The Wait Is Over

The announcement of a Covid-19 vaccine, developed by Pfizer and BioNTech, being more than 90% effective was cheered by global equity markets last week.

While the news is very welcome, we do think there are other factors to be mindful of here.

First, the 90% efficacy rate (on the 94 confirmed Covid-19 cases out of 164) in the full trial exceeds the US Food and Drug Administration’s (‘FDA’) criteria of a 50% efficacy threshold. However, the number of severe cases is unconfirmed, with the FDA guidelines indicating that a minimum of five severe cases would be required.

Second, is the approval timing. Pfizer/BioNTech have indicated that they intend to file the vaccine approval by the third week of November. A review by the FDA might reasonably take 2-4 weeks, which leaves the option for emergency use authorisation by the end of 2020. However, there is always the risk that the emergency use authorisation is restrictive and requires 6-month safety data to be available to the masses.

Third, the manufacturing and supply. Pfizer/BioNTech use Messenger RNA (‘mRNA’) technology to synthetically produce a vaccine. This works by encoding an antigen of the virus into mRNA, which is injected into the body. Cells are then instructed to produce the same antigen, which the immune system then uses to fight the virus. The good news here is that it offers advantages in terms of production: the mRNA is produced from a DNA template in a lab, removing the need to grow cultures of the vaccine, which is more difficult and usually takes more time. However, this vaccine has a deep-freeze hurdle: it needs to be stored at -70 degrees celsius. As such, distribution will require deep-freeze infrastructure. 2020 manufacturing capacity is likely to be around 50 million doses, ramping up to 1.6 billion in 2021. Of these, only 250 million doses will be available in the first half of 2021. Overall, the EU has secured 200 million (with an option for 100 more), the US 100 million (with a 500 million option), Japan 120 million doses and the UK 30 million.

As such, given the need for production to ramp up and the aforementioned delays to deal with safety and transportation issues, it may well be mid-2021 before vaccine supply reaches full swing.

Factor Upheaval: Painful for All Concerned

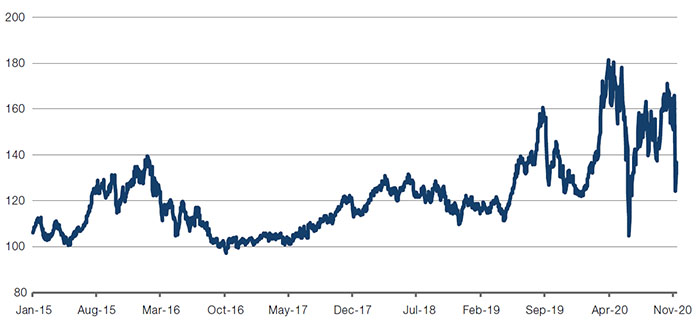

The aggressive Momentum selloff over the past week has prompted some discussion of what happens when there is a regime change in dominant factors. At Man Group, it has also prompted a discussion about the right measures for Momentum – discretionary managers typically favouring the less industry neutralised measures (that are published by investment banks), systematic managers opting for their purer counterparts.

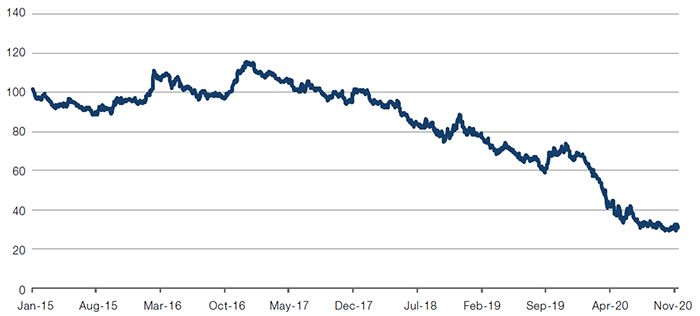

The former, as expressed by the Morgan Stanley US Momentum index, peaked in March and April 2020, and has experienced enormous volatility since. The latter peaked just this week. However, we are yet to see any pick-up in Value whatsoever (Figures 1-2).

Figure 1. US Momentum

Source: Bloomberg, Morgan Stanley; as of 12 November 2020.

Figure 2. US Value

Source: Bloomberg, Morgan Stanley; as of 12 November 2020.

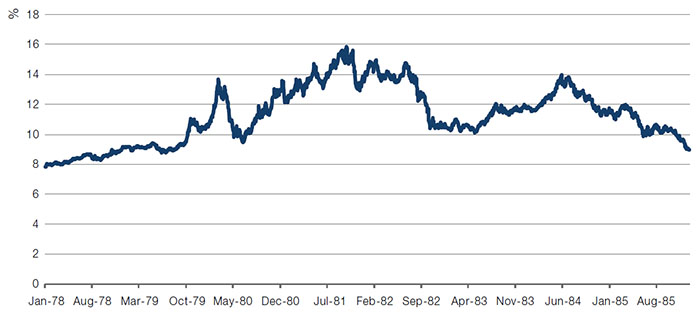

But if volatility does herald the beginning of a regime change, it is worth remembering that such periods are painful for all concerned, and that it is really only possible to tell that things have changed with the benefit of plenty of hindsight. Figure 3 shows the US 10-year yield between 1978 and 1985, the last time there was a major regime change. It is worth reflecting on the gut-wrenching swings that would have caused an enormous challenge to the conviction of those who correctly identified the end of inflation at the start of the 1980s. And the considerable relief at times to those who continued to bet on an inflationary regime persisting.

If this is the start of a regime change, managers should not expect a smooth transition to a new dominant factor. Instead, adherents of both the old and new regimes should expect to have multiple opportunities to potentially make enormous gains. Or alternatively, to be carried out.

Figure 3. US 10-Year Yield 1978-1985

Source: Bloomberg; as of 12 November 2020.

With contributions from: James Terrar (Analyst, Man GLG) and Ed Cole (Managing Director - Equities, Man GLG).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.