As the Federal Reserve (Fed) embarks on its interest-rate cutting cycle, lower borrowing costs are likely to exacerbate a growing divide in the direct lending market between its upper and core segments.

The September 50 basis-point (bps) rate reduction prompted some borrowers to seek cheaper loans with fewer restrictions, a trend that is likely to intensify with further cuts.

We expect this to mostly impact the already competitive upper middle market where large borrowers are pursuing lower financing costs with light or no covenants. In contrast, the core middle market remains largely unaffected, maintaining stronger pricing and deal quality.

Historically, declining interest rates tend to be accompanied by a widening in credit spreads. However, recent muted M&A activity has increased competition for deals, particularly in the upper middle market, where we have observed significant spread compression.

Going forward, we believe this will continue to reinforce the bifurcation in pricing and deal quality between the upper and core middle market segments with potentially far-reaching implications for risk profiles and returns.1

Problems loading this infographic? - Please click here

Upper middle market versus core middle market

As interest rates fall and the broadly syndicated loan (BSL) market reopens, the largest borrowers are pitting upper middle market lenders against the BSL market in the hunt for lower costs and more borrower-friendly terms.

According to ratings agency Moody’s, covenant quality and deal pricing at the upper end of the private credit market2 are weakening and beginning to emulate BSL deal characteristics.3

Conversely, core middle market deal quality and parameters have remained relatively stable. Spread compression has stayed muted and deals are largely limited to the highest quality borrowers. If this trend continues, private credit could see divergent risk-profiles between middle market borrower segments, with upper middle market borrowers potentially facing higher default and loss rates.

Impact on spreads

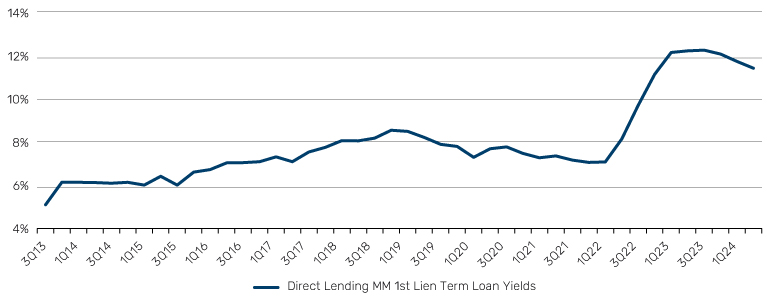

The interest rate futures market has priced in a more aggressive cutting path than the Fed has signalled. Should we see a further weakening in the labour market, interest rates may go down further. However, the current rate of 4.75-5.0% is a long way from zero. Historical data has shown that in the last low-interest rate period pre-COVID, direct lenders managed to generate a consistent 500bps+ spread and maintain an average unlevered yield in the range of 7-8% against the backdrop of a 1.1% average base rate.4

Figure 2: 1st Lien Middle Market Yield

Source: LSEG LPC’s 2Q 2024 Private Deals Analysis.

Future rate cuts will likely boost company valuations and bridge the valuation gap between buyers and sellers, encouraging more buyout deals, which is a positive for private credit lenders. That said, those borrowers also have access to the broadly syndicated market, where the availability of capital looking for deals may disadvantage upper middle market lenders.

The need for flexible strategies

Lower interest rates may offer borrowers’ liquidity profiles some respite. But the slowdown in consumer spending and higher credit costs will likely pressure the most leveraged borrowers, especially those with loans based on overly optimistic growth projections or weak covenants.

This requires lenders to adapt their strategies, balancing risk management with new opportunities. As rates decline, the pricing and quality of deals in the core versus upper middle market are likely to show continued bifurcation, with the latter deploying more capital into riskier deals.

Core middle market lenders have stuck to a recession-resilient strategy of strong covenants and lending to quality companies, which we believe positions them to continue offering strong risk-adjusted returns for investors.

Investors seek refuge in low volatility portfolios as Fed cuts rates

The tumultuous third quarter with its escalation of geopolitical uncertainty and market fears over a hard landing in the US has breathed new life into low volatility portfolios.

The MSCI World Min Vol Index5, a barometer for low volatility investing, saw a remarkable rebound in July and August as investors sought to protect their portfolios from mounting uncertainties. This resurgence followed its steepest decline since 1988, driven by a previous pro-risk market climate and concentrated returns. The recent rally has curtailed the index's cumulative drawdown to 41.7%.

Last month’s Fed interest rate cut is expected to be followed by further monetary easing, potentially boosting low volatility strategies. Historically, Fed cuts have signalled a shift to a ‘risk-off’ environment, where investors become more cautious and gravitate towards safer assets.

Problems loading this infographic? - Please click here

In these periods, low volatility portfolios typically outperform. When US three-month Treasury rates decrease by more than five basis points, the MSCI World Minimum Volatility Index outpaces the broader MSCI World Index by an average of 42 basis points each month. Conversely, when short-term treasury yields rise by more than five basis points, the Minimum Volatility Index typically underperforms, averaging a return of -0.22%. In stable rate environments, the index also underperforms, but by a smaller margin of 17 basis points. This pattern suggests macroeconomic environments of declining rates tend to be the most favourable to low volatility portfolios.

Problems loading this infographic? - Please click here

These portfolios are designed to offer downside risk mitigation by focusing on less risky stocks, often outperforming during economic downturns as investors seek safety. Notably, during substantial rate cuts in January 2008 and March 2020, the Minimum Volatility Index outperformed the broader market by 2.6% and 3.3%, respectively, highlighting their resilience in times of economic stress.

Interestingly, September saw a deviation from this pattern, as markets interpreted the Fed's actions with optimism, hoping for a soft economic landing despite the adverse news. However, if economic conditions deteriorate further, we expect investors to seek low volatility safe havens again.

With contributions from Putri Pascualy, Senior Managing Director, Client Portfolio Manager, Man Varagon, David Asafori, Private Credit Investment Services Specialist, Man Varagon, and Valerie Xiang, Associate Portfolio Manager, Man Numeric.

1. General market convention defines deals to borrowers with EBITDA in excess of US$75mm as “upper middle market”, borrowers with EBITDA lower than $15mm as “lower middle market” and borrowers in between as “core middle market”.

2. Moody’s defines the upper middle market is defined as deals to borrowers above US$300 million.

3. Private Credit Lenders Giving Up Protections to Win Bigger Deals - Bloomberg

4. Source: LSEG LPC’s 2Q 2024 Private Deals Analysis, Bloomberg.

5. MSCI Minimum Volatility Indexes are built to support investors seeking transparent benchmarks to inform risk reduction and asset allocation, particularly during downturns. They are designed to represent the performance characteristics of minimum variance - or managed volatility - equity strategies, prioritising volatility management over gains.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.