Give Us a Job – Or Give Us an Applicant?

The percentage of firms with few or no qualified applicants for open positions was at 60% in August in the US – its highest ever rate (Figure 1)1. US job vacancies stand at 11 million, outstripping the unemployed figure of 8.4 million (Figure 2). In the UK, all job losses from the pandemic have been recovered and vacancies are running at more than 1 million according to the ONS (Figure 3).

Aside from hiring talent, retaining it seems equally difficult. The US quits rate is also at multi-decade highs (Figure 4).

In our view, the squeeze is unlikely to be resolved any time soon. Anecdotally, we have spoken to a number of CEOs who expect that they will be able to hire freely during the autumn. In part, this confidence is based on the end of the US Unemployment Insurance scheme on 6 September and the UK’s furlough scheme, which fully ends on 30 September. However, with competition for candidates already fierce, it seems unlikely that multiple large firms will be able to hire as they please simultaneously, even though there will almost certainly be more people looking for work. Available workers are not necessarily fungible: in the UK at least, furloughed workers remain concentrated in Covid-affected industries such as hospitality and airlines (Figure 5). They cannot necessarily fill skills gaps in other sectors.

We therefore expect conditions to remain very favourable for labour during the autumn. The boot is on the other foot – instead of workers saying “give us job”, businesses are saying “give us an applicant”.

Source: Bloomberg; as of 20 September 2021.

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 20 September 2021.

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 21 September 2021.

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 20 September 2021.

Problems loading this infographic? - Please click here

Source: Coronavirus Job Retention Scheme statistics, as of 31 July 2021.

Problems loading this infographic? - Please click here

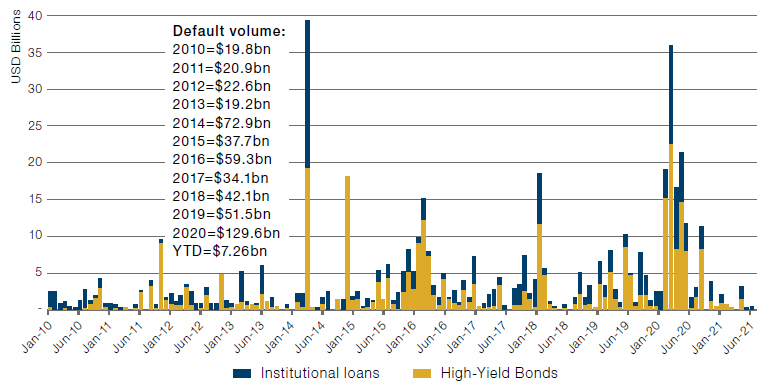

The Default Cycle That Wasn’t

The market downturn caused by the coronavirus pandemic could very well have been the end of this corporate credit cycle, with many expecting it to trigger a wave of defaults. In the end, corporates were largely bailed out by central banks and were able to issue cheap debt to shore up balance sheets. High yield and loan issuance is now on pace for a record year (although much of the issuance is refinancing-heavy), and bailouts via fiscal spending have brought the high-yield default rate to a record low of 0.5% annualised year-to-date (Figure 6).

Figure 6. Default Volumes

Source: Bank of America; as of 31 August 2021.

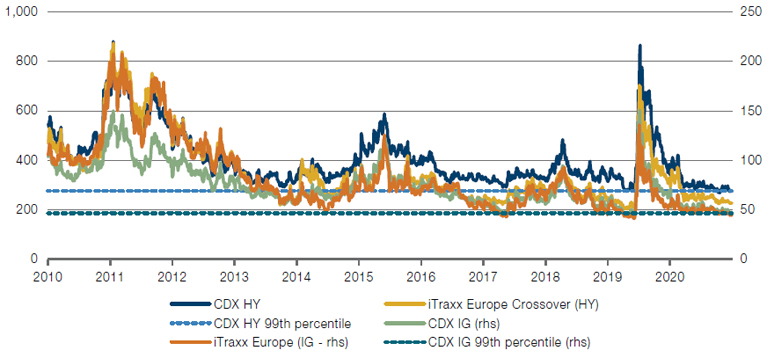

Despite surviving the possible end of a cycle, credit markets continue to face headwinds: the Delta variant, uncertain legislative policies including potential tax hikes, increased credit supply, continued high valuations, risk of downgrades, and a relatively heavy M&A calendar which could increase leverage. Yet so far, they’ve shaken most of this off.

What’s left is an uber-tight credit market and a wild goose chase for yields that are rapidly disappearing.

Using 2010 as a starting point, corporate credit spreads are currently sitting at the 99th percentile, meaning spreads have been tighter than they are right now less than 1% of the time. Yields are so low that that the yield of the ICE BofA European High-Yield Bonds index fell to 2.34% compared to Eurozone CPI of 3% in August.

Figure 7. Corporate Credit Spreads

Source: Bloomberg, Man FRM; as of 14 September 2021.

The outperformance of down-in-quality credits that we’ve observed for the past 12 months is further evidence that the market continues to reach riskier for yields. This year through August, investment grade returned -45 basis points, compared with 4.7% for high yield and 4% for loans. Even within high yield, year-to-date we’ve seen a total return of 7.4% for CCC rated credit, compared with 4.3% for BB.

Given how unusually tight spreads are, spread compression (lower rated credits tightening more than higher quality credits) may therefore be the first trade to unwind if spreads begin to widen into year end.

With contribution from: Ed Cole (Managing Director - Discretionary Investments, Man GLG), Henry Neville (Analyst, Man Solutions), Teun Draaisma (Portfolio Manager, Man Solutions), Jack Barrat (Portfolio Manager, Man GLG) and Jonathan Daffron (Deputy Head of Investment Risk, Man FRM).

1. Source: NFIB Small Business Survey

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.