10-2s: Curve Your Enthusiasm

Year-to-date, the US 10-year yield has moved from 1.5% to 2.0%. The 2-year has gone from 0.7% to 1.6%. Thus the so-called 10-2 yield spread (literally one minus the other) has halved from 80 basis points to 40bps.

As such, we are now approaching the dreaded yield curve inversion (in other words where this number goes negative). First observed by our very own Professor Campbell R. Harvey in 1988, the 2-year rate rising above the 10-year has correctly presaged all four of the economic recessions experienced since, including the 2020 recession induced by Covid-19. So how worried should we be when the yield curve does eventually invert?

Short answer, very. In a 2019 paper, we surveyed all curve inversions back to 1900. Including 2020, this now amounts to 28 instances (Figure 1). In 22 of these episodes there was subsequently a recession, an impressive 79% hit rate. Strategists at Deutsche Bank have calculated that the curve flattens 80 basis points in the first 12 months of a Fed tightening cycle. So if the first hike occurs in March, for which the market is now pricing a likelihood of more than 100%, that means we have until the first quarter of 2023 at the latest before the curve inverts, and perhaps much sooner if the current pace of flattening continues.

Slightly longer answer, in practice it’s a bit more complicated. The lags between the curve inversion and the onset of a recession are varied and average some 21 months. And a lot can happen in two years. To be clear we do think a 10-2 inversion is about as ominous a portent as you can get, and we’re certainly not dismissing it. Rather we’re pointing out that, in terms of market timing, it does need to be balanced with other indicators. We call to mind the old adage: there comes a point where right but really really early, becomes wrong.

Figure 1. 10-2 Yield Curve Inversions and Recessions

Source: Man Solutions, Bloomberg; as of 4 February 2022.

Talking Dirty: Clean Energy Stocks Go Cheap

2022 has been a disappointing year for responsible investors concerned with environmental issues, with Energy Select Sector SPDR ETF outperforming the iShares Clean Energy ETF by almost 37% (Figure 2).

However, while the outperformance of dirty energy stocks mirrors the surge in crude oil and natural gas (and the corresponding profits and free cash flow), counterintuitively we feel this may be a positive for clean energy investors.

Clean energy stocks have significantly de-rated (Figure 3). While this is testament to recent underperformance, it also provides a much better entry point for price-conscious investors. All things being equal, the probability of positive forward returns is much improved when an index sits on 26x forward PE as opposed to 43x at the end of 2020. Likewise, the index’s increased return on equity gives further scope for improvement in the future. Outflows remain muted, and short interest still remain low (Figure 4-5).

Big Oil stocks have also become cheaper, despite the recent surge in prices. Increased demand, lower renewables output coupled with decreased investment in new oil projects have fattened profits, resulting in forward price-to-earnings (‘P/E’) multiples less than half of the levels at the end of 2020. As we have previously written, fossil fuel companies are facing pressure from activist investors and regulatory regimes intent on reaching ambitious Net Zero goals. Are investors recognising that they have significant stranded assets, or is this a classic value buy for Big Oil? Regardless of the answer on fossil fuel companies, the art of investing is to buy good companies at cheap prices, and clean energy companies at the forefront of the Net Zero megatrend are now available for less.

Figure 2. iShares Clean energy ETF Versus Energy Select Sector SPDR ETF

Source: Bloomberg; as of 8 Feb 2022.

Figure 3. Clean Versus Dirty Multiples

Source: Bloomberg; as of 8 February 2022.

Figure 4. Shares Outstanding - iShares Clean Energy ETF Versus Energy Select Sector SPDR ETF

Source: Bloomberg; as of 8 February 2022.

Figure 5. Short Interest - iShares Clean Energy ETF Versus Energy Select Sector SPDR ETF

Source: Bloomberg; as of 8 February 2022.

Will the Quality Comeback Continue in 2022?

Globally, Quality performed exceptionally well in 2021.

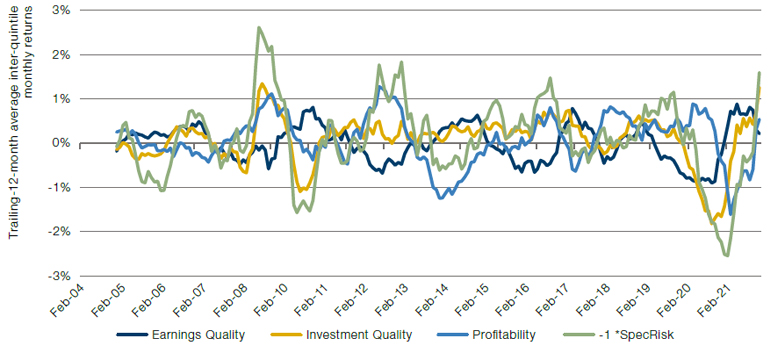

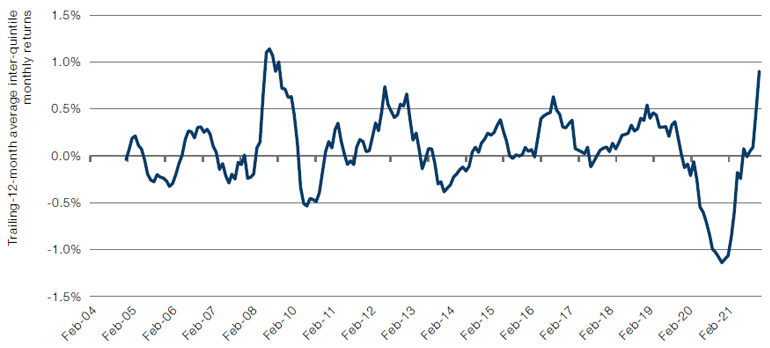

Individual Barra Quality factors, such as Earnings Quality, Investment Quality, Profitability and Negative Specific Risk all showed positive returns on a rolling 12-month basis for the first time since 2019 (Figure 6). When combined, this produced the biggest outperformance for Quality stocks since the Global Financial Crisis in 2008 (Figure 7).

However, will this continue in 2022? In our view, there may well be further cause for optimism. While many of the causes of the Quality renaissance were specific to 2021 – a supply chain squeeze, commodity inflationary pressure and Covid-driven demand disruption – their consequences may still be felt in 2022. Interest rates are likely to rise as central banks battle to contain inflation, with the former raising the cost of capital and the latter eating away at margins in the short term. If rate hikes do kill the post-pandemic bounceback, we may well see a perfect storm for equities – which might trigger a flight to safety, and thus boost the performance of Quality for a second successive year.

Figure 6. Rolling 12-Month Average Returns – Barra Quality Factors

Source: Bloomberg, Man Numeric; as of 31 December 2021.

Figure 7. Combined Quality Factor – Inter-Quintile Monthly Returns

Source: Bloomberg, Man Numeric; as of 31 December 2021.

With contributions from: Henry Neville (Man Solutions, Analyst) Robert E. Furdak (Man Group, CIO for ESG) and Dan Taylor (Man Numeric, CIO)

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.