Introduction

2021 was the worst year for sterling-denominated investment grade bonds since the Global Financial Crisis in 2008, with returns of -3.3%. Yet, as we write today, the index has declined a further c.5%. Despite the large sell-off over the past few months, we posit that investors should consider adding exposure to the asset class.

Why Have Sterling-Denominated IG Bonds Been Troubled?

Throughout 2021, much of the negative performance in the sterling-denominated investment grade asset class was driven by expectations of moves in interest rates, with credit spreads holding relatively steady. Near-zero interest rates stimulated risktaking, pushing yield-seeking investors further into lower-rated credit.

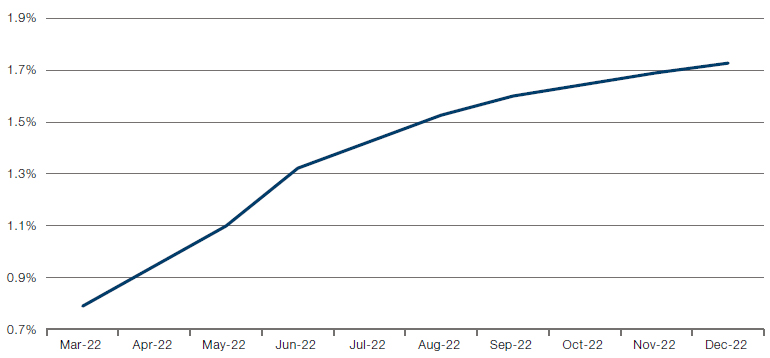

In addition, this time last year, inflation was but a transitory concern. However, today, the Bank of England is having to adjust to a paradigm where, absent monetary policy intervention, inflation will start to become structural. Indeed, the BoE started raising interest rates in December 2021, and has further increased base rate by 25 basis points in early February to 50 bps. Further hikes are almost certainly on the way: four members of the Monetary Policy Committee wanted to raise rates by 50 bps rather than the initial 25, and the market is likely to price in more than five additional rate hikes by the end of the year (Figure 1)1.

In addition, the BoE has also surprised the market by not only reducing asset purchases, but also by considering the sale of existing holdings of corporate bonds. Logic would imply that as soon as the BoE, which is a price-insensitive buyer, decides that blanket purchases no long support its aims, there will be a rapid period of price discovery. That price discovery is often painful, as we have seen in 2022.

Figure 1. Implied UK Policy Rates

Source: Bloomberg; as of 9 February 2022.

The Opportunity

However, we believe that this is exactly the time investors should consider investing in sterling-denominated investment grade bonds for two main reasons.

First, with the sharp move wider in spreads, we believe that valuations, even at the index level, now offer more attractive opportunities for investors. In particular, the real estate, energy and non-banking financial sectors look particularly attractive from a valuation perspective, in our view.

Secondly, with base rates moving higher, bonds have once again built up some cushion to protect on the downside should the inflation not persist, or if the global economy moves into recession which could create more downside pressure on risk assets. The traditional negative correlation between fixed income and risk assets should re-assert itself in the future. With bonds providing diversification from possibly volatile equities, we believe this should cause the discerning investors to re-consider fixed income within their overall asset allocation.

Conclusion

While sterling-denominated IG bonds have been troubled, we believe that investors should still consider the asset class, especially in real estate, energy and non-bank financials. With rate hikes already underway, wider spreads and offer a more attractive entry point than previous highs. Likewise, if central bank tightening can get a grip on inflation or if global growth stalls, bonds will again provide diversification from equities and a valuable margin of safety. It may have been a rough year so far – but don’t write IG bonds off.

1. https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2022/february-2022

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.