Introduction

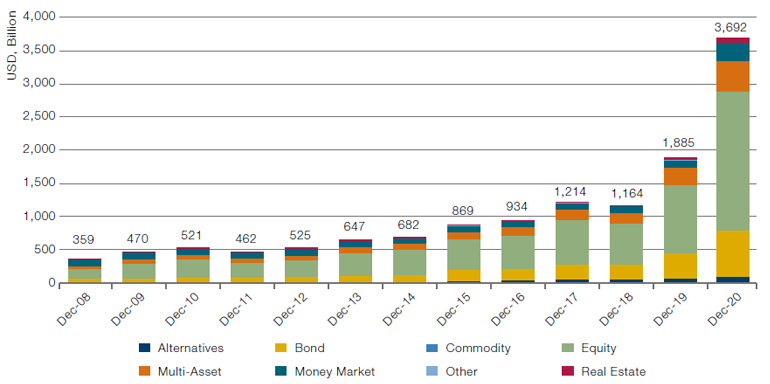

2020 was the year in which ESG investment went mainstream in the equity markets. Figure 1 shows the dramatic inflows into ESG-related funds, particularly in the US. In the course of a year, we have gone from a situation where management teams were largely able to ignore or underplay their commitment to ESG obligations, to a corporate landscape where those firms that do not prioritise their environmental, social and governance responsibilities risk being left behind.

Figure 1. Assets Invested in ESG Strategies

Source: Bloomberg, JPMorgan, Lipper; as of December 2020.

ESG In Fixed Income

ESG investors in credit have the ability to effect positive change in companies who do not have publicly tradable equities – the vast and increasing world of firms with private equity but public debt.

ESG has not yet impacted the world of fixed income to the same extent as the equity markets. At the end of 2019, only around 20% of global ESG-related investments were in fixed income. This is partly due to the fact that shareholders have voting rights and usually greater ability to influence management behaviour. There is also the potential of significant upside for the shareholders of those firms who can turn the current focus on ESG to their advantage. However, we still believe that ESG will increasingly become an important consideration for fixed income investors as the credit risk associated with them grows: ESG impacts the whole enterprise value, not just the equity. Initially there will be inevitable spillover from the equity markets, where ESG considerations are increasingly driving corporate behaviour. Longer term, we believe ESG risks will be considered as part of credit risk. There’s also the fact that ESG investors in credit have the ability to effect positive change in companies who do not have publicly tradable equities – the vast and increasing world of firms with private equity but public debt.

The identification and management of ESG-related risks is a form of enterprise risk management. We believe that it will increasingly be the case that firms which fail to address environmental, social and governance issues face being punished by their customers, regulators and investors. This may have significant ramifications for bondholders with the potential for such events to have a material adverse impact on a firm’s credit quality. We are already seeing increasing recognition from credit ratings agencies of the magnitude of potential ESG-related incidents and their ability to impact a company’s credit profile. With the advent of green bonds, ESG-focused fixed income funds that go beyond mere exclusion lists, and an increasing availability of ESG-related tools and data, we expect to see continued interest and growth in ESG-focused fixed income in the coming years.

There has, for some time, been a lively debate in the academic circles of quant equity investing as to whether ESG can be considered a factor in itself. Typically, a factor needs to fulfil the following characteristics:

- Each factor has a solid rationale for the existence of a return premium;

- There is significant historical empirical evidence to support the premium;

- They exhibit low correlation with other factors;

- They can be implemented at scale.

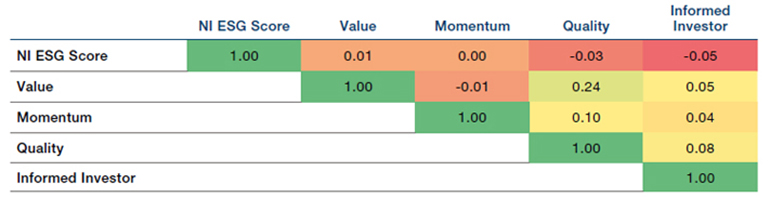

While there are certainly overlaps between ESG and other style factors (particularly Momentum and Quality), and there is perhaps not yet sufficient historical data to establish consensus around the designation, we believe that ESG is both material enough and discrete enough to be considered a unique factor and can be usefully applied to portfolios to generate alpha. Figure 2 outlines the correlation of Man Numeric’s own proprietary ESG factor with other factors.

Figure 2. ESG Is Complementary to Existing Signals

Source: Man Numeric; Between 1 January 2016 – 1 September 2019.

ESG is both material enough and discrete enough to be considered a unique factor and can be usefully applied to portfolios to generate alpha.

While there is a larger amount of research providing evidence of the performance of ESG-style factors in the equity markets, there have also been a number of compelling studies of its role in fixed income, including Polbennikov et al. (2016), Dynkin et al. (2018) and Ben Dor et al. (2021). The latter studied the performance of bonds issued by companies with ratings from the two major ESG data vendors, MSCI and Sustainalytics. They note that while by 2018 around 90% of the US dollar and euro investment grade corporate indices by market value were covered, this level of coverage drops off fairly swiftly when one moves back in time. They also note that the high yield indices suffer from much poorer coverage, given the number of private companies within the index as well as the usually smaller size of issuer, meaning that data vendors have not prioritised them in the roll out of their ratings.

