Key takeaways:

- The anticipated easing by the US Federal Reserve provides Asian central banks the flexibility to lower interest rates without risking their currencies.

- Recent policy changes in China, particularly in the hukou system and around rural land use, are expected to stimulate domestic consumption and reverse the deflationary cycle.

- The widespread adoption of AI is set to trigger a new technology hardware cycle, significantly benefiting Asian manufacturers and driving revenue growth, margin expansion, and profitability in the region.

Since the end of the COVID-19 pandemic, Asia ex-Japan has underperformed many global markets.

This year alone, the US exceeded its 10-year high 28 times, while Europe and Japan surpassed their peaks on over 20 occasions. In contrast, the MSCI AC Asia ex-Japan Index still trades below the levels we saw three years ago. And, currently, Asia ex-Japan equities trade at a 30% discount to global equities on a 12-month forward price/earnings basis.

Problems loading this infographic? - Please click here

Conditions are now aligning for a significant turnaround for Asia ex. Japan equities

This multi-year underperformance has led to significant outflows from mutual funds focused on the region and a near decade-low underweight positioning among global equity managers. However, we believe that conditions are now aligning for a significant turnaround. Earnings revisions in the region over the most recent reporting period are tracking at a median surprise of 4%, offering evidence that a cyclical recovery is in motion. And we see further, more structural signs, that conditions are in place to drive a positive absolute and relative earnings improvement, supporting a sustained narrowing of the current valuation discount.

Here are three reasons why we believe Asia ex-Japan is poised for a resurgence:

1. Monetary easing may open doors for Asian central banks

The US Federal Reserve’s (‘The Fed’s’) anticipated easing cycle is a critical factor in supporting Asian markets. Recent comments from the Fed Chair, Jerome Powell, at Jackson Hole, combined with weakening US economic data, suggest that the Fed is preparing for a generous cutting cycle aimed at maintaining a soft landing for the economy.

Fed rate cuts provide greater flexibility for Asian central banks to start their own easing cycles.

This expected action by the Fed provides greater flexibility for Asian central banks to start their own easing cycles without fear of negatively impacting their currencies. Many Asian central banks, particularly in Southeast Asia, have been in a position to cut rates but were restrained by concerns over domestic currency weakness. Even China has maintained a restrictive monetary policy to preserve the value of the renminbi despite economic weaknesses. With the Fed expected to lead the way, we expect these banks to follow suit, as evidenced by the Philippines already beginning its cutting cycle in mid-August. We also anticipate a more dovish stance in China, now that there is greater transparency on the direction of Fed policy rates.

The US growth outlook remains an important factor shaping this view, as historically, the performance of Asia ex-Japan equities following a cut to Fed policy rates hinges on the US economy’s ability to avoid a recession. However, should economic growth in the US continue to weaken, we believe select markets in the region will still benefit from the tailwind of lower interest rates, as local demand conditions improve. In this scenario, we expect China and certain Southeast Asian economies to outperform, driven by a rotation out of global cyclicals into domestic cyclicals.

2. Policy reforms in China: A catalyst for growth

China’s recent policy reforms have the potential to reverse the deflationary cycle and drive increased domestic consumption. Significant political meetings, such as the third plenum, Politburo, and State Council meetings, have resulted in several promising reforms, including hukou and social welfare reforms alongside possible rural land reforms.

Reforms and current economic weakness prompting greater policy support will break China's deflationary cycle.

In our view, the announced reforms to the hukou (residence permit) represent an important shift in economic policy. Traditionally, the hukou system has restricted internal migration by allocating social benefits, such as education and healthcare according to your place of birth, meaning households who have migrated to tier one cities for work have to pay social security in those cities. Granting rural migrants access to public services based on their current residence should reduce the need for saving. Similarly, the anticipated land reform measures, which aim to relax restrictions on the commercial use of residential property in rural areas, should offer China’s large rural population an opportunity to monetise rural land, something previously restricted by law. If executed correctly, we anticipate both these initiatives to deliver upside to consumption.

