Inflation: It’s the Direction, Not the Level, That Matters

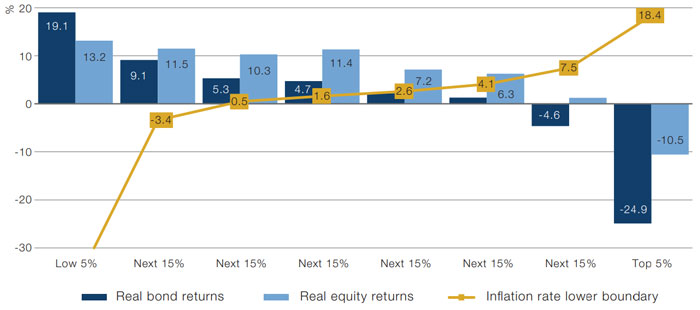

The publication of the Credit Suisse Yearbook has raised a number of points about asset returns and inflation. From our perspective, the most interesting was an examination of the effect of different inflation regimes on asset prices, using annual data since 1900 from 21 countries. As we might expect, bonds perform best in low-inflationary regimes, with equities showing remarkably little sensitivity until inflation goes above 2.6%, at which point they perform significantly worse (Figure 1).

However, the direction of travel is more important than the absolute level of inflation when it comes to asset class performance. Our own analysis indicates that rising inflation, which starts below 3% but eventually exceeds it, does depress equity returns over a 5-year period. Conversely, high but falling inflation bodes well for equites. For instance, US equity returns between 1982 and 1988 were strong, even with much higher levels of inflation than we experience today, as inflation was declining from its cyclical peak in 1980.

Figure 1. Real Bond and Equity Returns Versus Inflation Rates (1900-2020)

Source: Dimson, Marsh, Staunton, Credit Suisse; as of 31 December 2020.

Note: Percentiles of inflation across 2,537 country-years; bond and equity returns in same year.

Not Enough Oil Supply

The collapse of oil prices in 2020 resulted in a collapse in the US frac spread (Figure 2). This was not surprising: onshore fracking is one of the most expensive energy production methods, so low oil prices made US fracking uneconomical.

However, 12 months on, despite a recovery in oil prices and recent freezing weather in the state of Texas, the US frac spread is nowhere near where it was a year ago.

In our view, this supply constraint may mean that oil prices are likely to rise further. As vaccinations open up the global economy, the demand for energy will increase – and it doesn’t look like US supply is ready to match it.

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 12 March 2021.

With contributions from: Teun Draaisma (Man Solutions, Portfolio Manager) and Ed Cole (Man GLG, Managing Director – Discretionary Investments).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.