Almost half of the world’s population is heading to the voting booths this year. And, in recent weeks, a spate of election results in emerging markets (EM) have shaken local currency debt investors. What are the implications of this challenging near-term environment?

Election surprises

Recent elections across the Global South delivered unexpected results, sending sovereign bonds and currency assets tumbling. South Africa was one of the worst performing local currency markets in May, owing to sour sentiment after votes for the African National Congress fell considerably. Conversely, a wider-than-expected victory for the ruling party in Mexico served to heighten local political risk and caused the Mexican peso to plummet. In India, Prime Minister Narendra Modi and his party fell short of a majority in the lower house of Parliament. To form the next government, the party must appeal to their allies, a result which has hit bonds and the Indian rupee.

The wait for lower rates

Despite these political developments, the biggest driver of EM debt assets year to date continues to be US economic data, where we have seen regular narrative revisions. Federal Reserve (Fed) Chair Jerome Powell’s dovish stance in early May led to a ‘soft landing’ narrative and a partial relief rally in US yields and weakening of the US dollar. Optimism faded after Fed speakers provided more hawkish rhetoric, the cautious Federal Open Market Committee (FOMC) minutes and stronger-than-expected preliminary Purchasing Managers’ Index readings (PMIs). Most recently, better-than-expected core CPI for May sparked a new wave of optimism, soon tempered by the Fed's decision to hold rates and signal that it expects to cut rates just once this year.

Investors keep their powder dry

EM currencies continue to face pressure from a strong US dollar and shrinking interest-rate differentials, leading to outflows in some regions. A slower disinflation process than anticipated, and currency moves have prompted hawkish shifts from EM central banks. This may delay investors from moving into longer duration assets (and increasing their sensitivity to interest rates), especially for low-yield currencies.

Relief on the horizon?

Until US monetary easing becomes more certain, the opportunity cost for EM fixed income assets remains high, given the current level of US yields. Investors are not currently being compensated for the plethora of tail risks the asset class faces, ranging from ongoing conflicts to surprise election outcomes. In short, current valuations limit the potential for EM appreciation or local yields rallying. Against this backdrop, an overall defensive risk stance is warranted.

Any macroeconomic outcome in the US other than a soft landing has upside potential for defensive positioning in local EM debt. With current inflation levels, it's unlikely the Fed will be able to cut rates in time to avoid a recession. Once the dust settles, there may be relief for some areas of local EM debt.

More supportive valuations and terms of trade in some countries have helped bring EM current account balances back toward neutral, but country specifics will be vital for the path ahead. Increased valuation dispersion in EM currencies, as compared to the recent period of quantitative easing, should also pave the way for more relative value opportunities once the overall level of valuations adjusts.

New EU Parliament to Prioritise Defence, Telecoms Over Green Deals

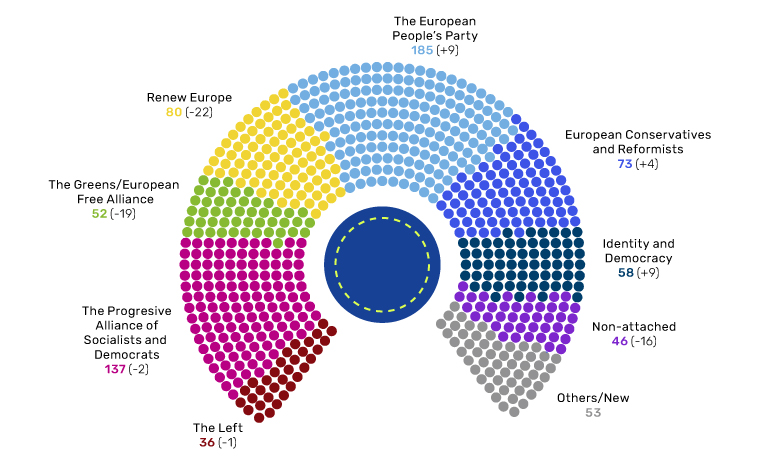

As expected, the new European Union parliament shifted right after the recent elections, even if the far-right surge not materialise. So what should investors expect? To us, it signals a dramatic policy shift from environmental protection to defense and strategic industries.

Right-wing European parties tend to oppose renewable energy projects. The pandemic and geopolitical strife in recent years have already altered the political landscape and protests against climate and agricultural policies have only reinforced this viewpoint. The snap election in France next month may further cement a European shift away from green policies if Marine Le Pen’s far-right National Rally can extend its lead in the polls to clinch a majority.

While a full reversal is unlikely, few will be surprised if we see less willingness from Europe’s new parliament to champion the 2019 Green Deal. This package of policies promised to boost renewable investment and targeted net-zero carbon emissions by 2050.

Swapping heat pumps for tanks?

Markets have already seen a shift in sustainable finance expectations, but criticisms of regulatory burdens persist. Key legislative proposals have faced delays or revisions, while others like the Nature Restoration Law has been indefinitely put on hold due to farmer protests against additional costs and cheaper imported foods.

Now, many policymakers’ key goals revolve around building economic scale relative to China and the United States.

Figure 1: The shift to the right will alter fiscal spending priorities

Source: Statista

Even before the elections, institutional changes were in motion. In April, EU finance ministers updated the European Investment Bank’s (EIB) ability to lend to the security and defence industry,1 a stark contrast to 2019 when the EIB announced its metamorphosis into the EU’s ‘climate bank.’2

Funding for the EU’s Strategic Technologies for Europe Platform (STEP)— a program that has supported EU leadership and innovation on critical technologies—was reduced from €10 billion to €1.5 billion, with members earmarking the remaining amount entirely for defence-related projects rather than the cleantech, biotech, and digital innovation funding it has traditionally be allocated.

European Commission President Ursula von der Leyen also proposed establishing the role of a dedicated defence commissioner, a first for the European Commission and one likely to be filled by a citizen of a member state in Central or Eastern Europe which is most exposed to Russian aggression. Additionally, the European Commission has introduced the European Defence Industrial Strategy (EDIS) which proposes a coordinated, top-down approach to enhancing the EU’s military readiness.

It isn’t only defence that is in the parliament’s sights. Enrico Letta, the former Italian Prime Minister, recently authored a report on the future of the single market which supports consolidation of the telecoms industry to create more powerful EU national champions. In other words, the crucial issue is how to replicate the Airbus model across telecoms, healthcare, and other industries. This signals to us that, more broadly, any European industries that are ripe for consolidation to create competitiveness will stand to benefit.

It isn’t easy being green

While the Green Deal will remain on the statute books, it will likely be de-prioritised. Investors should brace for changes in fiscal spending priorities, with a likely increase in support for defence and other strategic industries.

All sources Bloomberg unless otherwise stated.

1. https://www.eib.org/en/press/all/2024-143-eu-finance-ministers-set-in-motion-eib-group-action-plan-to-further-step-up-support-for-europe-s-security-and-defence-industry

2. https://www.eib.org/en/press/all/2019-313-eu-bank-launches-ambitious-new-climate-strategy-and-energy-lending-policy

With contributions from Guillermo Ossés, Head of Emerging Market Debt Strategies and Jason Mitchell, Head of Responsible Investment Research at Man Group.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.