Turkey: EM’s Patient Zero?

The sacking of Turkey’s central bank governor, Naci Agbal, triggered a run on the lira at the beginning of last week. At one point, the lira was nearly 10% down against the US dollar on 22 March. This significant decline in the lira and the blowout in spreads is evidence that Turkey’s access to the hard currency funding market is currently shut, with the market having lost confidence in the current regime’s ability to keep its short-term political instincts from sabotaging sustainable economic policy.

With Turkey beginning to crack, we see significant fragility being under-priced in a number of emerging market (‘EM’) countries. We believe there is a reasonable likelihood of contagion to other fragile EM economies, as well as some connectivity to Western European credit. Several large pools of EM corporate and sovereign credit – such as Argentina, Ecuador, Zambia, Lebanon – came into 2020 already vulnerable, and the pandemic has pushed a number of these credits close to or over the edge. South Africa, Brazil and Mexico are dependent on access to US dollar financing to fund their economies and are running huge fiscal deficits (made worse by the pandemic), which make them reliant on access the eurobond market for dollar funding. They continue to be very cheap shorts from our perspective. EM real money has been caught overweight the riskier assets, chasing yield and spread (which can only be found in the bottom quartile of EM credit). We think this is likely to produce an increase in distressed opportunities in the near term and is also offering up very interesting asymmetric risk/reward opportunities on the short side today.

For us, this is a very interesting landscape. In distressed credit, we believe there is an immediate opportunity to short Turkey, South Africa, Brazil and Mexico.

Additionally, crises tend to lead to ‘babies being thrown out with bathwater’, when investors and banks sell assets in the affected markets indiscriminately, hurting good credits as well as bad. As there tends to be an element of mean reversion, a selloff can counterintuitively present some opportunistic long investments. Outside of the distressed credits, we see ‘good company / bad balance sheet’ distressed situations multiplying with sovereign crises and currency devaluations looming in a number of the debt stocks.

We are optimistic and excited about the increasing opportunities from what we believe is a likely sovereign distressed wave which is not yet being priced in, outside of Turkey, today.

Where Are We With the AstraZeneca Vaccine?

The Oxford/AstraZeneca vaccine has been in the spotlight recently – and not for good reasons. First there were reports about blood clots in some recipients, which led to more than a dozen countries pausing the vaccine rollouts. Then the US Data and Safety Monitoring Board (‘DSMB’) questioned the 79% efficacy data, saying that it may be based on “outdated information”.

AstraZeneca then published revised results, stating that its vaccine has 76% efficacy against symptomatic Covid-19 (as opposed to the 79%). It also said the vaccine has 100% efficacy against severe or critical disease and hospitalisation due to coronavirus and is 85% effective against symptomatic Covid-19 in patients aged 65 years and over.

Even before this latest row, the Oxford/AstraZeneca vaccine was already caught in swirling miasma surrounding concerns.

First, the initial trials of the Oxford/AstraZeneca vaccine outside of the US (‘OUS’) were extremely complex, with development conducted by an academic institution consisting of 12 arms and using a variety of dosing strategies. This led to uncertain interim data:

- The low/standard (mistake) dose led to better outcomes than standard/standard dose (90% versus 62% efficacy);

- Very few events were in the elderly as Oxford recruited younger patients first (just 12% of patients in the trial were older than 55).

Despite this, it’s important not lose sight of the most important thing: in the primary analysis of OUS trials, it was confirmed there were no hospitalisations or severe cases in the vaccine arm.

The standard/standard dose strategy was confirmed at 63% efficacy. However, we were still left with a confusing picture as efficacy was 76% after the first dose, falling to 54% after second dose if the doses were delivered less than six weeks apart but increasing to 82% with a 12-week interval.

Secondly, debates have continued around efficacy in the elderly. Many EU countries banned the use in those older than 65, not because of negative data, but simply because there was not enough data to draw conclusions. As mentioned, Oxford designed the trials to recruit younger patients first, which meant the events didn’t accrue in elderly patients.

Third, we don’t know where the Oxford/AstraZeneca vaccine stands with variants. The UK trial was run mostly prior to the UK variant, and the US trial doesn’t contain many of the RoW variants, leaving us with no clinical data. AstraZeneca has said that the vaccine is ineffective against the South African variant. This remains a major outstanding concern.

Fourth, the story on safety has been a troubled one. The US trial was halted for weeks as a result of a complication, while a blood clots scare has led to negative headlines. However, out of 17 million vaccine doses in EU and the UK there were just 37 events, lower than natural incidence. The UK yellow card report system has shown 63 cases and two deaths with the Oxford/AstraZeneca vaccine versus 53 cases and two deaths for the Pfizer vaccine, which implies that that there are no abnormal occurrences with the AstraZeneca vaccine. Additionally, in the US trial, the DSMB specifically analysed thrombotic events and gave the all clear.

Ultimately, we remain confused by the DSMB decision to quibble the trial data. The global vaccination rollout has effectively created a trial dataset of millions. At this point in the pandemic, the benefits of vaccinating as rapidly as possible far outweigh the perceived risks of the AstraZeneca vaccine.

Opening Up: Scope for Positive Surprises

There is no question that we’re all feeling some Zoom fatigue. Not-going-out-to-restaurants fatigue. Not-going-on-holiday fatigue. Just general Covid-19 fatigue.

Good news then!

Research by Goldman Sachs shows broadly speaking, the rate of change for second derivatives for ‘back-to-normal’ beneficiaries in the US – such as gym attendance, restaurant bookings, retail and recreation – are starting to improve, while that of ‘stay-at-home’ beneficiaries – such as Zoom calls and online gaming – are staring to slow.

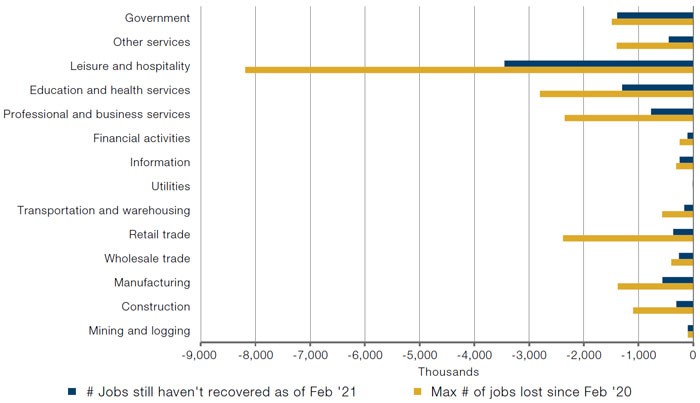

As the US economy starts to open up, we believe that there will be unprecedented demand for labour, especially in the leisure and hospitality sector, as every nightclub, bar, restaurant, theatre, gags to get back on track. And with jobs in the leisure and hospitality sector still 3.5 million below February 2020 levels (Figure 1), we believe there is a strong possibility of a large positive surprise to non-farm payrolls numbers in the coming months.

Figure 1. Jobs Lost Since February 2020 – By Industry

Source: Bureau of Labor Statistics’ (BLS) Current Employment Statistics, Establishment Survey (CES) public data series; as of 5 March 2021.

With contribution from: Patrick Kenney (Man GLG, Portfolio Manager), Santiago Pardo (Man GLG, Portfolio Manager), James Terrar (Man GLG, Analyst) and Ed Cole (Man GLG, Managing Director – Discretionary Investments).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.