Introduction

Most companies go through business cycles whereby changes in product demand or aggregate market supply drive periods of above average returns followed by periods of below average returns. These phases can be triggered by a wide range of macroeconomic and micro-economic factors and can last for many months, or even several years, depending on the industry. During phases of above average returns, the business is ‘over-earning’ while ‘under-earning’ is characterised by phases of below average returns.

Year to date, we have seen several companies beat earnings expectations. After posting record 2023 earnings, luxury car maker Ferrari announced that it expects to make higher than expected profits for the coming three years,1 Elsewhere, ride-hailing app Uber2, oil major Exxon Mobil3 and language-learning platform Duolingo4, to name just a few, all reported 2023 earnings that beat analyst expectations.

The existence of cyclicality like this is unsurprising. What is key is that the market is often poor at sufficiently derating businesses as they begin to over-earn and equally fails to sufficiently rerate businesses as they go through a period of under-earning. If appropriately identified, this can offer a source of alpha through time.

The case in point

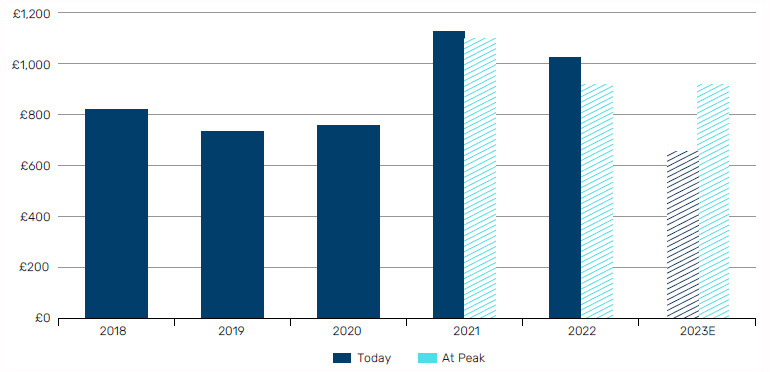

Take the example of a UK listed commodity chemicals business – a period of both constrained competitor supply in the wake of Covid-19 and restocking demand led to a surge in price for its performance elastomers. Figure 1 below shows that revenue per tonne jumped from approximately £800 between 2018 and 2020 to nearly £1200 a tonne in 2021. At that point, the market narrative, while cognisant that some of this was supernormal, still extrapolated well above average unit economics for 2022 and 2023 at more than £900 a tonne (aqua blue bars).

Figure 1. UK commodity chemicals business - Performance elastomers revenue per tonne

Source: Company filings, Bloomberg. Data as of 31 December 2023.

It can be difficult in that moment to psychologically come to terms with the potential for a full normalisation in the earnings power of the business. Everything is just going too well – the business has just upgraded expectations, the outlook looks great, and the shares typically look cheap on those forward earning expectations – and there is a hope that ‘this time is different’.

In this case, the attractive returns on capital being generated in performance elastomers incentivised the introduction of new supply. Simultaneously, demand began to fade as inventory levels across the supply chain rebalanced. Finally, spurred by high elastomer prices, customers reduced their own consumption plans by prioritising alternative chemical usage, significantly lowering their own planned capacity additions. Mean reversion is a powerful force, leading to falling incremental returns.

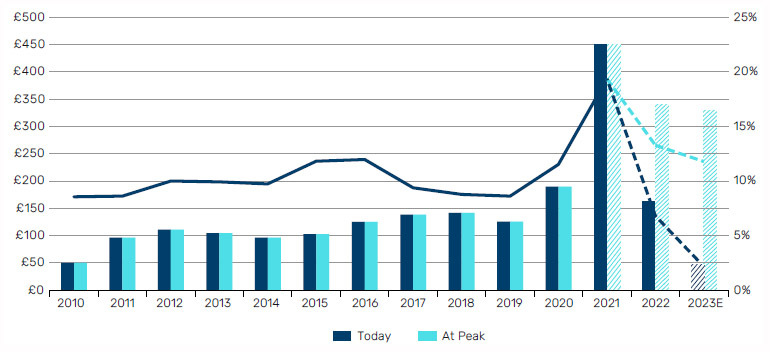

Group gross margins, having jumped from a 10-year average of 19% to 28% in 2021, then normalised faster and harder than consensus expected (see Figure 2). This had a material impact on consensus EBIT forecasts for 2022 as EBIT margins also normalised below the long-term average.

