Quote of the Week:

"Credit default swaps ‘encouraged the growth of a finance of chance and of gambling on the failure of others, which is unacceptable from the ethical point of view."

Liquidity Crunch?

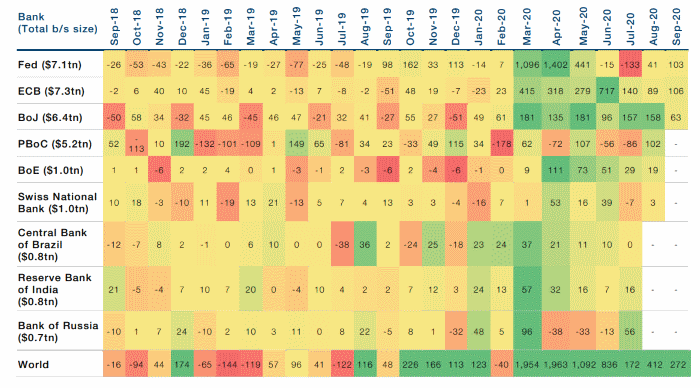

Over the past four months, the Federal Reserve has hardly injected any liquidity into the economy (Figure 1), compared with the cUSD3 trillion injected between March and May.

Does this mean we are heading for a liquidity crunch?

We believe the answer is no, for two reasons.

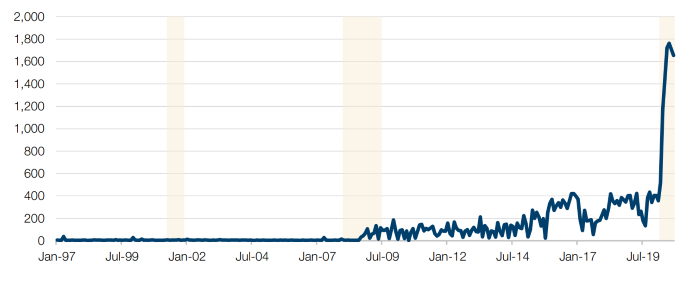

First, there has been a spike in the US Treasury General Account – or the government’s current account – to USD1.7 trillion (Figure 2). This is money that is waiting to be unleashed into the US economy. Of course, there is no guarantee that this money gets released given the current US political situation. However, if there happens to be an agreement, then this is a big quantity of money that will be injected into the US economy.

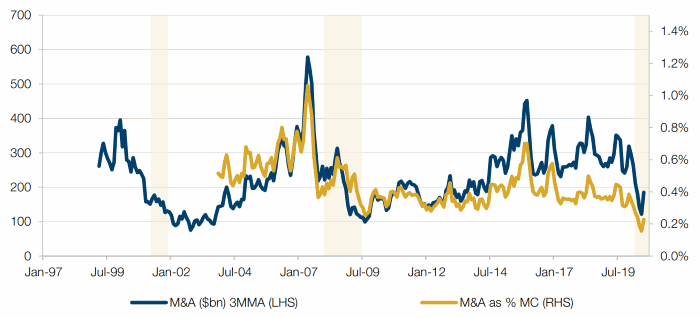

The second source of liquidity is M&A (Figure 3). In April 2020, the volume of M&A deals fell to USD96 billion, the lowest level since August 2009. However, since then, we have seen a bounce back in M&A activity, both in terms of volumes, but also as a proportion of market cap.

Figure 1. Central Bank Monthly Purchases (USD Billion)

Source: Man Solutions, Bloomberg; as of 30 September 2020.

Figure 2. US Treasury General Account (USD Billions)

Source: Man Solutions, Bloomberg; as of 30 September 2020.

Figure 3. Global M&A

Source: Man Solutions, Bloomberg; as of 30 September 2020.

Note: M&A is (LHS) monthly periodicity sum of all announced transactions across the respective month. (RHS) sum of all announced transactions on a daily periodicity.

Another V: US Temporary Payrolls

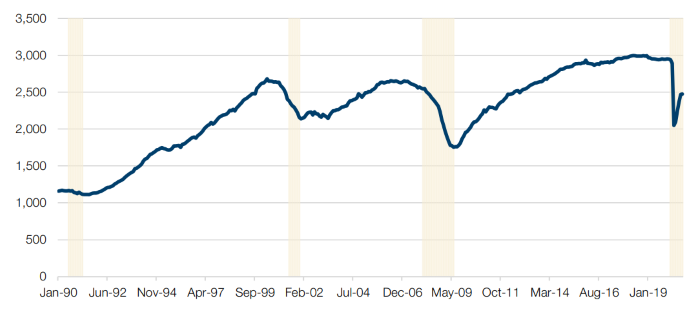

After falling to a 10-year low in April 2020 in the midst of the coronacrisis, US temporary payrolls have exhibited a spectacular V-shaped recovery. Indeed, US temporary payrolls have regained about half of those lost during the depths of the pandemic in just six months.

Of course, temporary payrolls would be expected to recover faster than permanent payrolls since they provide more employer flexibility. Still, the speed of recovery has been unprecedented. As a comparison, it took about 15 months for the US temporary payrolls to regain about 50% of those lost during the Global Financial Crisis.

Figure 4. Temporary Payrolls Recover

Source: Bloomberg; as of 30 September 2020.

With contribution from: Henry Neville (Man Solutions, Analyst), Teun Draaisma (Man Solutions, Portfolio Manager), Ben Funnell (Man Solutions, Portfolio Manager) and Ed Cole (Man GLG, Managing Director – Equities).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.