Key takeaways:

- The catastrophe bond market today is dominated by the ‘peak perils’ of US wind and quake, but extending beyond these two risks can improve diversification and tail characteristics in a portfolio

- Man-made risks, such as cyber and terrorism, materially differ from natural catastrophes and represent orthogonal perils

- While the novelty and inherent uncertainties of terrorism risk might cause hesitation among cat bond investors, these very factors may ultimately lead to more attractive risk-reward ratios

Introduction

Since its beginnings around the turn of the century, the catastrophe (cat) bond market has grown to an almost US$50 billion market today and is of systemic importance.1 However, the market is dominated by the ‘peak perils’ of US wind and quake. While such cover mitigates the economic cost of natural disasters for the insured, and Florida wind and California quake can offer capacity and yield impressive returns for an investor, extending beyond these two risks can improve diversification and tail characteristics in a portfolio.

In part one of a new series on the asset class, we discuss the origins of the pooled terrorism reinsurance entities in the UK and France, how these entities access the cat bond market, and we outline some investment considerations for cat bond investors.

Pooled terrorism reinsurers: Their origins and cat bonds

On 10 April 1992, the Provisional IRA detonated a one-ton bomb outside the Baltic Exchange, in the financial centre of London. It was the largest bomb in mainland Britain since WWII. This, combined with the subsequent Bishopsgate bombing by the IRA in 1993, led to a general seizure of terrorism insurance, with insurers excluding terrorism from their cover.

Case study: Pool Re

Pool Re was formed in 1993 to address the seizure in UK terrorism insurance following the IRA attacks in 1992 and 1993. The most remote risk is supported by the UK government, but cat bonds also provide more junior support.

In response, Pool Re was launched, which now stands as the UK’s largest terrorism reinsurer. Pool Re is a mutual reinsurer founded by the insurance industry in cooperation with the government. The latter provides an unlimited, but repayable, treasury financial guarantee.2 Despite paying out claims in excess of £1.25 billion3 across 17 terrorist events, Pool Re has never called upon the guarantee.4 This Treasury guarantee was intended as a temporary measure with Pool Re seeking private reinsurance where possible, including through the cat bond market.

It is worth noting that there are rules in place to prevent adverse selection of policies ceded to Pool Re. ‘Cede All’ requires members to cede all their eligible terrorism risk to the Pool; and ‘All or Nothing’ means that where policyholders insure their terrorism risk, they must do so in respect of all eligible property, premises and business.

The Baltic PCC Limited (Baltic PCC) cat bonds, with Pool Re as sponsor, feature an indemnity trigger with annual aggregate cover, such that Pool Re would have occurrence protection for major terror attacks and, in the event of a series of smaller terrorist attacks, frequency protection too. The 2019 and 2022 issues both had an initial attachment point of £500 million and an exhaustion point of £700 million.5

Somewhat unusually, Baltic PCC is domiciled in the UK, utilising the UK ILS (insurance-linked securities) regulatory regime designed to promote ILS issuance in the UK.6 The bonds provide cover against terrorism losses that occur in England, Scotland and Wales only. Within this geographical area, the bonds cover commercial and commercial residential property damage, and business interruption. There are various exclusions, for example war; riot; civil commotion; and losses in respect of data and money when triggered by remote digital interference (i.e. a cyber attack).

Case study: GAREAT

GAREAT was formed in 2002 to address the seizure in French terrorism insurance following the 9/11 attacks and the 2001 AZF explosion in Toulouse. The most remote risk is supported by the French government, but cat bonds also provide more junior support.

Turning now to France, GAREAT (Gestion de l’Assurance et de la Réassurance des Risques Attentats et actes de Terrorisme) was formed in 2002 following the attacks of 11 September 2001, and the AZF fertiliser-factory explosion on 21 September 2001 in Toulouse. While the latter is regarded as an accident, reinsurers began excluding terrorism cover and so GAREAT was set up as a co-reinsurance pool for its members. Members retain the lowest tranche of risk, private reinsurance covers the middle layer, and the remaining excess of loss cover is provided by the French state via CCR (Caisse Centrale de Réassurance).

In 2024, GAREAT entered the cat bond market with the announcement of Athéna I Reinsurance (Athéna), designed to mitigate the risk of terrorist attacks in France and its overseas territories. Somewhat similar to the Baltic PCC deal, Athéna has an initial attachment point of €500 million, and an exhaustion point of €700 million.7 Unlike the Baltic cover, the Athéna deal is not limited to commercial property.

Table 1. Summary of announced terrorism bonds

The first cat bond for Pool Re was launched in February 2019, with the risk being subsequently rolled into a second deal (and upsized). GAREAT made its debut in the cat bond market in December 2024. Source: Artemis, Bloomberg.

