SVB: The Micro Signals that Predicted Macro Risks

What was the first sign of trouble of Silicon Valley Bank (‘SVB’)? The first draft of history seems to have pinpointed 8 March, when SVB’s parent group announced it was attempting to raise additional capital. Our quantitative analysis, however, began to identify causes for concern in late 2022 – when SVB bonds were still rated investment grade and trading around 85 cents on the dollar.

Specifically, several of our micro bottom-up signals highlighted SVB’s bonds as potential candidates to short: the bank was increasing its leverage profile at the time through a higher quantum of debt, for example, and its bonds were attracting an elevated level of short interest. Perhaps most emphatic, though, was the network-based analysis. Through this work, it became clear that SVB’s ecosystem – its customers, partners and competitors – was highly exposed to technology companies during a period when these names were under considerable pressure.

This type of sophisticated network analysis and the broader use of alternative data are becoming more common among equity investors, but we believe they remain relatively rare on the credit side. At a time when single-name dispersion in credit is elevated and could still rise higher to former peaks given the ongoing uncertainty (Figure 1), we expect such analysis to benefit strategies that seek idiosyncratic opportunities.

Figure 1. Percentage of Global Investment Grade and High Yield Bonds Trading at Spreads +/- 150 Basis Points of the Index

Problems loading this infographic? - Please click here

Source: Man Numeric and ICE BofA; as of 23 March 2023.

Inflation Trumps Banking Turmoil

The Federal Reserve pressed ahead with a 25 basis-point rate increase to 5% on 22 March – the highest since 2007 – despite the turmoil in the banking sector. This was in line with consensus expectations.

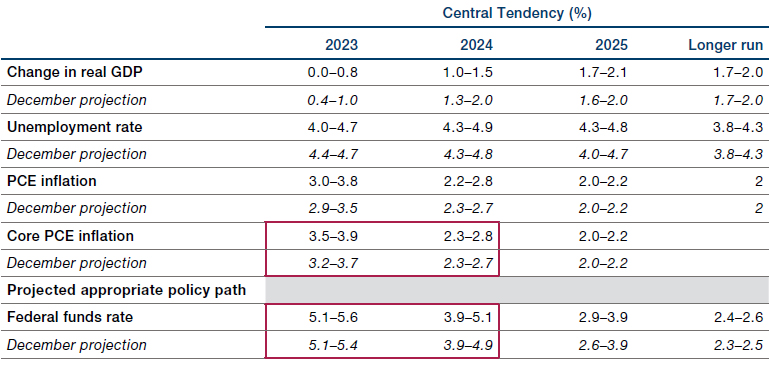

While the change in language in the policy statement is notable – from “ongoing increases” to “some additional policy firming” – what really caught our attention was the inflation and rates outlook in the Fed’s Summary of Economic Projections. Real policy rates (based on the mid-point of the rate projection minus core PCE) remain exceptionally tight going into 2024: at 1.7% for end-2023 and 2% for end-2024 (Figure 2), a level not seen since 2006.

Bottom line, the fact that the Fed didn’t choose a wait-and-see approach when it comes to their forecasts signals an unconditional commitment to taming inflation. Whether that’s the right decision remains to be seen.

Figure 2. Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, Under Their Individual Assumptions of Projected Appropriate Monetary Policy (March 2023)

Source: Federal Reserve; as of 22 March 2022. The central tendency excludes the three highest and three lowest projections for each variable in each year.

Transition Risks and Investors: A ‘Survival Guide’

Described as a “survival guide for humanity”1, the Sixth Assessment Report from the Intergovernmental Panel on Climate Change (‘IPCC’) published on 20 March contained both blistering conclusions and important insights:

- Current climate changes policies are insufficient: globally, we are not on track to meet emissions reduction targets and are likely to breach 1.5C in the 2030s;

- Nature is key to mitigating climate change, having absorbed around 54% of human-related carbon dioxide emissions over the past decade.

No surprise, then, that post the report’s publication, there have been calls for “higher ambition” at COP28 from EU climate chief Frans Timmermans, who is also calling for “strong national policies” to get the job done.2

In combination with climate policies, strengthened national policies on biodiversity in a post COP-15 world may have a significant impact on investors, especially as they relate to transition risks.

Indeed, according to a report published by the United Nations Framework Convention on Climate Change, if transition risks are unmitigated, the global food supply system could lose an average of 7% of its value. The average masks significant variation across different sectors, ranging from a nearly 15% value loss for the agricultural inputs sector to around 4.5% for the restaurants and food service sector (Figure 3).

Figure 3. NPV Loss Driven by Unmitigated Transition Risks (2020-2030)

Problems loading this infographic? - Please click here

Source: Race to Zero report by the UNFCCC; as of September 2022.

Note: The study looked at 40 of the largest food and agricultural companies.

With contribution from: Robert Lam and Paul Kamenski (Man Numeric – Co-Heads of Credit); Ed Cole (Man GLG – Managing Director, Discretionary Investments); and Jess Henry (Man Group – Senior RI Research Analyst)

1. UNSDG | New UN Report offers a ‘survival guide for humanity’ in the face of climate change.

2. EU climate chief calls for higher ambition at COP28 after IPCC report – EURACTIV.com

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.