Introduction

Quant credit is a strategy class that we believe will come increasingly to dominate the credit markets. Quant credit remains a relatively niche investment area compared to quant equity; one data provider1 stated that last year in the US, less than USD150 billion bonds were transacted electronically by quantitative investors.2 The reasons for the lack of progress in the space are numerous, but most come down to the differences in transaction mechanisms for bonds and equities. Bonds are still largely traded over-the-counter, meaning that they are less liquid, that prices are less visible and transaction costs higher than for equities. This is all changing as the electronic trading of fixed income becomes increasingly prevalent.

The Rise of Quant Equity

Fixed income is still dominated by large, slow-moving, buy-and-hold money and unlike equity markets it is not yet heavily trawled by quant managers.

The attraction of quant credit is clear. Fixed income is still dominated by large, slow-moving, buy-and-hold money and unlike equity markets it is not yet heavily trawled by quant managers. Consequently, it is a market rife with inefficiencies and quant strategies exist to harvest the opportunities that such inefficiencies throw off. Even in the most on-the-run strategies, it remains an uncrowded space. Quantitative investment strategies are increasingly using the growing amount of data generated by the fixed income and credit markets (and in the broader world) to deliver uncorrelated returns and eliminate the human biases to which discretionary investors are susceptible.

Quantitative investing has radically altered the investment landscape in equities. This evolution was partly driven by the move from over-the-counter to electronic trading of equities in the 1980s and ’90s. Since then, the growth of algorithmic approaches to investment has rocketed. In 2019, across the US stock market value (of more than USD30 trillion), less than a quarter of shares were held by human-managed funds. The balance was held by quantitative investing styles (through a combination of ETFs, which are essentially passive quant investing, and more than one-third by funds pursuing more active quantitative investing mandates).3

Equities were ideally suited for the deployment of algorithmic trading strategies; they were highly liquid, electronically traded, had low transaction costs and a significant and readily available amount of relevant data. Quant investing in equities offered investors a compelling alternative to traditional discretionary management, one that used a series of transparent, back-tested and rules-based models to construct the algorithms that drove investment decisions.

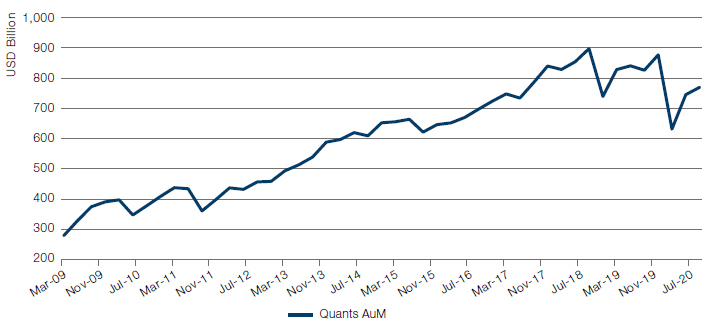

Figure 1. AUM Growth of 50 Leading Quant Equity Strategies, 2009-2020

Source: Bloomberg; as of 31 December 2020.

The Slower Rise of Quant Credit

It was always thought that credit would follow swiftly on the tails of the equity market in developing a substantial quant investment universe. That this hasn’t happened is down to a number of factors. Firstly, the Global Financial Crisis (‘GFC’) was born in the credit markets and specifically in the more innovative quarters of that market – asset-backed securities (‘ABS’), collateralised debt obligations (‘CDOs’), or credit default swaps (‘CDS’), for example. This necessarily put a damper on further innovation for some time. Quant credit would, at least in theory, benefit from a full and highly liquid CDS market, but a combination of the GFC and the continued low-spread environment has meant that CDS has never quite developed into the market it might have given a more supportive backdrop.

It should also be pointed out, as politely as possible, that the bond markets are not known for their openness to innovation.

It should also be pointed out, as politely as possible, that the bond markets are not known for their openness to innovation. It is an investment universe dominated by large, slow-moving, buy-and-hold investors. And, indeed, investors to whom the credit risk component of their investments is only one risk among many. These are managers who are often navigating liability-matched payment profiles (for instance pension funds). They are juggling interest rate risk and convexity. They have currency risk and may be invested across numerous other credit products outside of corporate bonds. All this is to say that quant credit’s focus on isolating and trading credit risk means that it is profoundly different from traditional fixed income investing. Successful development of quant credit strategies requires a deep understanding of the nuances of the credit asset class combined with sophisticated technical skills that have been time-tested and developed in other arenas such as equities.

