After an annus horribilis for cryptocurrencies in 2022, followed by a better 2023, 2024 has got off to a good start for bitcoin. In January, the Security and Exchange Commission (SEC) approved several US bitcoin spot exchange-traded products (ETPs), which attracted USD 30 billion in inflows over the course of the first 40 days, and in March the price of a bitcoin reached an all-time high, surpassing its previous record from November 2021.1 The next highly anticipated event for this digital currency is the fourth bitcoin halving, due to take place later this month.

What is halving?

Bitcoin mining is the process of validating a set of transactions, recording them in a cryptographically secure fashion in a ‘block’ and earning a number of bitcoin (plus other fees) as a reward. ‘Halving’ refers to points in time after which the reward for mining bitcoin is cut in half (in the upcoming halving, miner rewards will decrease from 6.25 to 3.125 bitcoin per block) and is designed to control inflation of the cryptocurrency by reducing the rate at which new coins are created and thus lowering the amount of new supply. Halving occurs every 210,000 blocks or around every four years and will continue until all 21 million bitcoins are mined, a milestone likely to be reached around the year 2140.

Bitcoin’s price has historically soared around halvings

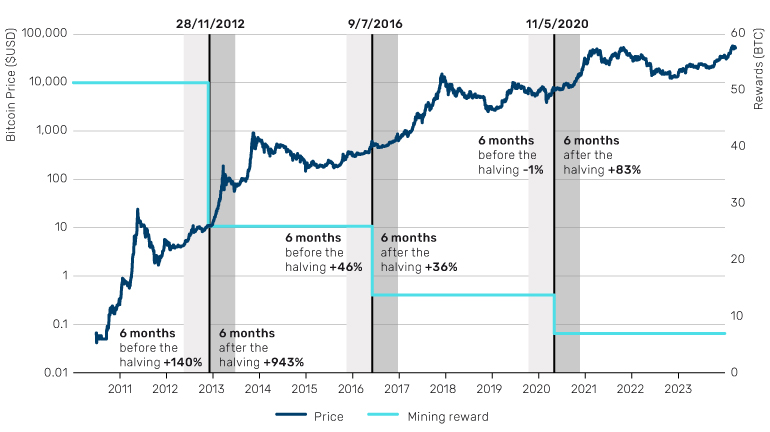

Historically, halvings have been positive for bitcoin's price. Indeed, bitcoin has experienced significant gains both before and after past halvings, although the magnitude of these gains has been progressively lower for each halving. The first halving in 2012 showed an exceptional 943% price surge in the six months post-event. However, subsequent halvings have shown more moderate returns, with the third halving in 2020 resulting in an 83% increase in the subsequent six months despite a 1% decrease prior (see Figure 1).

Figure 1. Magnitude of gains has diminished over time

The historical effect of bitcoin halving on price

Source: Bloomberg. Date range: 19 July 2010 to 4 April 2024.

So what might investors in bitcoin expect the fourth time around? The relationship between halvings and bitcoin's price, while historically positive, is not straightforward. Bitcoin's price is affected by a complex interplay of factors, including investor sentiment, adoption rates, regulatory changes and macroeconomic conditions. For instance, the price surge after the 2020 halving coincided with a period of significant fiscal stimulus and loose monetary policy in response to the Covid-19 crisis and therefore cannot simply be ascribed to the halving. Similarly, the recent price rally may have been influenced by factors such as the anticipation of spot bitcoin ETFs rather than the upcoming halving.

It is also important to consider the potential effects of the halving on miners, who will see their earnings, predominantly from block rewards, slashed by 50%. This reduction will likely intensify competition among miners as they vie for diminished rewards. As their profit margins shrink, miners could be compelled to sell more of their coin holdings, potentially increasing selling pressure in the market.

Despite this, the immediate market impact is likely to be limited since miners will be earning and consequently selling fewer bitcoins. In the long term, miners may become more dependent on transaction fees as a source of revenue post-halving. Were miners to try to push up transaction costs, Layer-2 solutions, which take small transactions off chain, might be an effective counter, though this would further affect bitcoin miners’ fees.

More broadly, the US Federal Reserve's monetary policy, potential selling pressure from bankrupt entities and the behaviour of long-term holders2 could also all influence bitcoin's price trajectory.

Conclusion

While halvings have been bullish events in the past, they are not the sole determinant of bitcoin’s price. Nor is it a given that the price action we have seen historically before and after halvings will be replicated this time around. More broadly, as cryptocurrencies like bitcoin become increasingly mainstream and sentiment around this asset class once again returns to positive, investors should not become complacent about the risks. The high and variable volatility of cryptocurrencies, coupled with significant drawdowns which are routinely in the order of 80%3, serves to underscore the vital importance of active risk management when wading into this asset class.

With contributions from Tarek Abou Zeid, Partner and Client Portfolio Manager, and Andre Rzym, Head of Systematic Opportunities, at Man AHL.

1. Source: Bloomberg

2. Defined as investors who typically retain their cryptocurrency holdings for at least 155 days.

3. Source: Bloomberg

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.