Unicredit's acquisition of a 21% stake in Commerzbank has sent ripples through the financial sector, highlighting a wave of large-scale mergers that we see continuing well throughout next year.

Over the past 12 months, there have been 35 domestic bank consolidations in the UK and euro area, not counting those related to the Russia-Ukraine conflict.1

Although cross-border deals aren’t new, the Unicredit/Commerzbank transaction is particularly significant as it involves a national champion in a major European economy, positioning it as a test of the European project's viability.

One question now is whether the mergers & acquisitions (M&A) surge will spur more cross-border deals that will create a few large pan-European entities. There are currently no eurozone, Swiss or Nordic banks in the global top 20 by market capitalisation, underscoring a perceived lack of scale and the drive for growth.

On the other hand, domestic deals typically involve fewer integration risks thanks to cultural alignment, deeper market insight, and less political interference.

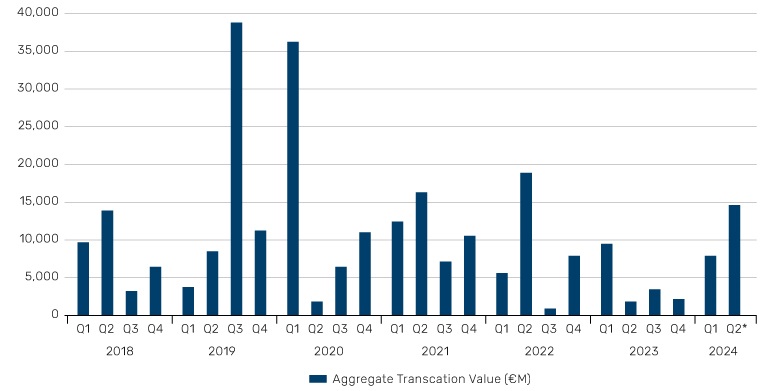

Figure 1. After some fallow years, European bank M&A activity has picked up in 2024

Source: Scope Ratings, S&P CapitalIQ

Q2 data to end of May, data for European banks, financial services, capital markets

There are three key drivers for this M&A surge, some that have been brewing for more than a decade and some are more recent manifestations:

A Legacy of the Great Financial Crisis

Nearly every European government was forced onto the shareholder register of national banking champions as the global financial system faced collapse in the late 2000s. Government intervention provided necessary stability, and they have generally been good, passive shareholders whilst struggling to see a return on their investments. As profitability has improved, these stakes are returning to the market. Banks like Britain’s NatWest and Ireland’s AIB and Bank of Ireland have re-emerged independently, while others, such as Spain’s Bankia, have been absorbed by rivals. Out of the remaining European banks with sizeable government stakes, Italy’s Banca Monte Paschi di Siena and Dutch bank ABN Amro remain a strategic target for both domestic and international competitors.

The COVID catalyst

COVID spurred a fiscal and monetary response of enormous magnitude that ultimately created the conditions leading to an interest rate cycle that few imagined possible prior to the pandemic. It’s a subtlety of the present monetary environment, but as the European Central Bank (ECB) slowly drains liquidity from the system this puts pressure on bank funding costs. For most financial institutions this isn’t a problem, but for some managing the exit of central bank liquidity will significantly affect their profitability.

Unlike the ECB’s very slow, careful approach to quantitative tightening, in the UK, the Bank of England is moving at a much greater speed. This is prompting consolidation in the smaller end of the UK banking system where the unwind of emergency liquidity provision is seen as more problematic. Being part of a bigger bank can be a simple way to resolve a funding problem.

A rebound in bank profitability has provided abundant capital, prompting management to choose between investing in growth, acquiring others, or returning capital through buy-backs. While buy-backs are attractive, they offer limited future growth potential.

European regulators have been urging banks to manage their costs and diversify their income streams throughout the post-GFC environment. As the interest rate cycle turns, this focus on cost and diversification becomes clearer, and creates incentives for acquisitions.

Regulatory Incentives: The Danish Compromise

The Danish Compromise will become increasingly important in the years ahead. Named after the EU presidency at the time of the agreement, it enables banks regarded by the European regulator as a financial conglomerate to acquire non-bank revenue streams at advantageous capital terms.

BNP Paribas’ recent acquisition of Axa Investment Managers has taken full advantage of the new law; prompting strategic recalibrations across the sector and making previously unviable acquisitions feasible.

Bold moves ahead

The factors driving this M&A surge are unlikely to dissipate soon. European banks, despite disciplined capital management through dividends and share buy-backs, have seen limited valuation benefits. However, with growing management confidence and a perception of inadequate scale compared to global peers, there is a strong appetite for expansion. The coming years will see cross-border deals, in-market deals, and deals across other verticals of Financial Services. Exciting times ahead.

With contributions from Martin Kinsler, a portfolio manager, specialising in equities in the financial sector at Man Group.

All data Bloomberg, unless otherwise stated.

1. https://www.whitecase.com/news/media/banker-uk-and-european-bank-mergers-increase-2025

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.