Quote of the Week

"We have begun rolling out the $1.25 price point at all Dollar Tree stores nationwide."

What Next in the Turkey Saga?

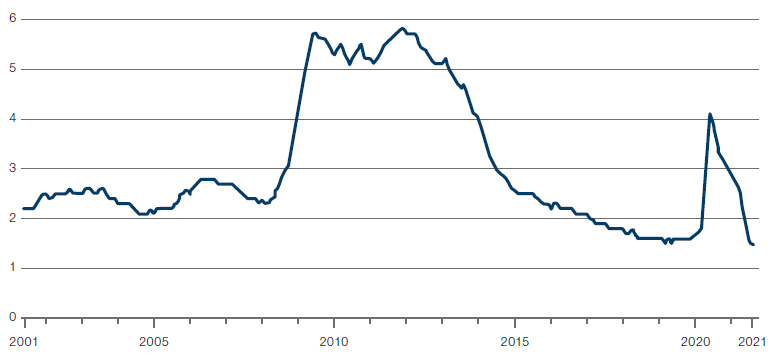

The Turkish lira was once again in the headlines last week after falling 12% against the US dollar on 23 November. Indeed, the currency has declined more than 40% this year and now sits at a record low against the greenback (Figure 1).

The lira came under pressure after President Recep Tayyip Erdogan, driven by Turkey’s improved economic fundamentals, piled the pressure on the Central bank of the Republic of Turkey (‘CBRT’) for fresh interest rate cuts.

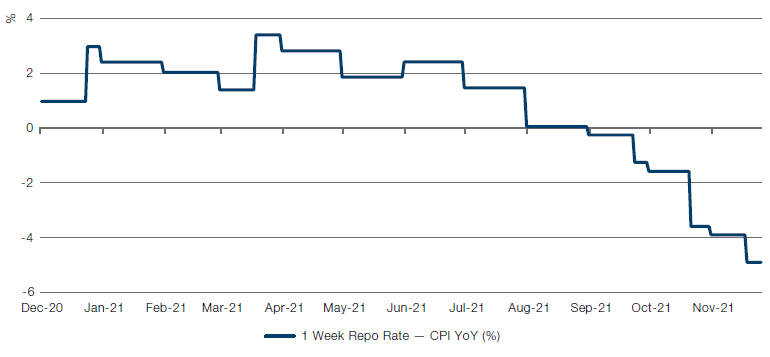

These interest rate cuts, despite the fact that inflation is running at about 20%, has resulted in deep, negative real rates territories (Figure 2). The belief that the central bank has lost its independence and credibility, combined with a lack of forward guidance to control inflation, has led to unanchored inflation expectations. As such, local investors are running to real assets or US dollars to safeguard their savings.

Figure 1. Turkish Lira at Historic Lows Against US Dollar

Source: Bloomberg; as of 25 November 2021.

Figure 2. Turkey’s Real Interest Rates

Source: Bloomberg; as of 25 November 2021.

The critical question now is what comes next? Unlike previously, the CBRT does not have the luxury of US dollar reserves to sell. Indeed, net reserves are close to negative USD40 billion! And the CBRT has been absent from selling dollars in the market in recent weeks. A rate hike is, in our view, out of question since President Erdogan has just started the cutting cycle.

Thus, we believe, the only remaining option to prevent US dollars leaving the system is to impose some sort of capital controls on locals. President Erdogan may be hoping that the devaluation will be a one-time adjustment and that the economy would move on afterward. However, a sharp devaluation not only can create a bank run as locals rush to take out their deposits, but can also create solvency issues for local corporations and turn the currency shock into a solvency crisis.

To the latter point, for the time being, the stress has not leaked into Turkey’s credit spread. Credit default spreads have been relatively calm, trading under 500 basis points. These credit spreads have been mainly supported by locals investing their dollars in Eurobonds, but only time will tell how long this equilibrium can be held for.

UK Labour Market Points to BoE Rate Rise

The number of open jobs in Britain rose to a record 1.1 million in the three months to August, according to the Office of National Statistics. However, the ratio of jobless people to open jobs stood at 1.45, the lowest point in 40 years. Just for comparison purposes, at the peak of the coronavirus crisis, the ratio of jobless people to open jobs was 4.1. This tight labour market has inevitably stoked fears about wage inflation.

We’ve previously spoken about how wage inflation should fuel higher demand and prompt firms to raise prices, already evidenced by recent inflation figures in the UK. These labour market bottlenecks, balanced against both rising price pressures and a steady economic recovery, is likely to place even more pressure on the Monetary Policy Committee to hike rates when it meets in December.

Figure 3. Ratio of Jobless People to Open Jobs

Source: Office for National Statistics; as of 12 October 2021.

With contribution from: Ehsan Bashi (Man GLG, Portfolio Manager) and Ed Cole (Man GLG, Managing Director – Discretionary Investments).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.