Quote of the Week:

"An often traduced Washington salvaged some of its reputation in the spring. It is close to forfeiting it all over again."

Not So Delightful: Turkey and the Risk of Capital Controls

The Turkish lira struck new lows on 10 August after the offshore interest rate on overnight swap transactions surged as high as 1,050% on 4 August as authorities tried to boost the currency. This, in combination with limited ability for the Turkish Central Bank to continue to prop up the currency with net reserves at negative USD30 billion, has led to weakness in the local bond markets, with rates widening to more than 100 basis points in the 2028 bonds (the most liquid local bond). Furthermore, the stress in local markets has started to spill over to the credit space: 5-year credit default swap (‘CDS’) spreads have also widened by about 100bp since 27 July.

We believe the recent actions have increased the likelihood of capital controls. In a rosier muddle-through scenario, the dollarisation of local deposits (i.e. local depositors converting their Turkish lira into US dollars) will be gradual and a full blowout scenario can be avoided for a while. However, if there is an acceleration of dollarisation and there are not enough US dollars to meet the demand of local depositors, we may see a quicker move to capital controls, and at the extreme, potential restructuring of bank deposits.

From War to Recession: Why Governments Borrow

What is the purpose of a government deficit?

It seems a strange question. After all, as financiers rather than politicians or philosophers, ours is not to reason why – ours is instead to understand the effect of policy on asset prices and react accordingly.

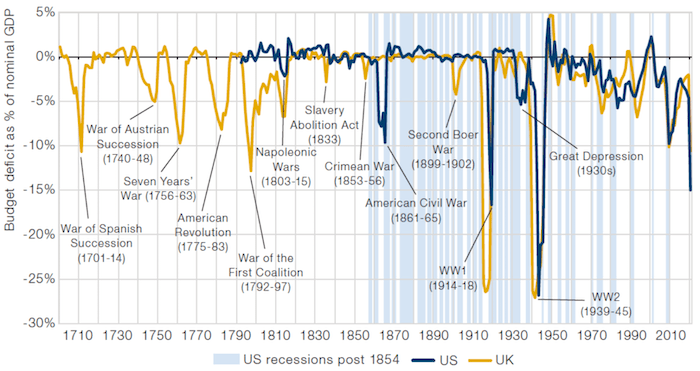

But considering the changing nature of budget deficits throughout history does give some insight as to their likely trajectory. As Figure 1 shows, until the onset of the Great Depression, fiscal policy was a matter of balancing the books, unless you had a fight on your hands, quite literally as it turns out. The Depression heralded a sea change in the role of government, with the New Deal and subsequent Keynesianism meaning that expanding deficits became correlated to recessions rather than conflict. Policymakers and the general public in both in the US and the UK came to expect that government spending would replace lost demand.

Because recessions are more frequent than wars, this change in role has caused a change in deficit patterns: instead of sharp plunges, and a quick return to zero deficits (or even surpluses), both the US and the UK have existed in a state of semi- permanent, but persistently expanding deficits since the 1950s.

In our view, the coronavirus recession will take this model of policymaking to its logical conclusion: the monetisation of the deficit. The US entered the coronacrisis after four years of deficit expansion. In contrast, the UK has been on a decade-long period of deficit reduction. However, both countries now have their biggest ever peacetime budget deficits. And we don’t think this is likely to change any time soon. In a context where the poorest in society have often borne the brunt of the Covid burden, it seems very unlikely that there will be the political impetus for another bout of austerity, as characterised the aftermath of the last crisis. Over the medium term, this represents a clear inflationary risk.

Figure 1. Budget Deficits for US and UK 1700-2020

Source: Bank of England, US Treasury, Man Solutions, Bloomberg. 2020 is current consensus estimate collated by Bloomberg; as of 22 February.

With contribution from: Phil Yuhn (Man GLG, Portfolio Manager) and Henry Neville (Man Solutions, Analyst).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.