The study by Ben Dor et al. made several interesting observations about the performance of corporate bonds when ESG style factors are applied. The first is that there is the possibility of unintentional biases being established in a portfolio. They found that an ESG-tilted portfolio of investment grade bonds had an average spread that was less than half that of a portfolio scoring poorly on ESG-related metrics. Thus, a portfolio that does not control for portfolio risk characteristics when implementing an ESG factor tilt may produce unanticipated returns because of an unintended bias towards higher-quality, lower-spread issuers.

Portfolio Construction

The quality of both the raw data surrounding ESG performance and the reliability and sophistication of the ratings system are seen as impediments to the continued growth of broader ESG investment. Here, though, is an area where quant strategies ought to be able to help.

As far as how to accommodate these observations in portfolio construction, there are two possible lines to take (or, indeed, a combination of the two): managers pursuing a peer-relative/best-in-class ESG approach; or managers addressing ESG more in absolute terms, working exclusion lists into their strategy (e.g. completely removing the energy sector). For quant strategies, again breadth is key, and we do tend to see strong ESG leaders in all industries. For this reason, although quant strategies can certainly accommodate redefined benchmarks or broad restriction lists, we tend to favour a peer-relative, best-in-class approach.

Just as in quant credit, we are only at the beginning of the market’s evolution and thus expect to see significant development in the coming years. Indeed, the integration of ESG factors into quant investing is still only in its infancy. ESG investment and quant strategies ought to be happy bedfellows. Quant investing loves data, and often the messier the data the better. The quality of both the raw data surrounding ESG performance and the reliability and sophistication of the ratings system are seen as impediments to the continued growth of broader ESG investment.

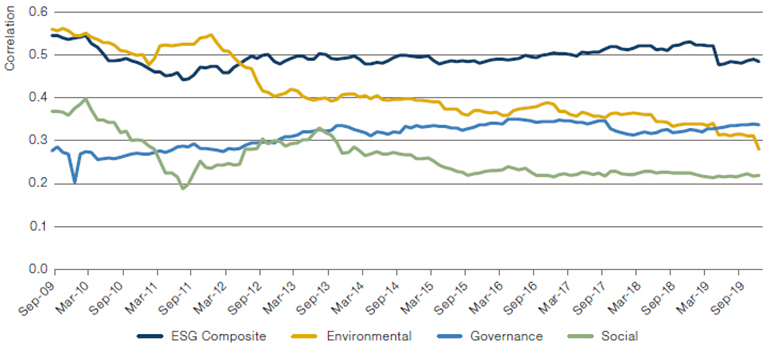

Here, though, is an area where quant strategies ought to be able to help. Fixed income markets will become more efficient when their inefficiencies are subjected to the clarifying attention of quant investors. Similarly, we expect the increasing focus from quant strategies on ESG will drive improvements in the quality of data vendor ratings. As Figure 3 shows, the correlation between ESG scores from MSCI and Sustainalytics are currently surprisingly low, reflecting the very different methodologies and priorities at each firm (credit rating agencies are around 95% correlated).

Figure 3. Correlation: MSCI Versus Sustainalytics

Source: MSCI, Sustainalytics, Man Numeric; Between 1 September 2009 and 24 September 2019.

There are a number of other points worth considering when thinking about the intersection of quant credit and ESG. The first is that as well as being a factor in its own right, other factors can be given an ESG tilt – some investors have incorporated green patent data in Value strategies or corporate culture information in Quality. The broader point here is that sophisticated managers in quant credit will be able to create their own proprietary ESG factor models and also integrate ESG elements into other style factors.

There’s also the question of the breadth of ESG as a concept – one criticism some investors have levelled at ESG-focused funds is that it is possible for companies with poor environmental records to be included in supposedly responsible portfolios if their performance in social and governance metrics is deemed an adequate counterbalance. This kind of selection error can be addressed by adding a further constraint to portfolios that specifically take into account environmental factors. Figure 4 shows that a portfolio with an ESG tilt may end up with significantly greater exposure to carbon emissions than the underlying index. This can be mitigated by adding an additional constraint that maintains carbon exposure below 80% of the index average. In a world where there is questionable data, it is important to think about how the intelligent use of data can deliver portfolios that cleave more closely to investor requirements.

Source: Man Numeric, Trucost; as of December 2020.

Conclusion

It is merely a quirk of timing that the rise of quant credit should coincide with the explosion of ESG investment. We believe, however, that the two worlds will continue to intersect and grow together.

It is merely a quirk of timing that the rise of quant credit should coincide with the explosion of ESG investment. We believe, however, that the two worlds will continue to intersect and grow together. Fixed income has been slower than equity markets to embrace ESG, but there is a clear and compelling rationale behind the use of ESG data in quant credit. Indeed, it could be that the strides made in quantitative ESG strategies in credit pave the way for a wider acceptance of responsible investment in fixed income more broadly.

We conclude with the observation that stewardship lies at the heart of any credible ESG strategy. The model-driven investment process of quant strategies does not preclude a deep engagement with stewardship. In fact, the rise of quant credit can strengthen that engagement, reaching even more issuers. We believe that all stakeholders should be presenting management teams with a consistent and coherent message regarding their ESG obligations. This is why we address ESG from a corporate level at Man Group, whereby a top-down approach helps ensure a coordinated response in which equity and bondholders are united in their approach to driving change at the companies in which the firm invests. What is clear is that the momentum of ESG investment in credit is large and growing, and we think consensus will continue to build in this space, not only across different fixed income disciplines, but increasingly across firms’ capital structures.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.