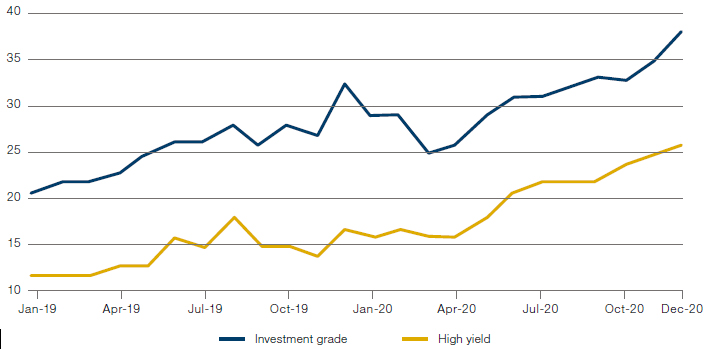

There are other impediments to the development of quant credit that need to be addressed. What is inelegantly referred to as the ‘electronification’ of the credit markets has been a halting process, but appears finally to have gained momentum in the past few years. As Figure 2 shows, the percentage of trades being executed on electronic platforms has grown substantially in recent years, with MarketAxess’s Open Trading platform alone securing a sizeable proportion of this. While investment grade credit remains more active than high yield or distressed, we expect a continuation of this move away from cumbersome over-the-counter trading towards more efficient electronic trading and straight-through processing (‘STP’).

Taking this one step further, more sophisticated market makers are investing heavily in algorithmic market making, where dealers continuously stream quotes directly to the market. This is a further development over and above MarketAxess’s predominantly Request for Quotation (‘RFQ’)-based process. As this process continues, credit investors will see more real-time price discovery and improved liquidity in corporate bonds.

Figure 2. Percentage of Bonds Traded Electronically

Source: Greenwhich MarketView; as of 31 December 2020.

Liquidity: A Challenge for Quant Credit

Liquidity is one of the major hurdles that quant credit has had to overcome. Partly due to the cumbersome trading process, partly because bond investors have traditionally taken a buy-and-hold approach and partly due to the complexity of bonds compared to the homogeneity of equities, bond markets have historically been less liquid than equities. This has been a problem for the rise of quant credit, given that quantitative strategies require visible and actionable trading levels. Until the advent of all-to-all electronic trading platforms, bond investors were reliant on liquidity offered by investment bank trading desks. As we saw in the GFC and to a lesser extent during the nadir of the coronacrisis in March 2020, this liquidity can disappear when it is most needed, but the general trend for liquidity in credit has been a positive one, supported by the dramatic increase in electronic trading.

Best Execution in Quant Credit

The rise of quant credit will drive greater liquidity and wider participation in electronic trading platforms.

Recent central bank bond buying programmes have given dealers comfort that there exists a dependable source of liquidity outside of the traditional market, while increasing participation in credit from investors whose strategies involve higher turnover suggest that the positive momentum in credit market liquidity is likely to continue. The point here, of course, is that there’s an interesting positive feedback loop. The rise of quant credit will drive greater liquidity and wider participation in electronic trading platforms, while larger players in quant credit have begun to make markets on the all-to-all electronic platforms, meaning that they are price makers as well as price takers.

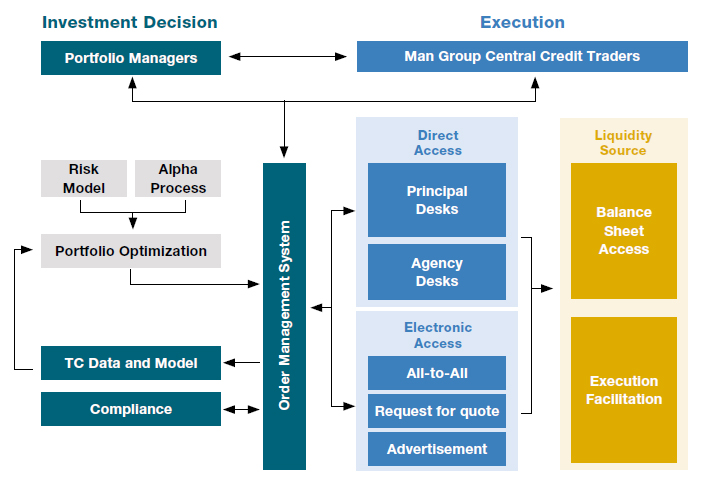

Ensuring best execution as a quant credit manager requires a recognition of the continued and significant presence of principal desks and the use of dealer balance sheets, while engaging equally with the growth of electronic trading. There is currently a great deal of hype around electronic access, but to manage credit portfolios now and for years to come, it takes data and careful analysis to route orders to the best venues. It’s a moving target as the sizes of these venues evolve, and at every point requires a considered approach not only to venue selection but to the actual portfolio optimisation process itself. An optimised portfolio solution is not optimal if you cannot trade it.

