You’ve Never Had It So Good…

There is a lot of good news right now – record highs in the S&P 500 Index, rebounding EPS growth and a burgeoning economic recovery. Indeed, data wise, we might paraphrase former British Prime Minister Harold Macmillan: “You’ve never had it so good”.

But with so much positivity baked into prices, might this be as good as it gets?

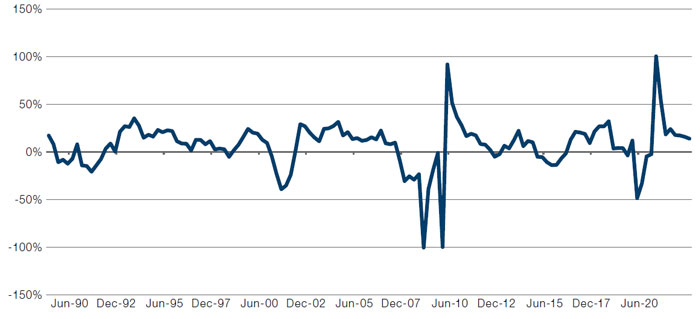

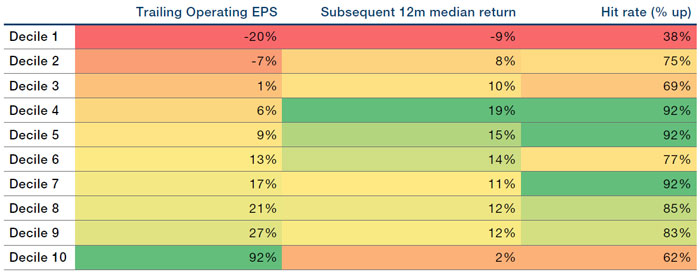

Figure 1 shows year-on-year trailing operating EPS growth for the S&P 500 since 1989 and using consensus earnings for the remainder of 2021 and 2022. As illustrated, EPS growth for the S&P 500 for the first current quarter is set to be 100% higher compared with 2020, within the top decile of earnings growth. Historically, this would indicate median returns of only 2% in the subsequent 12 months.

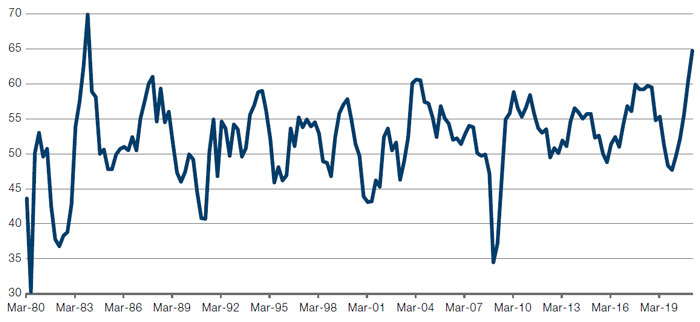

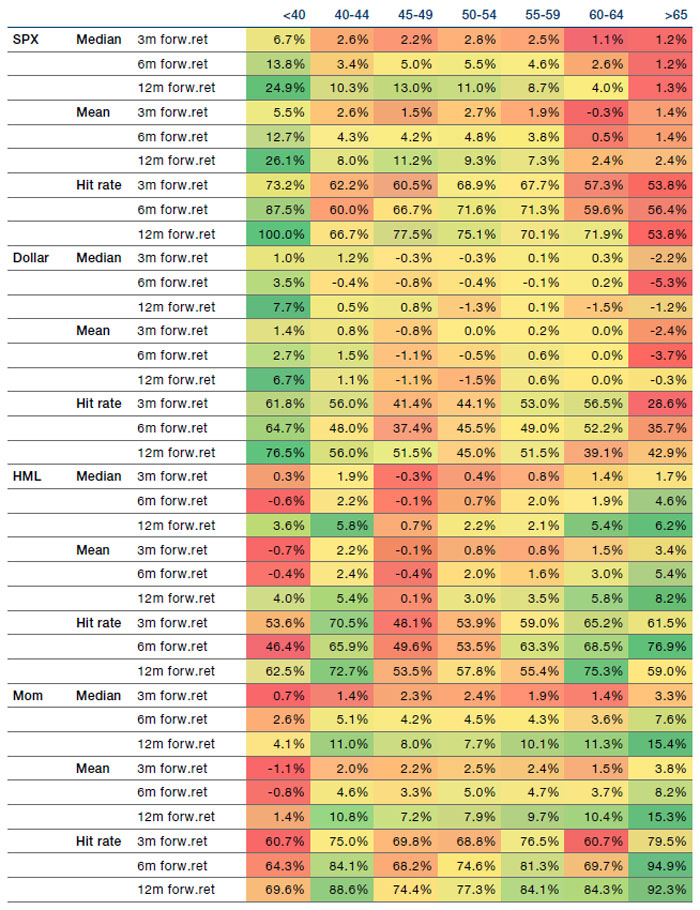

Similarly, the ISM Manufacturing PMI for March was nearly 65, its highest reading since 1983 (Figure 3). Broadly speaking, history implies that with the ISM at these levels, the subsequent three, six and 12 months saw deteriorating S&P 500 returns and a weaker US dollar (Figure 4).

Figure 1. S&P 500 Trailing Operating EPS (With Forecast)

Source: Bloomberg; as of March 2021.

Figure 2. EPS Growth Deciles, Subsequent Returns and Hit Rates

Source: Man GLG; as of March 2021.

Figure 3. ISM Manufacturing PMI

Source: Bloomberg; as of March 2021.

Figure 4. ISM Manufacturing PMI and Subsequent Returns

Source: Man GLG; as of March 2021.

Gold Anomalies

Three anomalies have caught our eye this week when it comes to gold.

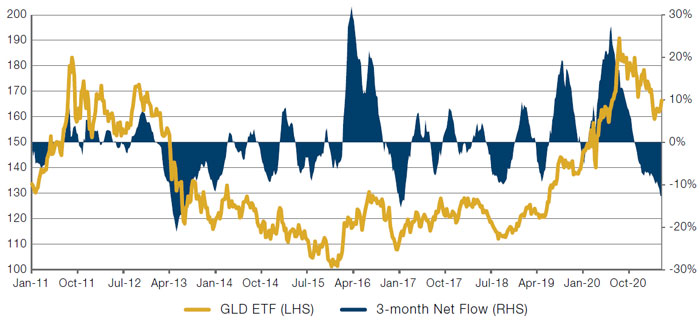

First, over the past three months, the largest gold bullion ETF has seen net outflows of about 13% of AUM (as illustrated by the blue bars in Figure 5), the third-biggest capitulation of the last 10 years.

Second, this has occurred in a period when the macro environment for gold has been as supportive as one can expect it to be. Generally, gold does well when rates fall (Figure 6), so to see this level of capitulation is surprising.

The third anomaly is China. Gold is an eligible asset class for Chinese investors, but one which had been subject to import controls – possibly to direct investment towards notionally more productive assets rather than simply into a store of wealth. These have since been relaxed1, creating a supportive environment for gold.

Figure 5. GLD Versus 3-month Net Flow

Source: Bloomberg; as of 22 April 2021.

Figure 6. Gold Versus 5-year US Real Rate (Inverted)

Source: Bloomberg; as of 22 April 2021.

With contribution from: Ed Cole (Man GLG, Managing Director – Discretionary Investments).

1. Reuters: “EXCLUSIVE China opens its borders to billions of dollars of gold imports – sources”; 16 April 2021.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.