markets tumble, investors often turn to three defensive equity strategies: quality, low volatility, and large-cap stocks, all readily accessible through exchange-traded funds (ETFs).

- Quality strategies target companies with stable balance sheets, high profitability, and prudent management. These firms tend to perform well during recessions and consistently outperform from drawdown to recovery, reinforcing past flight-to-quality behaviour

- Low volatility strategies leverage the anomaly of achieving market-like returns with less risk. They excel during periods of elevated volatility, such as 8 April when the VIX Volatility Index peaked at 52, but struggle in sharp corrections like COVID. Managing tail risks is key to handling sudden shocks

- Investors often turn to large-cap stocks during stress, assuming they are ‘too big to fail’. However, this approach can create false confidence, as large-cap defensiveness has historically underperformed in bear markets, except for the short COVID correction. Stability depends on fundamentals and risk management, not size

Their effectiveness, however, depends on the nature of the drawdown.

Macro extremes differentiate strategy performance

Defensive strategies are shaped by macro conditions. During COVID, industries unable to adapt to 'work from home' were hardest hit, driven by external factors rather than company fundamentals, creating challenges for all defensive strategies.

The February 2025 drawdown reflected a blend of traditional macro challenges, including a higher-for-longer rate environment, and idiosyncratic tariff risks. Key factors to macro differentiators include US dollar exposure, 10-year rates, break-even rates, and growth versus value tilts in stocks.

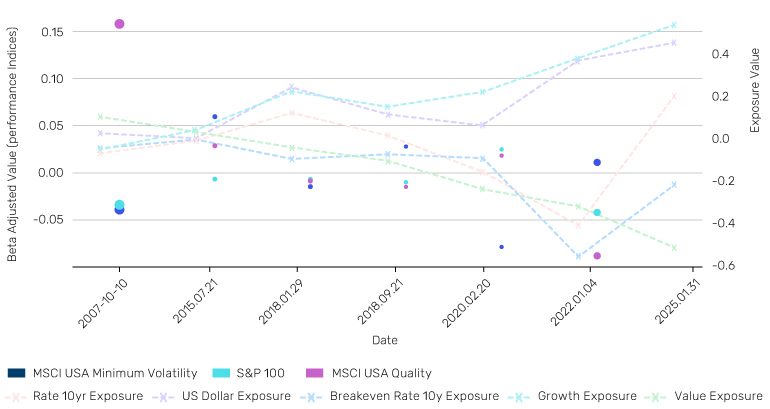

Figure 2 shows the beta-adjusted performance of defensive equity strategies during S&P 500 drawdowns exceeding 10% from 2005 to March 2025 from peak to trough. The size of the dot indicates the duration of the drawdowns, highlighting the varying impact of macro conditions on strategy performance.

Figure 2. Defensive equities performance in S&P 500 drawdowns

Source: Bloomberg and Man Numeric, as at 8 April 2025.

Today’s markets are defined by extremes. While the market has started to correct and large-cap technology stocks’ weight has reduced, they remain dominant, tilting the S&P 500 toward growth and leaving value at historic lows. Sensitivity to macro factors like the US dollar and rates may amplify volatility.

Why diversification helps

For the best performance in an equity drawdown, diversifying by blending uncorrelated strategies can help reduce overall risk. By analysing macro conditions and addressing inherent risks in the strategies most susceptible to the current environment, investors can better navigate extreme market environments.

Traditional defensive ETFs offer accessible ways to implement these strategies, but each has drawbacks. Quality ETFs struggle with an anti-growth bias, low-volatility ETFs are exposed to extreme tail risk shocks, and large-cap stocks often underperform or match the broader market. These limitations can drive significant performance differences.

We’re continuing to dig deeper into how macro shifts affect performance in a downturn and how strategy improvements can address key pitfalls. Future research will examine the costs of holding these strategies during rallies and uncover new ways to protect portfolios in volatile markets.

All data Bloomberg unless otherwise stated.

With contributions from Tracey Nilsen-Ames, Associate Portfolio Manager, and Janelle Wallace, Portfolio Analyst, at Man Numeric.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.