While the Baltic PCC and Athéna deals were the first to focus solely on terror, they were not the first cat bonds to have terrorism exposure. In 2003, coverage was obtained in the event of cancellation of the 2006 FIFA World Cup (specifically, that a winner was not declared by September 2007). The primary risk contemplated was terrorism, with world war a specific exclusion.8

Man-made risks, such as cyber and terrorism, do differ from natural catastrophes. For man-made risks, insurers are able to take action to reduce policyholder risk. In the case of cyber this may be performing an audit of the policyholder’s computing infrastructure, while for terrorism Pool Re offers a variety of programmes and tools aimed at incentivising good security and risk management behaviours. Qualifying businesses who successfully complete the Vulnerability Self Assessment Tool can receive a Loss Mitigation Credit (10% discount to their premiums).9

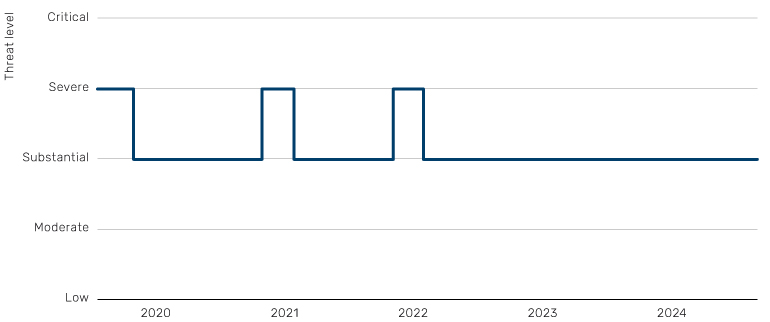

The UK terrorism threat level is set by the Joint Terrorism Analysis Centre (JTAC), based within MI5. The level falls into one of five categories: Low, Moderate, Substantial, Severe and Critical. Low indicates an attack is highly unlikely, while Critical implies an attack is highly likely in the near future. MI5 states that the current threat to the UK from all forms of terrorism is Substantial (Figure 1). However, given that this does cover all forms of terrorism, i.e. against persons as well as property, it is not a direct risk assessment of threat to property, and therefore the Baltic bonds.

Figure 1. MI5 national threat level

The national threat level has varied between Substantial and Severe over the last five years, although this measure includes the risk to persons as well as property

Source: MI5.

Terrorism alert levels in France, governed by the system known as ‘Vigipirate’,10 are issued by the French government. Following the Moscow attack on 22 March 2024, Prime Minister Gabriel Attal escalated the Vigipirate plan to ‘Urgence attentat’, its highest level, across the entire country.11

Thus far, only UK and French terrorism exposure is accessible through the cat bond market. However, there are more than a dozen terrorism pools throughout the world, with the bulk able to purchase cover in the private market.12 Thus, over time, it is possible that the terrorism cat bond geographical scope will increase.

Should an allocator consider terrorism insurance (a man-made peril) in their portfolio?

Pure terrorism risk (as embodied by the Baltic PCC and Athéna deals) is obviously a diversifier to natural catastrophe bonds, but a concern might be that a major terrorism event (and subsequent cat bond losses) would be correlated to a selloff in financial risk assets. There are a few counterarguments to this perspective:

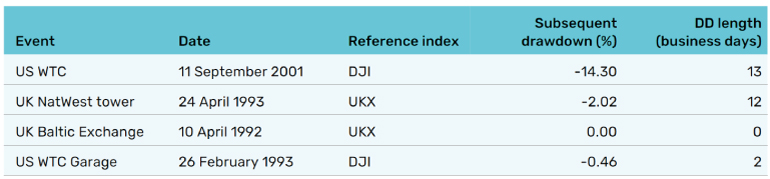

1. Policy response: Perhaps partly because of attendant policy responses, historical major physical attacks in central business districts have not impacted the financial markets as much as might be imagined (Table 2).

Table 2. The drawdowns in equity markets resulting from physical terror attacks are not as large as might be expected

Source: Bloomberg.

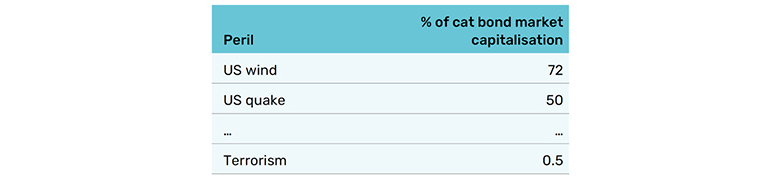

2. Materiality: There are approximately US$230 million of cat bonds outstanding linked to terrorism. This represents just 0.5% of the overall cat bond market capitalisation (Table 3). Thus, even total loss on terrorism bonds would not be material for the space (by contrast, the HIM (Harvey, Irma and Maria) hurricanes led to a 15.7% drawdown in the Swiss Re Cat Bond Total Return Index).

