Rising Interest Rates: Stock Markets’ Best Friend?

The Federal Reserve announced a 25-basis points increase in interest rates in March – the first since 2018 – and forecast a steady pace of rate hikes over the coming two years. Across the Pond, European Central Bank president Christine Lagarde refused to rule out rate increases in 2022.

What do these rate hikes mean for equity markets?

Our analysis, which focused on the previous eight rate hiking cycles in the US and seven in the Eurozone, found that:

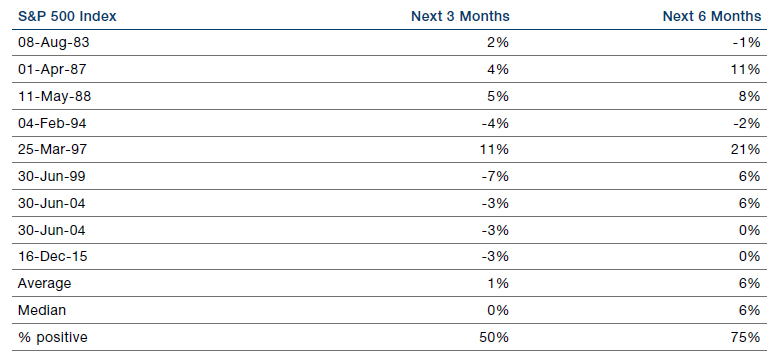

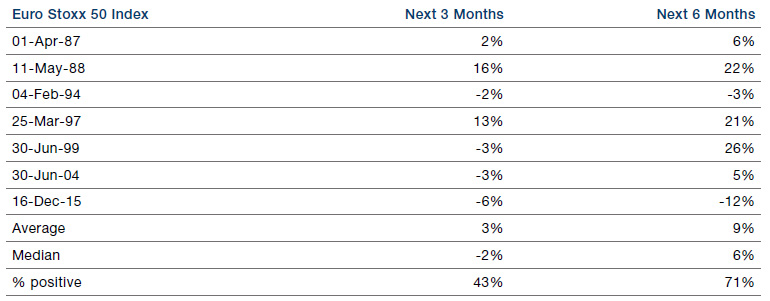

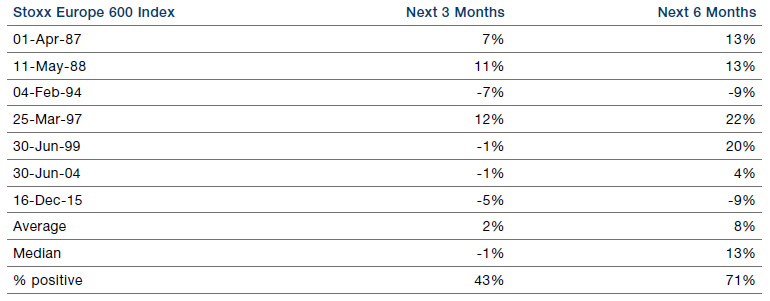

- US stocks, as measured by S&P 500 Index, returned an average 1% in the three months following the first rate hike (Figure 1). For the Euro Stoxx 50 and Stoxx Europe 600 Indices, returns averaged 3% and 2%, respectively, over that time period (Figures 2-3);

- In the six months after the first rate hike, both US and European stocks rose 70% of the time, with average returns of 6-9%.

We note that our analysis is done at the index level, and this excludes any dividends. In addition, our analysis includes the rate increase in March 1997, which was just a single rate hike. Still, our analysis yields similar results after excluding March 1997 from our analysis.

Of course, another thing to note is that inflationary regimes differed in each of the previous rate hiking cycles. Even so, if history from the most recent interest rate hike cycles were to repeat itself, it would show us that rising interest rates are, more often than not, equity markets’ best friend.

Figure 1. Returns for S&P 500 Index After Rate Hiking Cycles

Source: Man GLG; as of 22 March 2022.

Figure 2. Returns for Euro Stoxx 50 Index After Rate Hiking Cycles

Source: Man GLG; as of 22 March 2022.

Figure 3. Returns for Stoxx Europe 600 Index After Rate Hiking Cycles

Source: Man GLG; as of 22 March 2022.

Rising Mortgage Rates Not Enough to End US Housing Boom, for Now

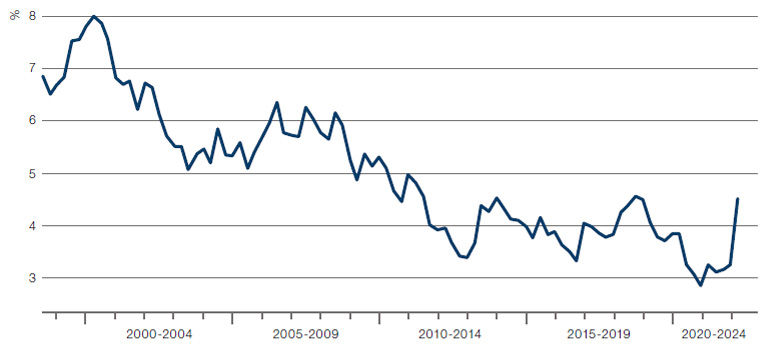

US 30-year fixed-rate national mortgage rates spiked to more than 4% in late March, the first time in three years and the biggest quarterly spike on record since records started in 1998 (Figure 4).

Despite the higher cost of borrowing for prospective homeowners, we believe that this increase in mortgage rates will not necessarily result in falling home prices in the short term for three reasons. First, the recent increase in rates and expectation of further rate increases has led to a near-term rush of buyers, continuing to push home prices higher. Second, there is still a chronic lack of available homes in the US which remain at/near historical lows, with many markets having less than 1-2 months of supply. In addition, we expect supply-chain issues to continue throughout 2022, slowing the pace of currently forecasted new home builds. Third, we are seeing an increasing number of institutional bids for homes, which didn’t exist in prior cycles.

As such, we believe US home prices will still increase above historical averages in 2022. However, there is growing sentiment that prices will decline at some point over the next 3-5 years.

Figure 4. US 30-Year Fixed-Rate Mortgage Rates Spike

Source: Bloomberg; as of 21 March 2022.

With contribution from: Gilles Gharios (Man GLG, Head of Investment Risk) and Anthony Cazazian (Man GPM, Head of US Residential Real Estate).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.