As UK Chancellor Rachel Reeves prepares to deliver Labour’s first budget in 14 years on Halloween Eve, the ghost of former Prime Minister Liz Truss's market meltdown still looms large.

Last week’s announcement of changes to fiscal rules, potentially enabling £70 billion in additional borrowing over five years, drove up gilt yields by seven basis points to 4.27%, pushing the spread over German bunds to a one-year high.

This immediate market reaction serves as a reminder of market sensitivity to UK fiscal policy, though within reason, investors are likely to be more tolerant of borrowing where it is targeted at growth-enhancing capital spending.

Problems loading this infographic? - Please click here

The new Chancellor faces a delicate balancing act by having to convince markets that increased borrowing for infrastructure investment won't compromise fiscal stability.

As Truss discovered two years ago, any loss of investor confidence could trigger a cascade of negative reactions across financial markets, with higher bond yields driving up government borrowing costs, a weaker pound potentially stoking inflation again, thus compromising the Bank of England’s rate cutting path which could impact corporate and consumer spending.

That said, with inflation finally below target and modest economic growth returning, Reeves perhaps has more room to manoeuvre, particularly if plans are presented in a thoughtful and constructive fashion, rather than seen to be forced through.

The success of Labour's economic program - and perhaps its political future - depends entirely on whether markets trust Reeves to stick to her promises while delivering on the party's vision of economic renewal.

Semiconductor Roller Coaster: Mixed Signals Unsettle Investors

Third-quarter results so far have been a bit of a roller coaster for tech investors who are grappling with mixed signals from major semiconductor industry players.

ASML's dramatic order shortfall, announced on 15 October, sent its shares down 20% and sparked a sector-wide sell-off. As the sole provider of high-spec semiconductor manufacturing machines, the Dutch company serves as an industry bellwether for the entire supply chain. This includes customers like Intel, Samsung, and Taiwan Semiconductor Manufacturing Company (TSMC), as well as semicap suppliers (equipment and materials used to make chips) further up the chain. With its 12-month lead times, ASML also acts as an early warning bell to investors in the sector.

Just two days after ASML's results, chip maker TSMC offered some relief, with shares hitting a record-high after surpassing quarterly estimates and raising its 2024 revenue growth target, easing fears about chip demand and the sustainability of the AI hardware boom.

The industry is trying to navigate a major shift, marked by a split in demand. On the one hand we have AI giants like Nvidia struggling to meet a relentless need for AI accelerators, while sectors like automotive and industrials suffer from excess inventory and are cutting spending. In addition, a key concern for 2025 is orders from China, especially given how local suppliers of semiconductor equipment are growing increasingly competitive against Western rivals.

We see three key themes emerging for the sector:

1. US restrictions and China’s drive for self-sufficiency

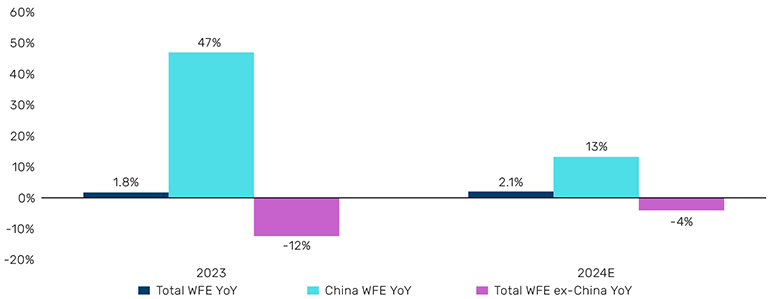

US-imposed restrictions have prompted Chinese companies to hoard semiconductor equipment, creating uncertainty about future demand from the world’s second-largest economy. This situation raises major questions for 2025, hinging on potential new US restrictions, the digestion period for stockpiled equipment, and whether the Chinese government will continue to incentivise local spending. ASML’s woes stem partly from a substantial drop in Chinese orders, with geopolitical tensions casting a long shadow over future revenue streams. The evolving US-China tech rivalry adds further complexity, potentially reshaping global supply chains and market dynamics.

Figure 2: Wafer fab equipment growth year-on-year

Source: Gartner

2. Leading-edge demand and investment dynamics

Leading-edge technology refers to the most advanced and efficient chips, crucial for applications like AI and high-performance computing. This is where the spending split between different sectors is particularly pronounced.

Investment cuts and delays in building or upgrading semiconductor manufacturing facilities (fabs) at ASML customers Intel and Samsung have significantly contributed to ASML’s order weakness and guidance cut. These issues have disrupted the supply chain and impacted investment in cutting-edge technology nodes.

Meanwhile, TSMC continues to supply its fast-growing customer base like key AI player Nvidia. For 2025, we expect companies like AMD and Apple to lead on spending on cutting-edge chip technology. However, with limited competition, TSMC is under no pressure to accelerate investments in the 2nm+ nodes which are advanced chip processes for highly efficient transistors.

3. Weakness in trailing-edge demand

Trailing-edge technology involves older, less advanced chip designs used in PCs, smartphones, and consumer electronics. Demand for these products remains sluggish, with no signs of immediate recovery. This stagnation means there is little increase in demand for commodity memory or processing chips. Furthermore, China’s overcapacity in trailing-edge production could lead to pricing pressures, impacting global players while benefiting local semiconductor equipment companies. This overcapacity might further depress market conditions, adding complexity for international firms. The competitive landscape may shift as companies attempt to balance production costs with fluctuating demand, challenging their ability to maintain profitability.

Looking ahead

Investors need to navigate the increasing division between those who can compete in leading-edge technology and those struggling with commoditisation in mature nodes.

ASML's order drop may mark the beginning of a prolonged period of weakness in China semiconductor equipment spending globally, while local makers continue to gain share. Companies with shorter lead times should brace for similar challenges in coming quarters.

All data Bloomberg unless otherwise stated. The organisations and/or financial instruments mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

With contributions from Adam Singleton, CIO, External Alpha, Solutions, Man Group and Hameed Awan, a senior analyst covering technology stocks at Man Group.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.