Introduction

Underlying residential fundamentals are healthy, providing an opportunity to achieve attractive returns through credit investing and a cushion against future value declines.

We believe the US residential private credit market offers a differentiated and scalable value proposition for global insurance companies. Underlying residential fundamentals are currently healthy, providing an opportunity to achieve attractive returns through credit investing, with a cushion against future value declines. It also helps to diversify existing exposures to commercial real estate (CRE). Furthermore, risk-based capital charges can be as low as <1%-2% and Federal Home Loan Bank (FHLB) financing can be accessed to leverage at a reduced cost. The granularity of the asset class is an opportunity driver but this also raises additional considerations. Finding investment management partners who can structure customised solutions for insurance companies to reduce the investment and administrative burden is crucial. Get this right, and the results may be compelling.

1: The Residential Asset Class

During periods of economic downturns or macroeconomic challenges, investments tend to respond in order of liquidity: first bonds, then loans, then real estate. With the emergence of inflation and interest rates moving from near-zero to over 5%, and then back to 4.50% + today, we have witnessed the repricing of bonds and then loans while US house prices have remained sticky.

Problems loading this infographic? - Please click here

Banks have continued to adopt a risk-off approach to certain types of lending and private market investors have increasingly stepped in to fill this void.

For institutions acquiring and aggregating Single-Family Rental homes (SFR, the equity side of the residential business), rapid home price appreciation and accretive leverage, coupled with attractive capitalisation rates (cap rates), led to substantial investment volumes before and during the COVID-19 pandemic.

As financing costs backed up, home prices nationally have continued to rise to the point where the cost of financing may exceed the cap rate or yield, resulting in a period of negative leverage. Yet, this exact challenge for institutional SFR equity investors underscores the opportunity within residential credit today: stability amid volatile rate cycles, with house prices reflecting healthy market fundamentals and strong consumer demand.

Paradigm shift for financing investment properties

For credit products, banks have historically served as the primary conduit for borrowers to access debt financing and capital markets. However, following the regional bank crisis in 2023, banks have continued to adopt a risk-off approach to certain types of lending. This has been attributed to a range of factors including: (i) increased capital requirements stemming from Basel III regulations, (ii) higher interest rates, (iii) a flatter (or inverted) yield curve, (iv) deposit outflows, and (v) growing risk in banks’ existing portfolios. Private market investors have increasingly stepped in to fill this void, particularly prominent in areas like commercial real estate, the non-agency residential sector, loans to smaller sponsors, and consumer lending. For investors, we believe the shift from public to private market financing is emerging as an attractive source of income-driven returns at low attachment points to underlying collateral.

Even though affordability levels are near all-time lows, we’ve seen home price resilience due to a lack of supply.

Rates are up, yet home prices grind higher due to lack of supply

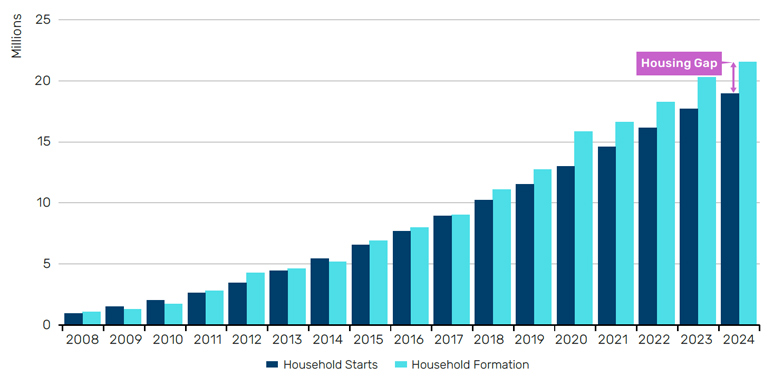

While yields have increased in many sectors from the lows of the zero-rate environment, we see the residential credit space as particularly compelling given the strong underlying fundamentals and opportunity to diversify other credit exposures. Conforming 30-year mortgage rates reached nearly 8% after the Fed’s rate hike campaign and have since fallen to the mid-high 6%s following recent Treasury moves. Despite affordability levels near all-time lows, we’ve seen home price resilience due to a stark lack of supply – a shortage estimated at around 2.5 million homes based on household formations between 2008 and 2024.

