As the most-hyped company in the world, Nvidia, hosts its conference on the future of AI this week, which some have dubbed “the Woodstock of AI”, it’s worth remembering that in almost every computing cycle, monetisation of new technology has usually moved from technology enablers to builders and then on to companies classed as innovators in software and services. Keeping these stages within AI monetisation in mind may give investors food for thought when it comes to deciding whether a single tech name should continue to be worth over $2 trillion.

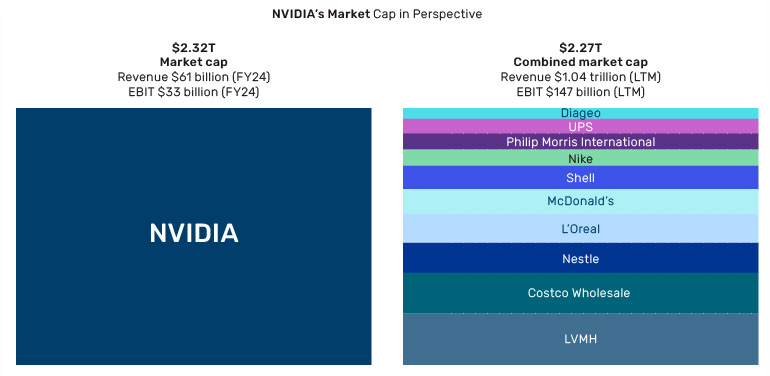

As pointed out by financial platform Quartr, the market capitalisation of Nvidia stock is now around $2.3 trillion, which is roughly the same as the combined market cap of 10 well-known stockmarket titans: Diageo, UPS, Philip Morris International, Nike, Shell, McDonald’s, L’Oreal, Nestle, Costco Wholesale and LVMH (see Figure 1). Should a single company be as valuable as all these long-established, tried-and-tested firms? The AI story is certainly big, but there may be other strands to the AI story that could prove to be areas where the investment story could potentially broaden out away from a single name.

Figure 1: Nividia’s market capitalisation has now surpassed that of 10 established titans

Source: Bloomberg and Quartr

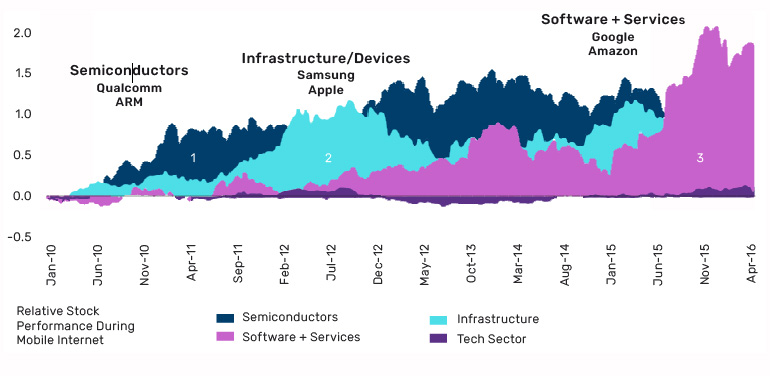

Recent history offers some clues as to how the stages of AI monetisation might evolve. If we look back at the example of the stages of monetisation of the mobile phone, as illustrated in Figure 2, we can see that there are three steps in play, during which the share prices of the companies involved in each stage tend to take off. These can be broadly broken down into the technology enablers, the infrastructure builders and then the innovators who provide software and services. Companies such as Qualcomm and ARM took off as they enabled the devices manufactured by firms such as Apple and Samsung, which enjoyed price gains in the second wave of the cycle, before software and services companies like Google and Amazon began to strongly benefit.

Figure 2: The three-step mobile-era monetisation cycle

Source: Morgan Stanley

Where are we in today’s AI monetisation cycle? We find ourselves at the first stage, which is the enablers stage of the journey, with the emphasis on semiconductor chips. In other words, and despite the sharp and concentrated market moves in tech companies, it’s quite likely that this computing cycle has probably only just started. In the future there may be infrastructure builders that will further capitalise on this cycle, and then finally the innovators that may not even have been discovered yet.

In addition, there are trends already in play that will mean that the AI monetisation cycle persists and evolves, whether or not the current hype around single mega-cap names like Nvidia proves to be short-lived. These trends include:

- The likely roll-out of in-situ AI chips into every new computing device.

- The importance of data and software to manage it, because AI can only be as good as the data it consumes.

- Moore’s Law slowdown beneficiaries (Moore’s Law being the observation that the number of transistors in an integrated circuit tends to double about every two years); as lithography scaling slows down, R&D spend is starting to shift to other methods of continuing to drive chip performance.

On the more negative side of the story:

- When it comes to knowledge process outsourcing (KPOs) in customer service management, testing, marketing and legal industries, the pace of AI adoption is rapid and unlikely to trough out.

- AI’s impact on creativity is a double-edged sword as it could improve margins for firms but it also then lowers barriers to entry, which could be negative for agencies, for example.

- There is a clear frenzy in the AI arm’s race but not all vendors in the supply chain are equal, and some will be left with no cashflow.

This means that there will be opportunities to be long and short individual names within this cycle of AI monetisation, as there will be both winners and losers as the cycle unfolds. Investors would do well to keep an eye on the underlying monetisation trends in AI and to look out for those companies who will continue to have a profit pool as the cycle evolves.

With contributions from Man GLG Portfolio Manager Sumant Wahi.

All sources Bloomberg unless otherwise stated.

Disclaimer: The organisations mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.