Quote of the Week:

"And, yeah, that is good financial art! I want to buy her soul securitisation and tokenise it on the blockchain."

R We Safe to End Lockdown?

How do we re-start the economy safely? This is the big question occupying governments around the world. The question is especially acute in those countries which have entered 'lockdown', restricting the basic freedoms of their citizens to travel, socialise and work in an effort to defeat coronavirus.

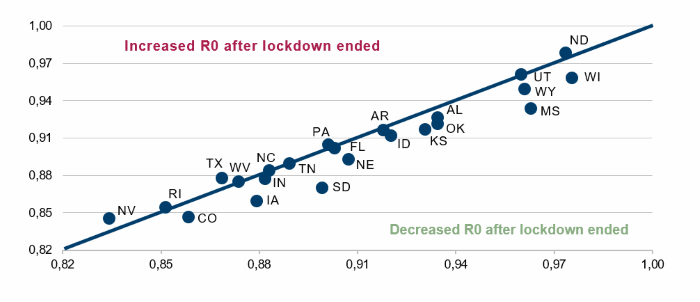

JPMorgan’s Marko Kolanovic has produced a paper arguing that there is no evidence of an increase in R0 if a US state ends lockdown, based on data so far (Figure 1). R0, also known as the reproduction number, is a measure of how contagious an infectious disease, and is the average of the number of people infected by a single person who contracts the disease. If the average increases, the infection rate increases and vice versa. An R0 less than one for a sustained period indicates that for each existing infection, less than one new person will become infected, and that the disease is therefore in retreat.

But is the thesis plausible? As with much of the data surrounding coronavirus, there are question marks as to its quality. The study has been conducted over a necessarily limited data set, in a short space of time. Further problems arise when we consider that easing lockdown restrictions does not necessarily change behavioural patterns: many people will have remained furloughed and may not have returned to the level of social interaction they engaged in before coronavirus.

What are the consequences if ending lockdown has not increased US R0 rates? The logical assumption will be that this gives policymakers the opportunity to end lockdowns, and attempt to get as many people back to work as possible. Any easing may well be supportive of equity prices, triggering a rush of positive sentiment.

Nevertheless, the operative word is still ‘may’. The study is encouraging, but we need more confirmation to declare that lockdowns can be over. And whilst lockdown easing seems to trigger an equity bounce across geographies, it remains to be seen what kind of economy will emerge from the bunkers.

Figure 1. Increase in R0 After Lockdown Ending

Source: JP Morgan; as of May 2020.

The Responsible Revolution Continues

2020 has been an odd year by most yardsticks. But one way in which it is not odd is that the trend towards responsibly invested portfolios is continuing.

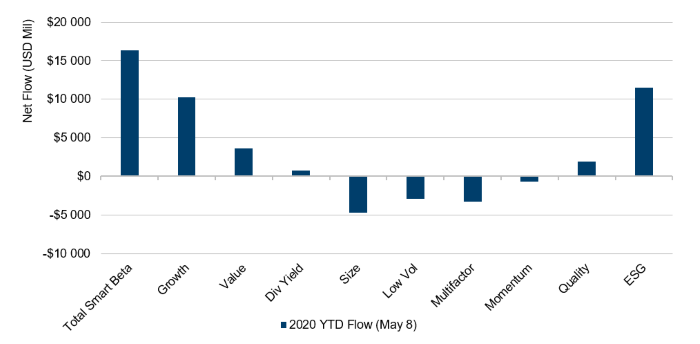

Figure 2 shows the inflow of assets to smart beta ETFs since the start of 2020. With a net inflow of about USD11 billion, ESG ETFs have seen the strongest inflows this year, closely followed by Growth.

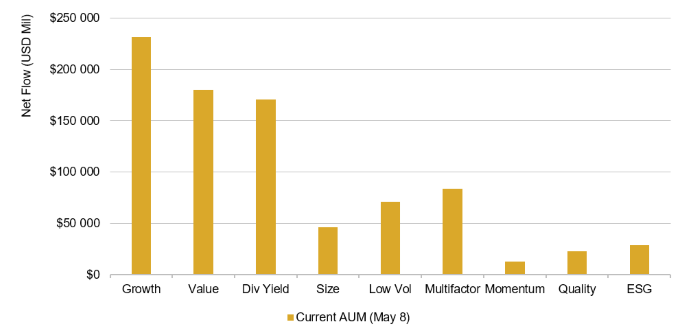

However, whilst ESG assets are growing, they remain a stubbornly low percentage of overall assets under management (Figure 3). ESG assets are just a tiny USD29 billion slice of the USD858 billion smart beta pie, despite the USD11 billion of inflows so far this year. Whilst the responsible investing revolution continues, in our view, its incompleteness actually represents a positive for ESG-oriented managers. More responsibly managed assets could potentially provide a tailwind for managers whose investment process and holdings already incorporates ESG analysis.

Figure 2. Smart Beta ETF Flows

Source: Bloomberg; as of 8 May 2020.

Note: Figures include all US listed ETFs, not all categories included (totals represent over 99% of all AUM).

Figure 3. AUM of Smart Beta ETFs – By Factor

Source: Bloomberg; as of 8 May 2020.

Note: Figures include all US listed ETFs, not all categories included (totals represent over 99% of all AUM).

With contribution from: Teun Draaisma (Portfolio Manager, Man Solutions) and Rob Furdak (CIO for ESG; Man Group).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.