Short Patience or Short of Courage: The Curious Lack of Bets Against Unattractive Equities

You can make a compelling case against owning equity beta in two straightforward charts. First, stocks look expensive relative to bonds: Figure 1 shows our ‘FED’ model, which subtracts the 10-year US Treasury yield from the S&P 500 Index’s forward earnings per share (‘EPS’). This spread is now at its lowest point over the 18 years for which we have complete forward earnings data. Second, the consensus view on US earnings is now negative across the board (Figure 2). This is considerably more pessimistic than even the first half of 2022, when analysts had to weigh the start of a land war in Europe and rapidly tightening monetary policy.

And yet, despite these significant headwinds for equity indices, we also note that short-interest utilisation in our global universe (Figure 3) has declined from October heights of 12.7% on an equal-weighted basis (and 5.2% when cap weighted) to 11.4% (and 4.4%).

Why aren’t traders taking the bait? We believe that even though being long the market is relatively unappealing, investors in aggregate are cautious of the potential for volatility and sharp rallies to punish shorts.

Figure 1. FED Model: Forward S&P 500 EPS Minus 10-Year US Treasury Yield

Problems loading this infographic? - Please click here

Source: Man Numeric; as of 17 February 2023.

Figure 2. Change in Consensus View on US Nominal Earnings Per Share

Problems loading this infographic? - Please click here

Source: Man Numeric; as of 16 February 2023.

Figure 3. Short Interest Utilisation in Global Equities

Problems loading this infographic? - Please click here

Source: Man Numeric; as of 17 February 2023.

Value Timing – The Pain Trade

The possibility of timing factor exposure is as enticing as it is contentious. Intuitively, a period of sustained underperformance should leave a factor primed for recovery. But experience teaches that it is unwise to rely on any mechanistic reversion. The tension is perhaps clearest with Value: when the factor becomes much cheaper than its historical range, an allocation becomes tempting.

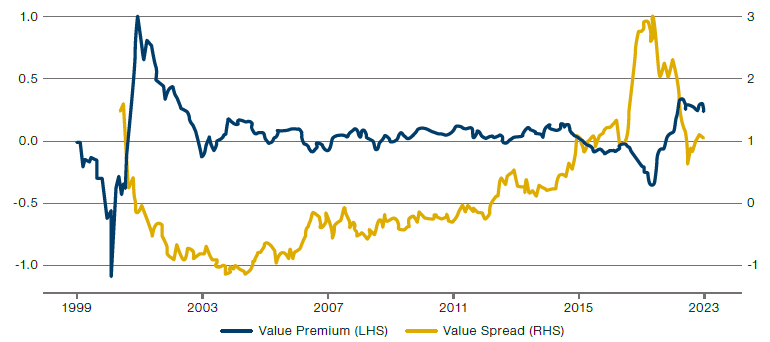

Our analysis suggests that such moments can be attractive entry points, but only for those with long investment horizons and high pain thresholds. Figure 4 plots Value, as measured by book-to-price (‘BP’) ratios, for the largest 1,000 US equities. The yellow line represents the Value spread, calculated as the winsorized ratio of the 75th BP percentile to the 25th percentile; the higher the reading, signifying people paying more for Growth than Value, the better the potential opportunity in Value. The blue line portrays the Value premium, calculated as the next-month return differential between an equal-weighted Value portfolio (the cheapest third of the universe) and an equal-weighted Growth portfolio (the most expensive third of the universe), rebalanced monthly. When it hits 1, for example, it means Value has outperformed the Growth portfolio by 100% over the previous 12-month period.

The most salient point here, in our view, is that extreme levels of Value spread can forecast Value outperforming over the next 12 months – albeit with material drawdowns along the way.

Figure 4. Value Opportunity Versus Value Premium

Source: Man Numeric; as of 16 February 2023.

More Twists on the Factor Rollercoaster

Factor reversals happen, but rarely so dramatically or so completely as over the past two months. The generic exposures that rewarded investors in 2022 have hurt them this year, and vice versa (Figure 5). Adding to the whiplash effect, we also see that the period from 17-22 February 2023 brought a miniature reversal of the reversal.

The magnitude of the turnaround in Volatility and generic Beta, in particular, through the start of 2023 has been exceptional by historical standards. Indeed, a generic factor model that equally weighted Value, Momentum, Anti-Volatility and Earnings Quality had one of its worst-ever months in January (Figure 6).

Such a left-tail outcome should not be discounted as purely anomalous, in our view. Looking ahead, we should be aware that the Momentum/Volatility/Value diversification complex – the bedrock of generic models given their negative correlation for much of the recent past – has broken down, for now at least (Figure 7). Anti-Volatility/ Momentum and Value/Momentum have reached a degree of positive synchronisation never before seen in our dataset. In our experience, these periods of elevated correlations can persist for 12-18 months.

Figure 5. Generic Factor Performance in Sector-Neutral Global Equities

Problems loading this infographic? - Please click here

Source: Man Numeric; as of 22 February 2023. 2023 performance is not annualised.

Figure 6. Monthly Returns of Generic Factor Model, January 2000 to February 2023

Problems loading this infographic? - Please click here

Source: Man Numeric; as of 22 February 2023.

Figure 7. One-Year Trailing Return Correlation in Global Equities

Problems loading this infographic? - Please click here

Source: Man Numeric; as of 22 February 2023.

With contributions from: Eric Wu (Man Numeric – Principal, Quantitative Alpha Integration and Strategy), Yakym Pirozhenko (Man Numeric – Quantitative Alpha Integration and Strategy Analyst), Wanjun Jin (Man Numeric – Senior Portfolio Manager), and Andrew Kindman (Man Numeric – Portfolio Manager)

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.