Table 3. Terrorism represents only 0.5% of the overall cat bond market capitalisation, while peak perils such as US wind and quake dominate the space

Source: Man Group database.

3. Causality: If only by virtue of the modest market cap of the cat bond space (about US$47 billion), allocators will likely have a modest allocation to cat bonds relative to, say, equities and bonds. As such, we care about the causal relationship between terrorism and equities:

1. Does an equity selloff cause a terrorism bond selloff?

2. Does a terrorism bond selloff cause an equity selloff?

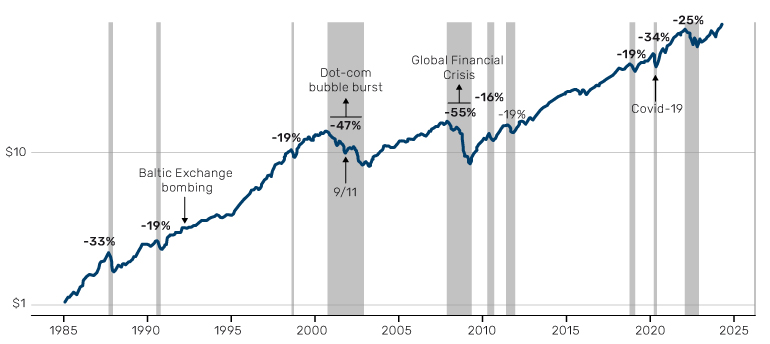

The answer to the first question is probably ‘no’. Even if the answer to the second is ‘always’ (and the point above suggests that it is not the case), then, as Figure 2 shows, the bulk of the equity selloffs over the last 25 years have not been terror related, and therefore addition of such risk has still been diversifying for an investor.

Figure 2. Historically, the cause of S&P 500 Index selloffs has been non-terror related. As such the addition of terror has been diversifying

Source: Bloomberg.

Conclusion: A natural diversifier to natural catastrophe insurance

Catastrophe bonds support their issuers (usually governments and insurers) with the promise of an insurance payment during an extreme tail risk event. As such, they ideally mitigate – at least – the financial and social impact of such a disaster. For investors, while the uncertainties of terrorism risk may cause hesitation, these very factors present unique opportunities. Terrorism insurance, as an orthogonal peril, offers diversification benefits distinct from traditional natural catastrophe risks. The launch of the GAREAT deal signifies a potential expansion in the availability of terrorism insurance bonds across various geographies, further broadening investment horizons.

Some investors may not be able to participate in these deals because of their ‘Nat Cat’ (natural catastrophe) mandate. Others may choose not to do so because of limited historical loss data and model uncertainty. However, all other things being equal, this softer demand may lead to more attractive risk-reward ratios – helping to compensate investors for that very modelling uncertainty. In addition, this uncertainty is increasingly diversified away as the pool (geography and seniority) of terrorism risks increases. As the cat bond market continues to evolve, the inclusion of non-natural catastrophe risks like terrorism might become increasingly appealing to investors seeking to optimise their portfolios through diversification.

1. https://www.esma.europa.eu/press-news/consultations/call-evidence-review-ucits-eligible-assets-directive#responses

2. https://www.gov.uk/government/publications/terms-of-reference-for-hm-treasurys-review-of-pool-reinsurance-limited/terms-of-reference-review-of-pool-reinsurance-company-limited-pool-re

3. Inflation adjusted

4. Who We Are - Pool Reinsurance

5. Baltic PCC Limited (Series 2022-1) (artemis.bm) Noting the differing initial attachment probabilities for the bonds, 3.05% for the 2019 series and 2.59% for the 2022 series.

6. https://www.nortonrosefulbright.com/en/knowledge/publications/898f8503/new-united-kingdom-insurance-linked-securities-ils-regime

7. https://www.artemis.bm/deal-directory/athena-i-reinsurance-dac/

8. https://www.rms.com/blog/2014/07/16/rms-and-the-fifa-world-cup-insuring-against-terrorism

9. POOL Re - Helping to build resilience against terrorism risk - City Security Magazine

10. An acronym of ‘vigilance et protection des installations contre les risques d'attentats terroristes à l'explosif’

11. https://www.interieur.gouv.fr/actualites/actualites-du-ministere/plan-vigipirate-niveau-urgence-attentat-declare-0

12. https://iftrip.org/wp-content/uploads/2022/06/terrorism-pool-index-2022.pdf

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.