Figure 3 provides a comprehensive overview of Man Group’s investment and execution process, illustrating the complex interrelatedness of each stage of the portfolio management and implementation procedure.

Figure 3. Man Group’s Quant Credit Execution Process

Source: Man Group; for illustrative purposes only.

It’s worth stressing here that modelling trading costs remains challenging in credit because there is simply less data. There are fewer trades, that tend to be larger in size with much less well-defined intraday reference prices. On top of that, the access to liquidity, especially historically, has been relationship-driven, not commoditised as it is in equities. Furthermore, whereas you can model the concept of probability of fill in quant equity strategies with fairly simple heuristics, the concept is decidedly far more challenging in credit given the time varying nature of liquidity and a fairly large illiquid tail.

It’s not just that we require visible and actionable trading levels to execute transactions. Part of the core value proposition around quant approaches includes continuously pushing towards an optimal portfolio, minimising transaction costs, and taking advantage of the full breadth of an investable universe: this all generally points to larger amounts of smaller-sized trades compared to discretionary approaches. This has meant that quant strategies have had to and continue to adapt to where liquidity/best execution is in the market.

The Mechanics of Quant Credit Investing

The mechanics of isolating the credit risk premium of a portfolio of bonds and constructing both long-only and long-short strategies are worth outlining in detail. Firstly, it is worth reiterating that quant credit seeks to distil the credit risk premium, generally neutralising interest rate risk. The credit risk premium is a reflection of the market’s estimation of the default risk of a particular bond, taking into account any potential recovery, such that the credit spread over the risk-free rate paid to an investor in a bond should on average compensate an investor for potential loss given default (‘LGD’). At a basic level, an investor wants to be long (overweight) a portfolio of bonds whose credit spreads tighten over time and short (underweight) a portfolio of bonds whose credit spreads widen. First, though, other risks must be isolated and hedged out.

In order to remove the interest rate risk from a credit portfolio, quantitative investors have two choices. The first is to take exposure – either long or short – via CDS. Since CDS protect credit risk directly, there is only a minimal interest rate element to hedge out. The second option is to establish the interest rate sensitivity of the benchmark though measures like duration and key rate exposures. Investors then match the bond portfolio exposures to the benchmark exposures to neutralise this risk. In matching the benchmark’s rate risk, even when rates have large moves overall in total return space, it is not a performance driver of our benchmark-relative returns.

While using CDS offers a less convoluted means of achieving exposures, there are several limitations to a synthetic strategy. The first is that the CDS market is both smaller and less liquid than the cash market it references. Using the US market as an example, there are only just more than 200 US CDS names that trade with great regularity and a wider universe of perhaps 200 more that trade sporadically. This contrasts with the universe of cash bonds, which stands at north of 10,000 instruments outstanding from close to 2,000 issuers.

Suffice to say here that factors in quant credit are similar but crucially not the same as quant equity. It is not enough simply to apply concepts like Value and Momentum to credit instruments as they have been applied in equities.

We will write more fully on the intricacies of factor investing in a subsequent paper, but suffice to say here that factors in quant credit are similar but crucially not the same as quant equity. It is not enough simply to apply concepts like Value and Momentum to credit instruments as they have been applied in equities; rather each factor must be adapted and calibrated to adapt them to a different asset class with its own unique characteristics.

Alongside the application of style factors, quant credit managers must decide whether to apply leverage to their portfolio and if so what degree of leverage to use, the credit quality they wish to target – investment grade and/or high yield – and whether they are expressing their views through a long-only strategy or long-short. Typical leverage for long-short strategies currently active in the market starts at 4-5 times and extends to levels comparable to and sometimes beyond the most leveraged quant equity managers. While high yield long-short strategies are typically less levered, this is not always the case.

There has been some scepticism expressed about the ease with which corporate bonds can be shorted; our experience in executing live trades in the market has been positive and we believe short liquidity will continue to improve and fees will remain attractively low. Prime broker security lending decks can now efficiently process broad lists of requested cash bond allocations with quick turnaround times. This was largely unheard of even a few years ago when all cash bond security lending was essentially manual and ad hoc.

