Key takeaways:

- ESG investments proved unexpectedly resilient during April's market storm

- The theme delivered strong absolute returns and reaffirmed its defensive traits

- Long-term structural drivers remain intact with continued corporate commitment to the clean energy transition

After a long, harsh winter for environmental, social and governance (ESG) investing, signs of spring have begun to emerge. Amid April’s stormy markets, this investment theme has proven unexpectedly resilient, demonstrating its defensive qualities while also offering resilient performance.

At the end of April, Clean Energy stocks1 were up 3% year-to-date, Water Resources2 had held steady, and Defence stocks3 continued to deliver strong absolute returns (Figure1). By contrast, the S&P 500 and MSCI World indices ended the month down 5% and 3% respectively, despite the strong rally after the ‘Liberation Day’ market meltdown early in the month. Meanwhile, Global Energy stocks4 slumped 12% in April alone.

ESG factor returns have also shone brightly with the Barra ESG factor the third best performing factor year to date5, behind only Size and Profitability. This resilience is especially striking given the prevailing anti-clean energy and diversity, equity and inclusion (DEI) sentiment in the US.

Figure 2. Year-to-date ESG asset and factor returns versus equity indices

Problems loading this infographic? - Please click here

Source: Man Group, Bloomberg, as of 30 April 2025.

Strong defensive traits

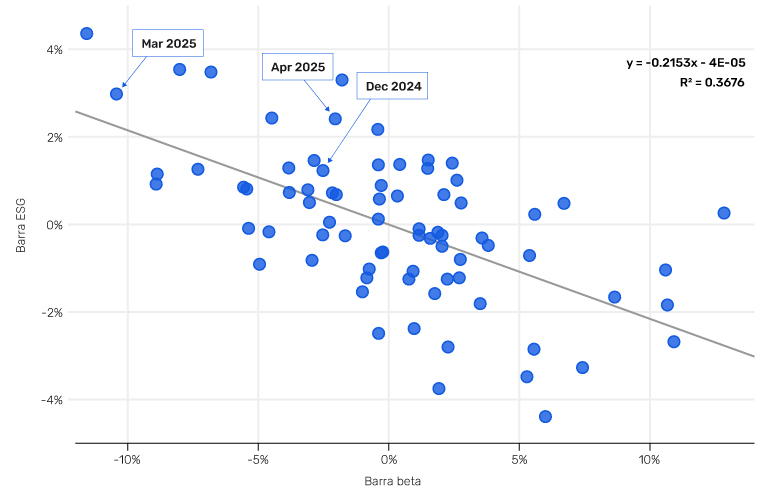

April’s selloff also reaffirmed a strongly defensive character to the ESG factor. Figure 2 shows that in weak markets like March/April 2025 and December 2024 (as proxied by the return to Barra Beta), the ESG factor exhibits positive returns. These defensive characteristics benefit portfolios in stormy times and offer a ray of light for ESG investing. We continue to monitor these correlations closely, including within our proprietary ESG alpha model, where we see ongoing alpha-generating opportunities for investors committed to ESG strategies.

Figure 3. ESG and Beta factor correlations

Source: Man Group using MSCI Barra monthly returns (December 2018-April 2025).

After a dismal 2024, all the signs were pointing to ESG’s bleak winter continuing into 2025.

Much of last year’s weak performance was fuelled by the growing political backlash, with critics targeting ESG investments and corporate sustainability initiatives. In 2025, the new US administration intensified these pressures with its ‘drill-baby-drill’ agenda, threats to dismantle key clean energy policies like the Inflation Reduction Act, and an executive order to roll back corporate DEI programmes. Adding to the strain, new tariffs will raise the cost of renewable energy manufacturing (over two thirds of US lithium-ion battery imports come from China, for example).

So, as actual winter fades away, why have ESG’s fortunes unexpectedly brightened?

ESG blooms just in time for spring

The reality is that despite the backlash, the long-term structural drivers of ESG remain intact and investors seem to be nurturing the green shoots. Corporations remain committed to the clean energy transition, with major global companies from the technology and energy sectors investing significantly in decarbonisation efforts, alongside AI’s insatiable need for power.

Meanwhile, our own experience is that ESG-oriented clients, especially outside the US, continue to demonstrate strong interest in decarbonisation, transition and adaptation, reinforcing the long-term viability of the space.

Our recent paper Climate Investing: A Hierarchical Approach outlines how trillions of dollars of investment will be required to support the transition to the green economy.

While one swallow does not make a summer, a key takeaway from the ‘Liberation Day’ market selloff episode is that we are starting to see the resilient nature of responsible investing.

1. As represented by the iShares Global Clean Energy ETF.

2. As represented by the Invesco Water Resources ETF.

3. As represented by the Vaneck Defense ETF (DFEN).

4. As represented by the iShares Global Energy ETF (IXC).

5. As of 30 April 2025.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.