Quote of the Week:

"Although today’s data tells us that the economy is recovering as lockdown restrictions ease, it still has a long way to go. And that challenge will be bigger for the UK than for most other rich countries."

Fear and FOMO

When investors are fearful, they often buy gold: the metal has long been considered as a safe haven, rising in times of financial stress, and is also regarded as a hedge against inflation.

When looking to participate in the upswing of economic cycle, investors often buy copper. The metal has multiple industrial uses and is strongly correlated with rallies in bullish sentiment.

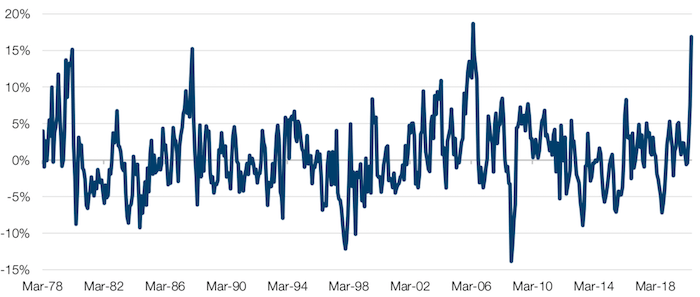

So how do we explain the fact that both copper and gold have rallied simultaneously? As Figure 1 shows, the rolling 4-month return of a risk-parity portfolio of the first copper and gold future was 17% at the end of July, the second- highest reading ever.

In our view, investors are displaying both fear and the fear of missing out. Whilst the coronavirus pandemic has triggered the deepest recession of all time (in the UK at least), the macroeconomic news points towards a fast recovery. And so we get both fear and FOMO – investors desperate to participate in the rally, yet terrified that the coronavirus recession indicates a prolonged period of grinding misery.

On the other hand, and given that both have tended to perform strongly in times of high and rising inflation, maybe, just maybe, this price action represents an inkling that this 30-year disinflationary regime may be coming to an end.

Figure 1. Four-Month Rolling Return, Risk-Parity Portfolio of 1st Gold and Copper Future

Source: Bloomberg; as of 31 July 2020.

What’s Hot, What’s Not

How are analysts feeling about certain stocks?

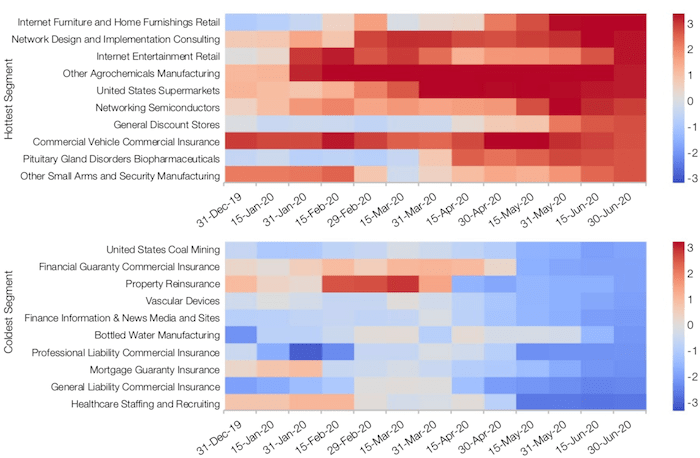

Our analysis shows that analyst sentiment has been more fickle than usual due to the extraordinary level of economic uncertainty during the coronacrisis (Figure 2).

Unsurprisingly, ‘internet’-related businesses are still favoured by analysts. Interestingly, security manufacturing has also heated up as of late, while ‘commercial liability insurance’ and ‘mortgage guaranty’ is one of the visible themes on the negative side.

Figure 2. Analyst Sentiment Over Time

Source: Factset, Man Numeric; as of 30 June 2020.

Data measures average analyst revision of business segments with at least eight companies.

With contribution from: Henry Neville (Man Solutions, Analyst) and Ed Fang (Man Numeric, Director of Research).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.