We’ve all seen that scene in a movie; a tense command centre erupts into cheering and high fives, apart from that one person staring at something suspicious on their screen. Plot twist! Turns out there is a problem, throwing the mission upside down.

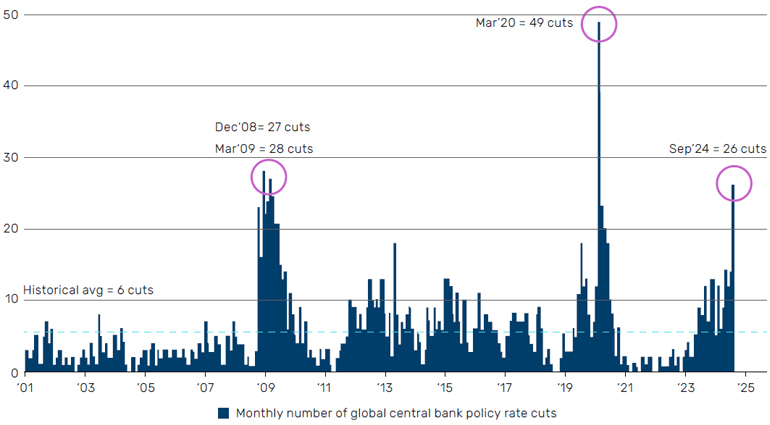

Back in the real world - while market participants are cheering central banks going into full cutting mode, some of us are indeed staring at our screens, concerned.

Figure 1: The cutting cycle is in full swing

Source: BofA Global Investment Strategy, Bloomberg. Large sample of 100+ central banks.

There are two particular threats to US inflation that worry us:

1. Donald Trump becoming the next US president

2. Escalation of the conflict in the Middle East

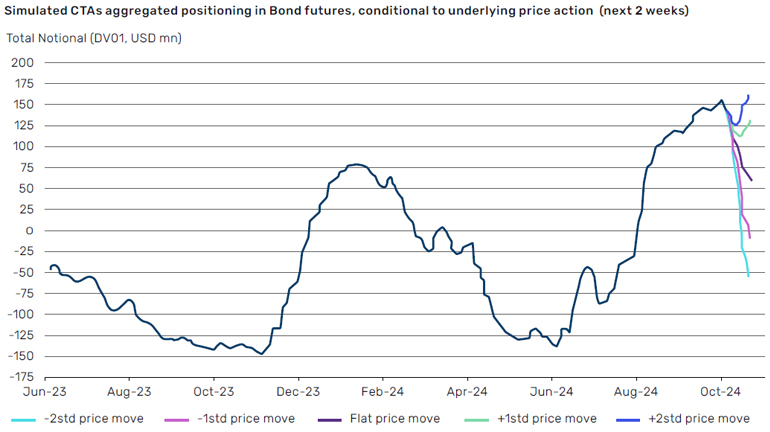

The first concern relates specifically to Trump’s proposed tariffs on US imports; 60% on Chinese goods, and 10% on other imports. The scale of these tariffs is far bigger than those enacted in 2018. Goldman Sachs estimates that the impact to US inflation will be around an extra 1% on CPI in the first year. The tariffs will likely also have a material negative impact on US economic growth. Higher yields from rising inflation will hurt on their own, but put that together with a negative growth impact, and it could trigger our biggest concern - a stagflation-type scenario in which bonds and equities both sell off together. That would be quite challenging for traditional 60/40 portfolios. In addition, some commodity trading advisors (CTA) may be exposed to this scenario – Figure 2 highlights a very simple trend program (not representative of any strategy at Man Group). We see some managers have already trimmed their positions, to varying extents.

Figure 2: The UBS CTA model implies highest long bond exposures since 2021

Source: UBS.

The second threat to US inflation comes via geopolitics and, in particular, the escalating conflict in the Middle East. We know from history that conflicts in the region can have an initial “risk-off” impact on equity markets, but this is generally short-lived and stock prices recover soon. A bigger impact comes via the oil price, and indeed we did see some reaction as tensions between Iran and Israel intensified. Energy prices are of course very important to inflation, as we saw in Europe following Russia’s invasion of Ukraine and the impact on the region’s inflation via gas prices.

Problems loading this infographic? - Please click here

These scenarios add to existing concerns that the inflation genie has not quite been pushed back into its bottle. Last week’s September CPI numbers showed that underlying US inflation exceeded expectations, indicating a pause in the recent trend of easing price pressures. The core consumer price index, which excludes food and energy, rose 0.3% for the second consecutive month, breaking a series of lower readings. Bloomberg calculations showed the three-month annualized rate climbed to 3.1%, the highest since May.

So how should we manage through a spike in inflation? Risk teams are busy analysing bond exposures and stress testing portfolios for higher yields and oil prices. Where we identify uncomfortable levels of risk, that is flagged to our portfolio managers and can result in some action to reduce exposures. It’s worth mentioning that bond yields are rising this month, so we’re seeing some natural trimming of long bond exposures.

If we think back to those command centre movie scenes – they added some drama to the films – ultimately the heroes managed through the difficulties. By staying vigilant of the risks and proactive in our portfolio management, we have a better chance of tackling whatever comes next.

Beijing marches to its own tune

While some investors may feel underwhelmed by the lack of detail during finance minister Lan Fo’an’s press conference on Saturday, we remain confident that we are at the definitive turning point in China’s attempts to reverse the cycle of deflation.

Beijing will no doubt march to its own tune in terms of the timing and communication, but we remain convinced that further stimulus will be forthcoming, and with it a sustained recovery in China’s economic outlook.

Prior to the much-hyped press conference, surveys by Bloomberg indicated that economists and investors were expecting a commitment of up to 2 trillion yuan in new fiscal measures.

Awaiting parliament approval

Lan announced that Beijing was issuing bonds to support local government purchases, strengthen bank capital to spur lending, and aid vulnerable groups without disclosing the stimulus amount. The Ministry is awaiting approval from China’s parliament, the National People’s Congress, which is expected to convene in the coming weeks.

Lan said that the countercyclical adjustment will go far beyond what has already been announced and that more steps were under discussion.

The raft of announcements in recent weeks, coupled with currency stability and bank profitability now appearing to be less of a constraint on future monetary policy easing will allow the private sector to do the heavy lifting, although implicitly backstopped by the central government.

Moreover, from a fundamental perspective we have already seen signs that forward earnings have stopped falling which has not been reflected by market levels.

Do we need more stimulus? Yes. Do we expect it will come? Yes.

For more on our views on China, read our recent paper outlining the three key catalysts for a resurgence in Asia ex-Japan equities.

With contributions from Faisal Javaid, Head of External Alpha Investment Risk at Solutions, Andrew Swan, Head of Asia (ex-Japan) Equities, and Nick Wilcox, Managing Director for discretionary equities at Man Group.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.