When Idiosyncratic Risks Lead to Systemic Headwinds

By now, it’s likely you are well acquainted with recent events at Silicon Valley Bank (‘SVB’). In brief, SVB faced an asset/liability mismatch as its predominantly tech-sector depositors began to ask for their money back – money which had been invested in longer-duration bonds whose prices had declined during the current hiking cycle. The authorities acted over the weekend, guaranteeing deposits and introducing the Bank Term Funding Program to help banks avoid mark-to-market losses on their bond holdings.

The troubles at SVB – and other banks like Silvergate or Signature – are in large part idiosyncratic, in our view, given their niche clienteles. But they also reflect the deregulation of smaller US banks since 2018, when they were exempted from some enhanced prudential standards. We therefore don’t expect the backstop now provided by the US regulators, welcome as it is, to set US banks on an unequivocally investor-friendly course. Rather, they could face an expensive process of tighter regulatory scrutiny.

We think the outlook is somewhat different for European banks, though. Europe’s regulators didn’t give smaller institutions a lighter touch in the same way, subjecting all banks to stringent liquidity and capital requirements. We also take some comfort from European banks’ experience through the challenges of the pandemic and war in Ukraine, which suggested they are well positioned in credit provisioning if the broader economic situation deteriorates.

Shock And/Or

SVB, and the reaction of markets to the situation, illustrate the importance of preparing portfolios for exogenous shocks. Beyond contagion from the financial system, these could arise from any of the world’s ongoing geopolitical tensions or some other tail risk. Given investors’ preoccupation with inflation, which dominated the start of last week following Federal Reserve chair Jay Powell’s testimony to Congress, positioning in such an eventuality could be dangerous. An obvious example would be the short-bonds trade, which would be hurt by a traditional risk-off reaction.

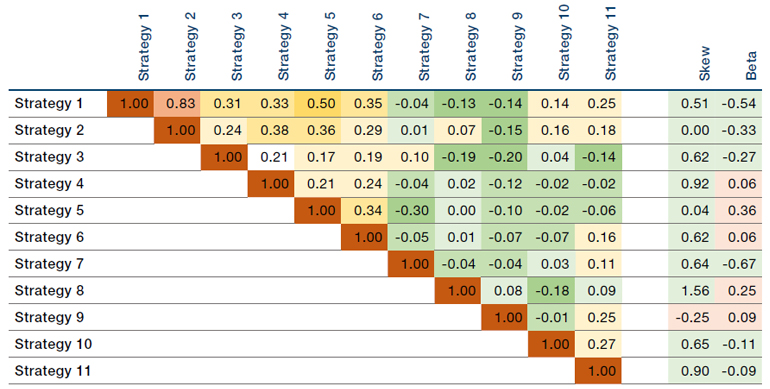

To try to mitigate this situation without abandoning the portfolio-construction principles that have served investors well through recent years, we look for multiple complementary sources of defensiveness. In an illustrative allocation across 11 underlying hedge funds, we see that a diversifying range of characteristics can still be obtained (Figure 1). In particular, we seek positive skew and negative or very low beta from across the gamut of relatively niche strategies. We find that employing multiple sources of defensive exposure can make a multi-strategy portfolio more robust to unexpected market developments.

Figure 1. Correlation Matrix with Skew and Beta Profiles for an Illustrative Portfolio of Hedge Funds

Source: Man FRM; as of 7 March 2023.

With contribution from Martin Kinsler (Man GLG – Portfolio Manager) and Adam Singleton (Man FRM – Head of Investment Solutions)

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.