Last week, we saw the S&P 500 Index suffer its worst day since December 2022 and the Nasdaq experience its biggest fall since October 2022 following underwhelming earnings reports from mega-caps Alphabet and Tesla. The other constituents of the Magnificent Seven1 all fell as the market awaits their second-quarter earnings due to be released this week (with the exception of NVIDIA, which reports in late August). The sell-off occurred amid a broader market rotation in which we have recently seen small caps surge and heavily-owned, mega- and large-cap names affected to the downside.

A blip -- or is the Magnificent Seven’s golden age over?

To help answer this question, we revisited our analysis on the longer-term prospects for this important cohort of stocks, which have dominated markets since 2023. In January, our simple analysis suggested most of the Magnificent Seven were not exorbitantly valued, apart from Tesla. In April, our analysis highlighted that expectations had increased fairly dramatically for NVIDIA, and had also risen for Microsoft. We’ve been watching a basket of 10 names which, as well as including the Magnificent Seven, reflects another key current theme, the popularity of the GLP-1 weight-loss medication (represented by Eli Lilly and Novo Nordisk). Also, in chip manufacturing, it includes the company which at one point was worth almost 10% of the MSCI Emerging Markets Index, Taiwan Semiconductor Manufacturing Company Ltd (TSMC). From 1 April to 24 July, the average return of this group has been 13.5%, with Meta falling 5%, Microsoft, Amazon, and Novo Nordisk close to flat, and the other six stocks up to double digits.

Capex concerns

While the rotation we have witnessed over the last few weeks has many potential causes -- from momentum simply having run too far, to geopolitical risks surrounding the semiconductor industry, to weakening seasonals -- there has also been concern over the increasing capital expenditures related to artificial intelligence (AI) infrastructure (primarily benefitting NVIDIA and TSMC thus far). Further, investors are keen to understand when companies will start to show revenue and/or margin growth from their incremental spending. For example, Microsoft’s capital expenditure rose from $23.9 billion to $28.1 billion from financial year 2022 to financial year 20232. On a trailing four quarters basis, capex is now $39.5 billion, and is expected to be $44.8 billion in financial year 2024 and $52.9 billion in financial year 2025.

While Alphabet modestly beat forecasts on both revenues and net income for their second quarter, reported last week, capex came in at $13.2 billion versus analyst estimates at $12.2 billion. Year-to-date capex is now $25.2 billion, nearly double the $13.2 billion in the comparable period last year. For the year, capex is expected to be $48.3 billion versus $32.2 billion in 2023.

Tesla is a different story, as even though it has always invested heavily in both technology and capacity growth, the deteriorating fundamentals of the automotive business came back to the forefront last week. After rallying 40% from 1 April through 23 July due to optimism over its AI capabilities (full-self driving (FSD), robotaxi etc.) and a sequential improvement in deliveries from the first quarter to the second, the reality of significantly lower margins combined with a delay (shocker!) in their robotaxi unveil initially scheduled for August led to a severe sell-off on 24 July.

The numbers

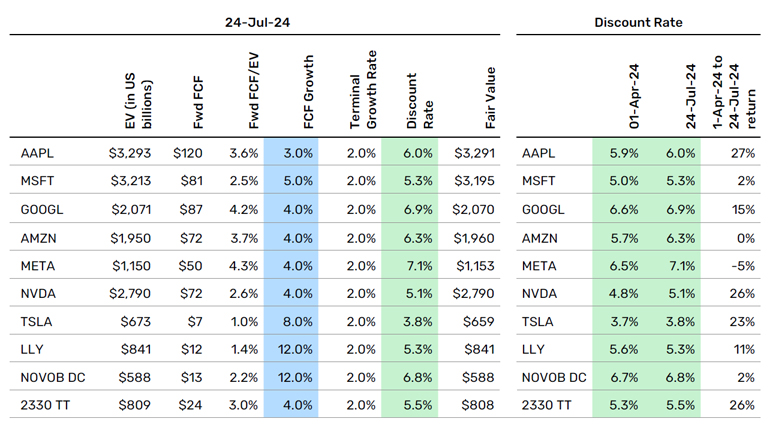

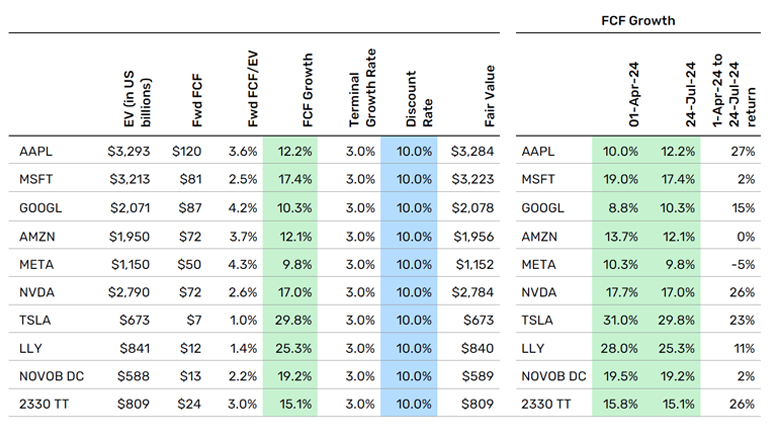

In Table 1, we have updated our model of the 10-year annualised expected return (the discount rate), given a certain level of free cash flow (FCF) growth, as well as the required level of FCF growth to generate an annualised 10% return in Table 2. The reality is not that much has changed in terms of either an expected return or a required growth in FCF. This is, in part, due to the significant sell-off in these names over the last few weeks which has brought valuations to arguably more reasonable levels. Of the three companies that have reported so far this month (Alphabet, Tesla, and TSM), not much has actually changed following their recent price moves.

Table 1. What might investors realistically expect?

Source: Man Numeric and Bloomberg, as of 24 July, 2024.

Table 2. What would be necessary to produce a 10% annual return?

Source: Man Numeric and Bloomberg, as of 24 July, 2024.

What will investors be looking out for this week?

From a growth perspective, expectations are highest for Microsoft, and there will also be a significant focus on their capex and forward-looking commentary. Apple has rallied recently on the back of AI enthusiasm, growth in India, and improvements in China. Seasonally, this is usually the least important quarter of the year for Apple, and expectations will be higher than a quarter ago. Notably, the firm has always been more disciplined from a capex perspective and has recently shown more robust FCF growth than the likes of Microsoft and Alphabet. Amazon has had improving fundamentals recently and all eyes will be on whether they can sustain that success. Meta has arguably the lowest expectations of the group, though there will be focus on the capex spend and prospects for incremental revenue or margin improvement.

NVIDIA doesn’t report until late August, but it will likely be sensitive to any incremental comments from these companies. According to Bloomberg estimates, Microsoft and Meta amounted to 29.1% of NVIDIA’s revenues in the last quarter, and if you include Alphabet, Amazon, and Tesla, that number increases to 45.1%.

Returning to the question we posed at the beginning of this article, we anticipate that the week ahead will provide crucial insights as to whether recent weeks have been a blip for the Magnificent Seven, or whether its golden age has reached an end.

With contributions from Dan Taylor, Chief Investment Officer at Man Numeric.

1. Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla.

2. Note they are on a June FY cycle.

Views from the Floor is taking a summer vacation. We are pausing our commentary during August and look forward to seeing you back here on Tuesday 3 September for more market and portfolio insights.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.