Quote of the Week:

"Some issuers say they’re borrowing more cheaply with green bonds than regular ones, while investors say they’re not paying more. Both can’t be true."

Brexit Negotiations: Gloom Priced In

Whilst coronavirus has monopolised the public debate, the previous blanket coverage issue in the UK – Brexit – has not gone away. Indeed, we are now approaching the crunch period of the negotiations.

Negotiations between the UK and the EU are scheduled to continue until on 7 September, 2020, but the deadline for extending the transition period passed at the end of June. In our view, the key time for negotiations will be in the autumn, as without a trade agreement, the UK will begin trading with the EU under WTO rules from 1 January, 2021.

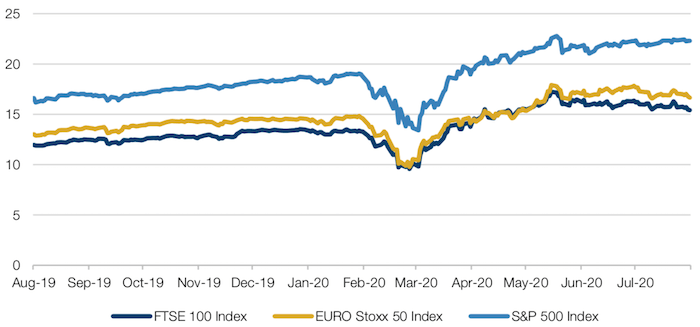

Our base case remains that a compromise will be found, allowing a broad trade agreement to be implemented in the new year, with the details at the industry level to be negotiated over the coming years. However, UK assets are currently pricing in a negative outcome from the negotiations: whilst global assets have been hit by the pandemic, the relative valuation of UK stocks has declined compared to US and European indices. Figure 1 shows that on a blended price to-earnings ratio (‘PE’) basis, the FTSE 100 index has recovered less well than the Euro Stoxx 50 or S&P 500 indices – in part due to Brexit fears.

Figure 1. Blended PE Ratios – UK, US and Europe

Source: Bloomberg; as of 21 August 2020.

Coronavirus as a Catalyst for Long-Term Trends

The coronavirus pandemic has accelerated the rate of structural change in many industries and has initiated several more, including:

- Working from home;

- Digital communication;

- Transition to digital retail;

- Increased focus on hygiene;

- Health and wellness;

- Government outsourcing;

- Increased automation;

- Changing demand for physical real estate.

Our view is that these trends will persist for many years, especially as they were already in motion. As we see medical advancements to combat the coronavirus, the market is likely to go through periods when these themes are thought to have matured. This feels reminiscent of the banking sector in 2008/09. Although the Global Financial Crisis has passed, the banks continued to feel the effects of it, both from a political and regulatory perspective for the ensuing decade. This has been reflected in the ongoing underperformance of banking stocks. Indeed, we would not be surprised to see many of these pandemic-related themes persist for years to come.

Already, the pandemic has also had a significant impact on the supply side of many industries, including:

- Travel and leisure capacity, with numerous airline bankruptcies and significant curtailing of capacity as balance sheets have come under pressure;

- Physical retail space, with significant redundancies announced in the retail and leisure sectors;

- Insurance, with the pandemic likely to put further pressure on underwriting capacity after a period of several years with above-average claims. Rates are already starting to increase to reflect this;

- Government funding for industry, with industries likely to get less support going forward.

These issues will present structural growth opportunities for many companies, in our view. We believe that where capacity and competition is reduced by the pandemic, those companies that possess strong balance sheets and competitive positioning, should be able to prosper. This can be the case even where the industry itself sees the overall profit pool diminish. Low-cost airlines would seem an obvious case in point, where the long-term demand for cheap travel for leisure is unlikely to be significantly diminished by the epidemic, but many of the legacy airlines will be left in a far weaker position.

About That Efficient Markets Hypothesis...

Why do companies split their stock? After all, there is nothing in the efficient markets hypothesis which suggests that there is any benefit to a stock split. When splits occur, investors are simply issued new shares in ratio to their previous holdings, which means that splits have no fundamental impact on company valuations – the original market cap is simply distributed across a larger number of shares.

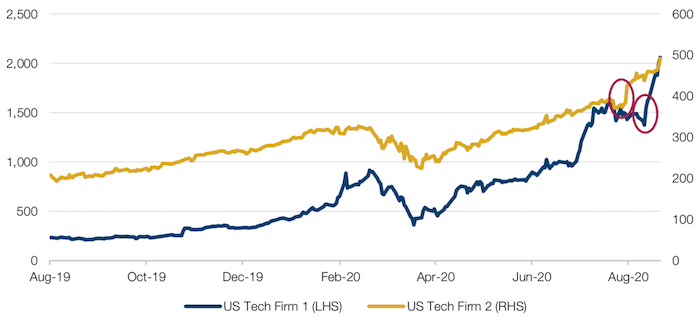

Two recent US stock splits indicate why companies bother to try and reduce the price of their stock. Figure 2 shows how both stocks surged higher in the period following the stock split, off the back of increased retail trading volumes. This, in our view, is the main attraction: by making individual shares appear more affordable to retail investors, companies can actually increase the price of their stock. Many retail investors buying stocks which seem cheap in nominal terms, rather than as a multiple of company earnings - reducing the headline stock price can actually encourage a stronger bid from retail traders.

Ultimately, there is no reason why stocks should re-rate after meaningless corporate actions. But the increasing importance of the retail investor in equity markets is an indication that they will continue to do so for the foreseeable future.

Figure 2. Price After Stock Splits – Two US Tech Firms

Bloomberg; as of 20 August 2020.

With contribution from: Charles Long (Man GLG, Portfolio Manager), Nick Judge (Man GLG, Portfolio Manager) and Ed Cole (Man GLG, Managing Director – Equities).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.