Further, it is precisely because markets are over-earning and generating supernormal returns that attracts capital investment. This means markets experiencing a period of above average returns often then go on to face a period of below average returns immediately after. As new capacity comes online in steps, the market swings from under-supplied to over-supplied. As a result, having been over-earning, the performance elastomers business went on to make EBIT margins more than 500bps lower than average for the next few years.

Figure 2. EBIT of UK commodity chemicals company

Source: Company filings, Bloomberg. Data as of 31 December 2023.

This might seem almost too simple when laid out with the benefit of hindsight, but it is worth remembering that it is because it never feels so simple in the moment (‘at peak’) that alpha exists.

Equity markets are also often inefficient

While sell side consensus forecasts often fail to appropriately model a normalisation in businesses that are over-earning, equity market valuations also need to fail to recognise this too for a business to be an overvalued asset.

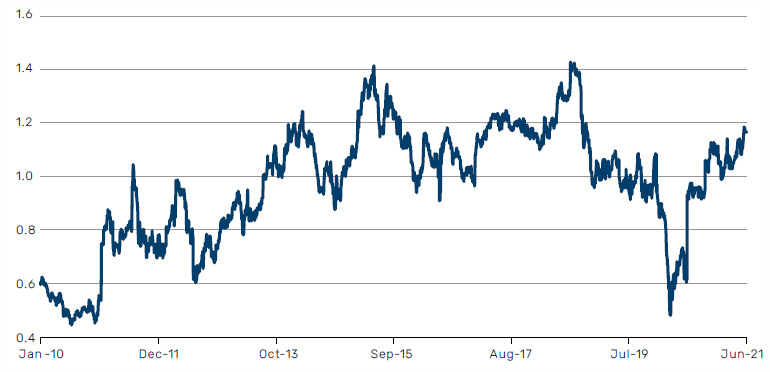

And equity markets are also often inefficient. The share price for this UK commodity chemicals business peaked in August 2021, when expectations were ‘at peak’. The narrative was great, the business was trading exceptionally well, earnings had been upgraded repeatedly by the company, causing analysts to lift expectations by nearly 75% since the summer of 2020 – the over-earning cycle was playing out.

Rather than derate the equity into this period of supernormal profitability, the shares rerated from 0.8x EV/sales to 1.4x EV/sales. This creates significant fragility in the equity as an above average multiple is applied to above average returns, with the subsequent normalisation in both valuation and cash generation expectations causing the shares to fall 95% from highs to the end of 2023. This is why valuation matters.

Figure 3. EV/Sales of UK commodity chemicals business

Source: Bloomberg. Data as of 30 June 2022.

Conclusion

In summary, equity markets repeatedly fail to sufficiently derate businesses as they begin to over-earn and equally fail to sufficiently rerate businesses as they go through a period of under-earning. Could this phenomenon be something for investors to pay particular attention to in light of today’s backdrop of buoyant earnings? Shorting businesses when they are over-earning as sales are growing faster than ever before, margins are high, the narrative is universally positive, and the shares can appear optically cheap can feel acutely scary – yet that is precisely when the fragility of the equity is highest. Similarly, it may seem counterintuitive to invest in a business that is under-earning combined with a trough through-cycle valuation and good balance sheet, but that is when the risk reward and alpha opportunity are most attractive.

The organisations mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

With contributions from James Houlden, Portfolio Manager at Man GLG.

1. www.ft.com/content/ff9aef38-4eed-4bc2-b85a-a7b2be33fcba#post-542b3c40-e307-4ce6-a7a5-0fd539650ba7

2. www.ft.com/content/7a333873-b860-4139-82db-4517eb7ddcd2

3. www.reuters.com/business/energy/exxon-beats-estimates-ends-2023-with-36-billion-profit-2024-02-02/

4. www.bloomberg.com/news/articles/2024-02-28/duolingo-adds-users-with-new-ai-content-but-sees-growth-slowing

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.