It’s important to note that while discretionary and quant strategies differ in many mechanical aspects, the essential motivation behind them is similar: to avoid defaults and downgrades and to capture spread tightening and avoid spread widening. Discretionary managers, who tend to have larger positions in a smaller number of names, try to achieve outperformance through deep fundamental analysis. Quantitative strategies, which are exposed to a more diversified portfolio with smaller position sizes on average, seek to outperform by capturing as much data as possible, and using this data to build optimised portfolios. Diversification and risk management are key for quant credit – understanding both quant factor risk and idiosyncratic risk, ensuring that there is disciplined position management at issue- as well as issuer-level, to propel the portfolio towards the efficient frontier.

The Current Market in Quant Credit

It may appear strange that this primer on the strategy class is so focused on the headwinds that quant credit faces. We think of it differently: it seems to us both logical and inevitable that quantitative strategies will develop into a major component of the credit markets. We have outlined above the issues faced by the market as a way of explaining why quant credit has not yet attained the size and reach of quant equity. We have also outlined why we think these impediments will not stand in the way of the market’s development much longer; indeed, we are confident that the next five years will see dramatic growth and increasing breadth in terms of the size and scope of quant strategies in the fixed income world.

The size and breadth of the market lends itself naturally to a rigorous, rules-based, quantitative approach.

As far as the quant credit market goes now, there are a few boutique hedge funds involved but it is largely dominated by a handful of complex quantitative/multi-strategy asset managers investors. As far as numbers go, it’s hard to get a clear sense of the size of the market, although it’s clear that it remains a tiny fraction of both the quant equity market and the overall fixed income market. There was USD116.5 billion traded on Open Trading via quant funds during the first three quarters of 2020, a 150% increase from the same period a year ago. In Europe, the London Stock Exchange Group’s MTS BondsPro has seen the number of quant strategies deployed on the trading venue double each year since 2017.4

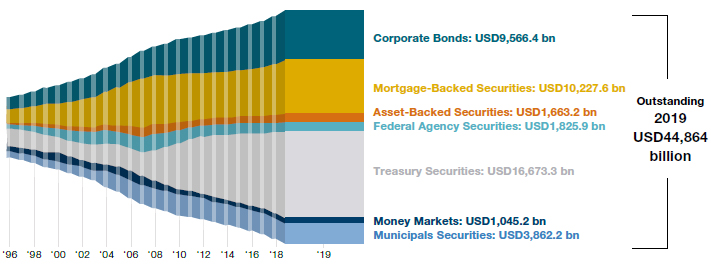

It is worth pointing out how vast the corporate credit markets are, with almost USD11 trillion of non-financial corporate debt outstanding in the US alone at the end of 2020. The obvious point to make is this: the size and breadth of the market lends itself naturally to a rigorous, rules-based, quantitative approach. We believe that it is only a matter of time before this happens in a dramatic way.

Figure 4. Outstanding Fixed Income Securities – US

Source: SIFMA; as of 31 December 2020. For illustrative purposes only.

Conclusion

We are witnessing the early days of a strategy class that we believe is due to grow exponentially. There are currently a host of inefficiencies in the bond markets, a result of the profile of the traditional investor base, embedded human biases (given the current dominance of discretionary strategies) and the absence of widespread adoption of alternative data and data science. The rise of passive bond ETFs has potentially created further distortions that will drive pricing away from fundamentals and produce opportunities for active investment strategies.

If you look at the early days of quant equity investment, those hedge funds that moved into the space early produced significant alpha. It is no secret that alpha in quantitative equity strategies is now more difficult to capture since it is now diluted over a larger pool of managers and inefficiencies are now more fleeting in nature. We believe that early-mover opportunities will persist in credit for some time to come and although available alpha may eventually decline somewhat with widespread investor participation, we believe quant credit is likely to follow the path of quant equity, so that new opportunities and new strategies will emerge as the investment universe becomes broader and more sophisticated. We believe that quant credit is here to stay and will increasingly come to dominate the credit markets. Investors who embrace and educate themselves about the strategy class now ought to be at an advantage as this process plays out.

To read our in-depth white paper on quant credit, please click here.

1. Business Insider: ‘Quants focused on the corporate bond market are in high demand as firms like AQR, Blackstone, and Point72 lean in’, 16 December 2020.

2. Ibid.

3. Toptal: ‘Human vs. Machine: The Next Frontier of Wealth Management’.

4. Business Insider: ‘Quants focused on the corporate bond market are in high demand as firms like AQR, Blackstone, and Point72 lean in’, 16 December 2020.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.