Figure 2. Household formations are outpacing housing starts1,2 (cumulative measure since 2008)

Source: 1. Federal Reserve Bank of St. Louis, as of September 2024. 2. Roughly 250,000 housing units are lost per year to demolition, Joint Center for Housing Studies of Harvard University, as of September 2024.

We believe this balance between scarcity and affordability will continue to support US house prices in the near-to-medium term.

Problems loading this infographic? - Please click here

Residential real estate provides investors with a unique opportunity to gain the benefits of real estate exposure without some of the traditional limitations of other real estate classes.

Government agencies provide stability through cycles

Residential real estate provides investors with a unique opportunity to gain the benefits of real estate exposure without some of the traditional limitations of other real estate classes. Unlike assets that rely solely on debt capital markets, residential real estate has support throughout credit cycles from government-sponsored enterprises (“GSE” or “Agency”), such as Fannie Mae, Freddie Mac, and Ginnie Mae. The existence of permanent agency financing for multifamily and single-family housing, typically 10- and 30-year terms, respectively, makes for an even more stable investment over time.

Role of the consumer in residential real estate

In addition to attractive agency financing, which is unique to residential real estate, the residential market has distinct features that support the sector. Unlike other property types, the single-family market is granular and driven by individual homeowners purchasing primary residences. Meaning, as long as the job market remains healthy and people have the means to pay their mortgage, there’s no margin call putting downward pressure on housing due to 30-year agency mortgages, which are primarily fixed rate.

2: Capital Treatment & Financing

The capital treatment of these assets should further appeal to insurance companies. At Man Group, we focus on residential investor loans; typically, residential transition loans (“RTL” / “Fix & Flip”), SFR loans, institutional development loans and bridge loans. The borrowers are property investors, not homeowners.

These investments, whether held on balance sheet or accessed through an affiliated fund structure, receive risk-based capital charges as low as 1% for life insurers. This is quite attractive when compared to commercial real estate equity at around 11-13%, or equities/ alternatives at approximately 30-40%. At current yields, the return per unit of risk-based capital would be as high as 1,000% or more, in this example.

These assets are generally FHLB-eligible loans, an attractive way to access inexpensive financing. The FHLBs form a consortium that provides liquidity at subsidised rates to finance housing and economic development activities. Members of the system, including insurance companies, have access to low-cost leverage.

3: Customised Solutions for Insurance Companies

While large-balance-sheet CRE investors are typically comfortable with loans ranging from tens to hundreds of millions of dollars, a typical RTL strategy involves a large number of smaller loans with even smaller renovation draws as developers meet specific milestones. It is therefore important for insurers to consider partners with asset management expertise, particularly across workout, operations, and accounting. If something goes wrong with a granular residential loan, it may go delinquent, which requires expertise to resolve issues, work out the loan or step in and dispose of the asset.

Investment managers who structure solutions to address the operational complexities associated with the granular nature of the strategy offer enhanced benefits, particularly for small-to mid-sized insurers. Alternatives to balance sheet investing include trust structures that reference single line items and the world of securitisation and Nationally Recognized Statistical Rating Organization (NRSRO) ratings, where capital charges can be reduced further. RTL investments made through affiliated trusts that reside on Schedule BA can receive look-through treatment to the underlying mortgages, thereby maintaining an attractive 0.68% RBC charge while addressing the need for extensive line-item reporting.

Conclusion

Partnering with an experienced investment manager is key to create a seamless way for insurers to access that yield pickup, diversification, capital treatment and financing option.

The macroeconomic environment has recently been supportive for private US residential credit investors; as rates have risen, leverage has decreased, and regional banks have pulled back. Meanwhile, residential real estate fundamentals are healthy and anticipated to remain so. Amid this unique market dynamic we see a compelling opportunity for insurance companies seeking a differentiated source of income with a yield pick-up and exposure to a healthy underlying market. This is coupled with attractive capital treatment and inexpensive FHLB financing. Partnering with an experienced investment manager is key though, to create a seamless way for insurers to access that yield pick-up, diversification, capital treatment and financing option, without the burden of buying and asset managing hundreds to thousands of individual residential mortgage loans.

All data sources Bloomberg unless otherwise stated.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.