Branching Futures: Inflation, Interest Rates and Volatility…

The publication of the Fed’s latest dot plot shows that central bankers remain less bullish than investors. As we can see from Figures 1 and 2, members of the Federal Open Market Committee expect interest rates to rise to a maximum of 3.5%-4.5% by early 2023 before beginning to fall. This is in contrast to the Eurodollar curve, which as of 29 June shows that the market expects rates to peak at the end of 2022, before beginning to fall from the first quarter of 2023.

This presages two scenarios – one in which markets are correct and rates begin to fall from 2023 (Path A), and another in which central bankers are correct and the rates have to rise higher for longer (Path B).

In our view, the former situation may well be positive for risk assets. High but falling inflation is historically very good for equities and bonds, as we discuss in our paper ‘What Works When Inflation Hits’. Indeed, we suspect there may be an element of wishful thinking driving the Eurodollar curve: market participants seem to be anticipating the outcome which would boost returns and therefore job security.

Path B, in which inflation proves harder to tame and hikes have to be more sustained, would be very different. Aside from the risk of stagflation, a situation where inflation is high and rising has historically been very bad for equities and exceptionally bad for bonds. In addition, we would expect volatility to remain high as well.

Figure 1. The Fed’s Latest Dot Plot

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 28 June 2022.

Figure 2. Eurodollar Curves

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 29 June 2022.

…And Their Consequences For Asset Allocations

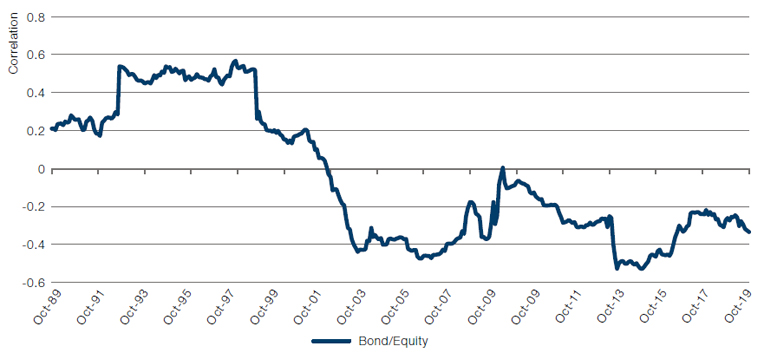

During the first two quarters of this year, asset allocators had to contend with both equities and bonds selling off in tandem. In the context of recent history, this is very much out of the ordinary, as the stock/bond correlation has mostly been negative for the past 25 years. However, while this is deeply inconvenient from the perspective of a traditional 60/40 portfolio, it is by no means unprecedented. Figure 3 shows that the correlation between stocks and bonds has usually been positive.

If we remember our two interest-rate paths, then, we must also look at how the stock/bond correlation will affect asset allocations. With bond yields at current levels, investors must consider the possibility that fixed income can reassert its diversifying attributes – particularly if markets follow Path A and interest rates start falling earlier than was expected just a few weeks ago (Figure 4).

On the other hand, asset allocators cannot discount Path B – and such a scenario of persistent inflation necessitating a much longer and steeper hiking cycle would be significantly less supportive for bonds. In that case, hedge funds may continue to prove their worth as diversifying strategies. Traditionally, hedge funds have had diversifying properties compared to equities and bonds, and this appears to be continuing in 2022. As we showed last week, many hedge funds have been successful in generating positive returns during the year to date and so delivering on their titular purpose – hedging.

Figure 3. Stock/ Bond Correlation

Source: Man Solutions, Bloomberg; as of 31 December 2020.

Figure 4. Real US 10-year Treasury Yield

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 30 June 2022.

With contributions from: Adam Singleton (Man FRM – Head of Investment Solutions)

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.