Mr Market’s Love Letter to Beta

If you’re thinking of treating a loved one to an extravagant gift this Valentine’s Day, they don’t come much more expensive at the moment than Beta. Across our universes of global developed and US stocks, Barra Beta is near its all-time valuation highs, on both a trailing and forward basis (Figure 1). Emerging markets are interestingly the exception here.

US and global Beta conditions look very similar to early 2000 to us; the valleys seen in 2009 were a little different from today’s situation, in our view, given the greater divergence between forward- and backward-looking earnings. In any event, both the early 2000s and early 2010s were strong periods for Low Beta after these extreme valuation points.

Low Beta has admittedly not enjoyed an impressive start to 2023, having been a terrible performer in 2020/2021 and then surging in 2022 (Figure 2). History suggests that the past few weeks are the anomaly, however, and investors may rediscover their ardour for Low Beta in the months ahead.

Figure 1. Sector-Relative Valuation by Sector-Relative Beta in Global Developed, US, and Emerging Market Equities

Problems loading this infographic? - Please click here

Source: Man Numeric; as of 2 February 2023. A lower Z score (y axis) signifies an elevated valuation. EM data begin in 2004

Figure 2. Sector-Relative Return of Low Beta Stocks

Problems loading this infographic? - Please click here

Source: Man Numeric; as of 31 January 2023. Performance reflects bottom Barra Beta decile among largest 1,000 companies by market cap

On Again, Off Again – Central Banks’ Relationship with Bond Markets

A former governor of the Bank of England (‘BoE’) was once likened to “an unreliable boyfriend”. Now it seems that the bond markets are blowing hot and then cold despite consistent messages from the central bankers. After the most recent set of monetary announcements, government bond yields swiftly dropped materially in the UK and the euro area before rebounding higher (Figures 3 and 4).

Some of the immediate reaction could be attributed to the increasing consensus that inflation may be slowing, even though neither the BoE nor European Central Bank (‘ECB’) were particularly dovish on the day. But we also note technical factors at play: market positioning has been bullish on developed sovereign debt, with strong fund flows into these bonds. Counteracting this, however, investors tend to be quite cautious heading into central-bank meetings, so we suspect significant rates hedges were in place in case policymakers turned more hawkish. When those fears were not realised and yields dropped, stop losses are likely to have been triggered on some of those large hedges, exacerbating the rally. Enthusiasm ultimately then seems to have been tempered by a robust US jobs number and upside surprise on the ISM services indicator, plus reinforcement of the inflation-taming mantra by several ECB officials.

This round trip leaves us with what is, in our view, much cleaner positioning in bond markets now. We expect further moderate hikes in the UK and US, but possibly faster tightening in the near term in the EU, so would caution against hopes that bond yields will tumble again soon.

Figure 3. I22 GBP United Kingdom Sovereign Curve, Mid YTM

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 10 February 2023.

Figure 4. I13 Euro Benchmarks Curve, Mid YTM

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 10 February 2023.

Are Investors Still Too Romantic in Their View of Energy?

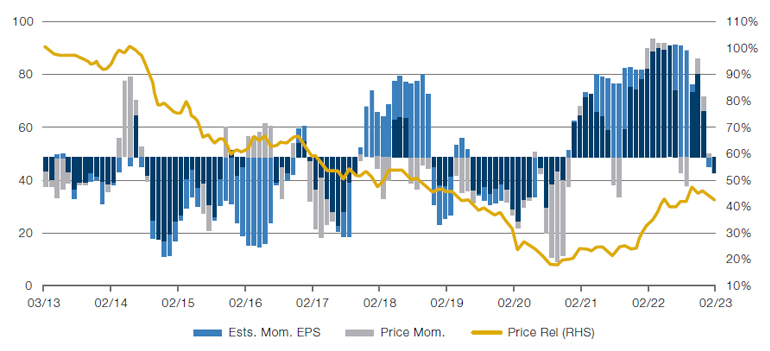

Oil majors around the world have been reporting record-high profits and cash flow this earnings season. The challenge for investors is that these bumper numbers reflect the exceptional events of 2022, not a particularly rosy outlook for the sector. Indeed, after a correction in oil and gas prices in the later months of last year, earnings momentum in both the US and Europe energy sector has been rolling over decisively (Figure 5).

Despite this, we did not see a corresponding reappraisal of these companies’ share prices until relatively recently; we expect this trend of the sector’s underperformance to persist as the earnings trajectory becomes clearer. Where we do take exposure, we prefer European names to their US counterparts due to the former’s better progress on the transition to alternative energy and superior carbon-footprint credentials. Within the sector, we also have a strong preference for Equipment & Services companies instead of their Integrated and Exploration & Production peers on the back of a cyclical pickup in oil-and-gas capex ahead, after multiple years of subdued activity.

Figure 5. US Energy Sector EPS and Price Momentum

Source: Redburn; as of February 2023.

With contributions from: Dan Taylor (Man Numeric – CIO) and Yakym Pirozhenko (Man Numeric – Quantitative Alpha Integration and Strategy Analyst); Craig Veysey (Man GLG – Portfolio Manager); and Filipe Bergana (Man GLG – Portfolio Manager)

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.