Introduction

Inflation and interest rates continue to dominate the conversation in asset markets, with much attention on the speed of the slowdown in inflation and what it might mean for central bank policy and the longer-term cost of capital for companies. Such razor-sharp focus has meant that the market has been less cognisant of the cumulative change in the overall level of prices in goods and services since the end of 2019, the potential impact on corporate earnings and the opportunity this could present for equity investors.

The numbers

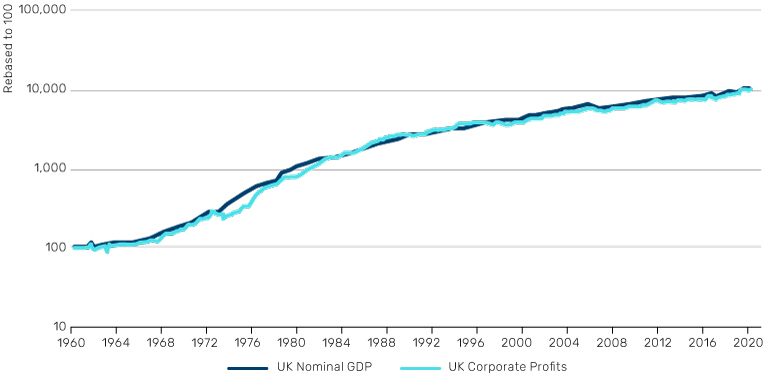

In both the UK and US, the nominal price index has seen a cumulative increase of approximately 20% since the end of 2019 alone. Combined with the gentle continuation of real global GDP growth, this has led to a 26% rise in nominal UK GDP since the end of 2019 and an increase of greater than 30% in nominal US GDP over the same period. Given this context, it would be logical – and consistent with history (as shown in Figure 1) – that profitability for many corporates over time is also likely to be materially higher than it was before the current inflationary episode began.

Figure 1: Stable historic relationship between nominal UK GDP and UK corporate profitability

Source: Bloomberg. Data as at 31 December 2023.

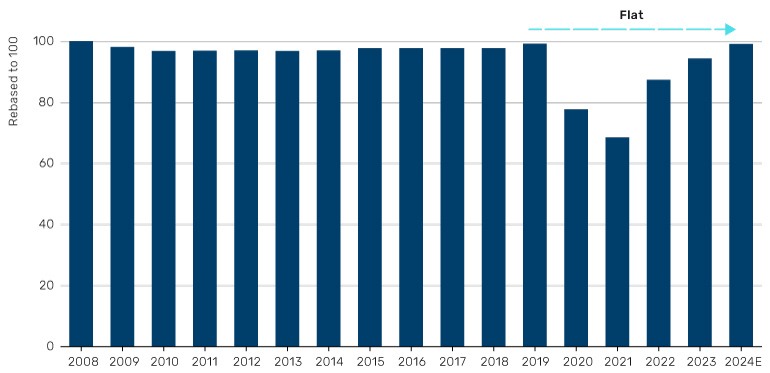

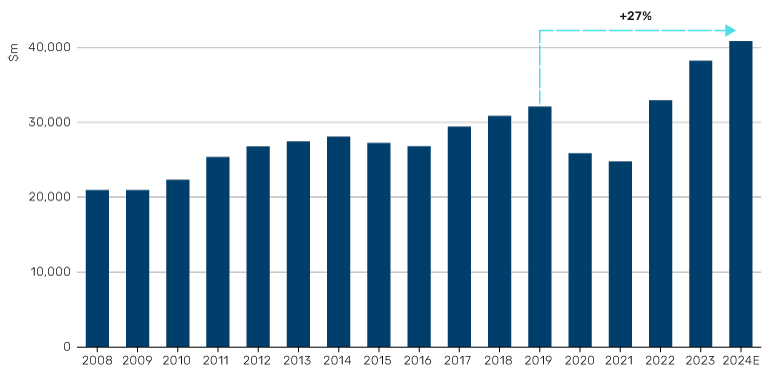

Indeed, this has already started to play out in many pockets of UK equity markets. Let’s take a UK catering company as an example. Figure 2 shows that volumes have now recovered to 2019 levels, before the hospitality industry was brought to a near standstill during the Covid-19 pandemic in 2020. Importantly, as shown in Figure 2, revenue is nearly 30% higher than it was for the same volume level back in 2019. This is because nominal inflation has worked through the P&L structure of this business. This also holds true for operating profit, which is nearly 20% higher than it was in 2019.

Figure 2: UK catering company volumes have recovered to 2019 levels

Source: Bloomberg, Company Accounts. Data as at 31 December 2023.

Figure 3: UK catering company revenue is nearly 30% higher than it was for the same volume level

Source: Bloomberg, Company Accounts. Data as at 31 December 2023.

It is important to underscore that this is neither a business which is over earning because of inflation nor one which is under earning. In fact, the margin structure of this company is well aligned with its long-term averages. It is simply making more absolute profit than it was because of the higher nominal price levels that have washed through its structure.

The investment opportunity

There are several cyclical UK businesses – operating both domestically and internationally – where this phenomenon has covered up or ‘hidden’ a significant underlying volume recession.

More specifically, there has been much concern about recession and its potential implications, particularly for many cyclical businesses, which are more susceptible to fluctuations in the economy than their non-cyclical counterparts. In actual fact, a recession has already played out for some of these companies through volumes, but it has been hidden from view by the higher nominal GDP growth that has flowed through.

The foremost opportunity we see is identifying not where earnings could crack from here, but as and when volumes recover – which they typically do for cyclical businesses – how much more profit these businesses can generate in the future than they made in 2019. With current valuations for many of these companies at decade lows, they are ripe for the picking.

With contributions from James Houlden, Portfolio Manager at Man GLG.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.