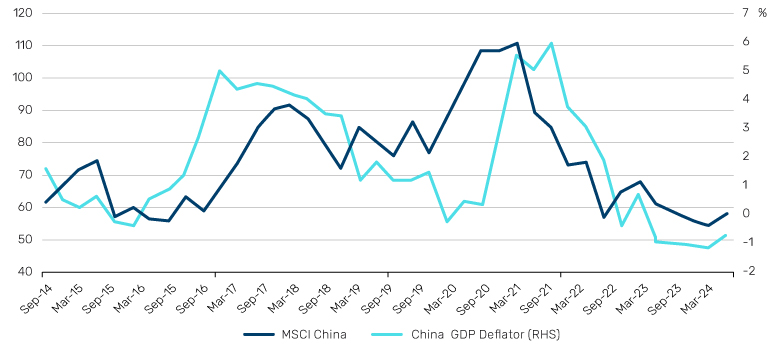

Historically, investing in Chinese equities at the peak of its deflation cycle has led to strong forward returns. For instance, early 2016 saw inflationary forces re-emerge after a period of deflation from 2014 to 2015, causing the size of the MSCI China Index to double in the two years that followed. These policy reforms are expected to stimulate economic activity and improve investor sentiment, making China an attractive investment destination once again.

Figure 2. MSCI China quarterly performance versus the GDP deflator

Source: Bloomberg as of 30 June 2024.

While recent data out of China may paint a challenging short-term picture, with new orders falling for a fifth month and fiscal data suggesting a more difficult backdrop, it is precisely this weakness that fuels our expectations of greater policy support. We believe China will begin to execute on its announced policy reforms, breaking the deflationary cycle and driving a meaningful pickup in domestic consumption.

3. AI adoption: A new technology hardware cycle

The broad adoption of AI is set to catalyse a new technology hardware cycle, disproportionately benefiting Asian manufacturers. Despite some scepticism about the pace of AI adoption and the scale of capital expenditure involved, AI functionality may be integrated into all types of consumer devices soon.

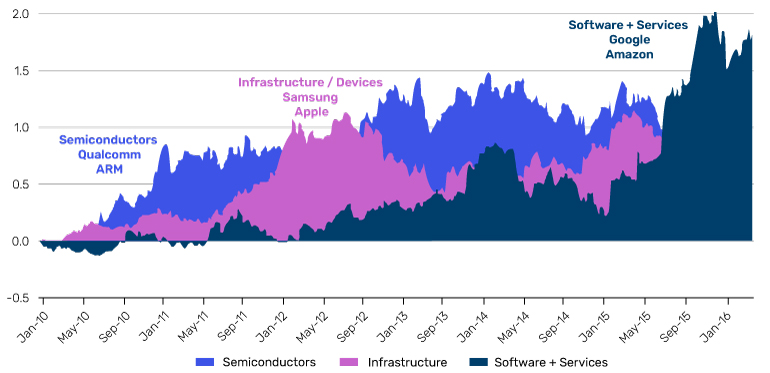

Figure 3. Relative stock performance during the mobile internet-era, January 2010 to April 2016

Source: Morgan Stanley Research. Relative performance based on an equal weighted basket of local currency price performance versus S&P500. The organisations and/or financial instruments mentioned are for reference purposes only.

This new product upgrade cycle is poised to be most pronounced in the PC and smartphone markets, with forecasts suggesting that by the end of 2026, 100% of enterprise PC purchases will be AI-integrated.1 The expected release of new AI-integrated products beginning next quarter will allow numerous Asian tech companies to capitalise on the burgeoning demand for advanced technology solutions, driving revenue growth, margin expansion, and profitability. This mirrors the growth seen during the mobile internet era, where enablers became the next winners (see Figure 3).

Conclusion: Increasing optimism about a diverse region

We are increasingly optimistic about the future prospects for Asia ex-Japan. The anticipated easing by the Fed, combined with China’s policy reforms and the impending AI-driven tech cycle, provide strong catalysts for positive relative and absolute returns.

The region’s diverse markets, with China now representing just over a quarter of the MSCI Asia ex-Japan Index, provide a broad and varied opportunity for bottom-up stock picking. The strong performance of India and the growing influence of Southeast Asian nations further diversify the investment landscape, making the region an attractive proposition for discerning investors.

Investors who have steered clear of Asia ex-Japan for the past three years should reconsider their stance, as the region’s potential for growth and recovery becomes increasingly apparent. The time to reassess and potentially increase exposure to this region is now. The confluence of these factors could lead to a sustained outperformance in the coming years, making Asia ex. Japan a compelling opportunity for forward-thinking investors.

All data Bloomberg unless otherwise stated.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.