Inventories Flash Red

Inventories are rising at their fastest-ever rate. In a post-pandemic world, this shouldn’t come as a surprise: deprived of alternatives during lockdowns, a great deal of consumer spending was directed towards durables. This effectively sucked demand forward in time, leaving those who thought that pandemic-era purchase levels were the new normal badly caught out, and even those who expected demand to revert to pre-pandemic volumes carrying too much inventory.

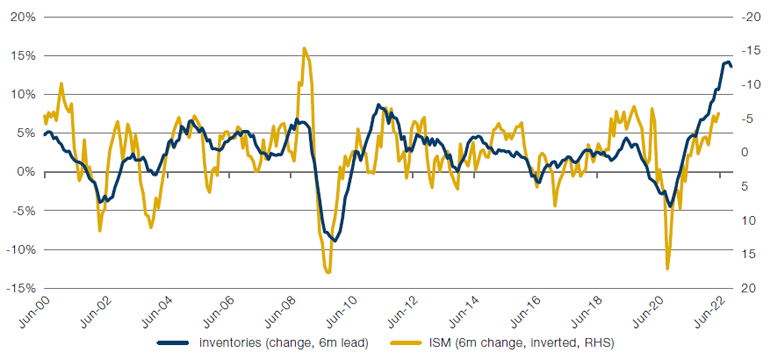

Aside from being inefficient for the firms themselves, rising inventories bode ill for the economic cycle. The level of wholesale inventories reliably leads ISM Manufacturing PMI declines by around six months (Figure 1). The latter metric is regarded as a barometer of economic activity, and the economy is thought to be in recession when it falls below 45.

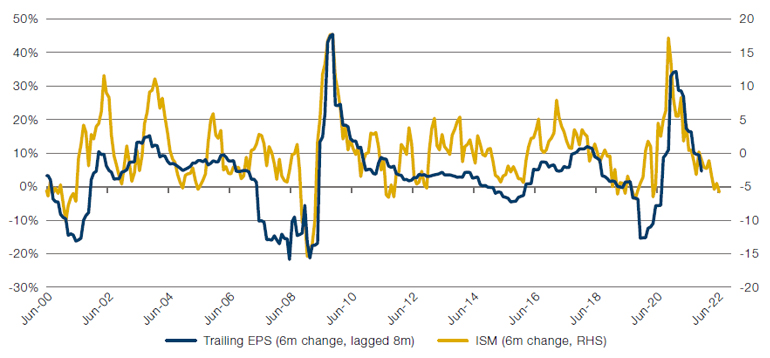

Where the ISM goes, earnings tend to follow (Figure 2), all of which makes deeply uncomfortable reading for equity managers. If inventories stay high, it may be another sign that far from being technical, we will be experiencing a full-scale US recession close to year-end or early next year.

Figure 1. Rising Wholesale Inventories Have Presaged Weaker ISM Readings

Source: Bloomberg, Man GLG; as of 2 August 2022.

Figure 2. Lower ISM Levels Have Been Associated With Lower Earnings

Source: Bloomberg, Man GLG; as of 2 August 2022.

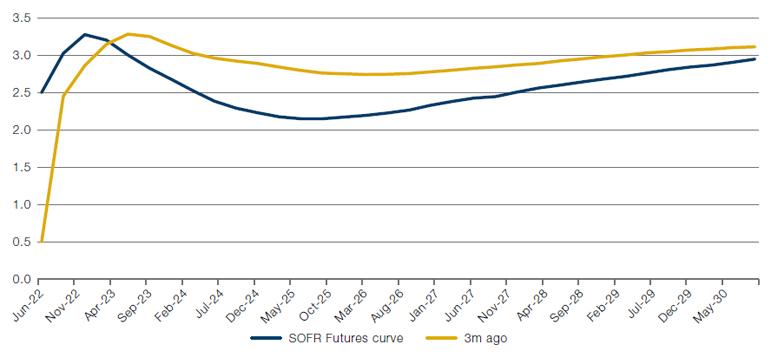

The Fed Doesn’t Have Your Back

The market is now pricing a materially different policy environment from even a few months ago (Figure 3). The SOFR futures curve now anticipates continued hikes up to around 3.25%, and then a series of cuts back down to 2% beginning in early 2023. Three months ago, fewer cuts were anticipated, with rates staying closer to 3% than 2%. This in part reflects the hiking cycle already underway, but the fact that the market seems to be assuming that rates stay above 2% implies to us that expectations of a soft landing are widespread.

Given the inventory overhang described above, we are sceptical that demand will be robust enough to support earnings, which would be a point in favour of more accommodative policy.

But this argument fails to consider the vexed question of the Federal Reserve’s credibility. Our understanding is that 1974 is etched in the FOMC’s consciousness – blinking in the face of a recession saved the cycle in the short-term, but fomented an environment of high and volatile inflation, culminating in CPI peaking at 15% and policy rates at 22%. No Fed chair wants to be Arthur Burns, but all venerate Paul Volcker, which suggests that such a dovish pivot is really not very likely.

One other consideration bothers us: if the Fed is to be pushed towards a true dovish pivot at some point, it will require a materially worse growth and earnings outlook than is currently envisaged. As explained in the section above, we think such a scenario is entirely possible, but are under no illusions that getting there will be a comfortable path for markets. World equities more than 12% off their lows and going higher in the face of the Fed reiterating their intention to tackle inflation suggests real complacency.

Figure 3. SOFR Futures Curves

Source: Bloomberg, Man GLG; as of 2 August 2022.

With contribution from: Ed Cole (Man GLG – Managing Director, Discretionary Investments)

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.