1. Introduction

The summer proved to be a continuation of the uncertain macroeconomic backdrop for markets and for hedge funds. As inflation continues to fall across developed economies, the paths for policymakers from here are more varied, with competing narratives over the timing of peak interest rates and the level of inflation that may support future rate cuts. Discerning the lag effects of higher rates on the corporate and consumer landscape is equally open to interpretation. With long bond yields rising to levels not seen for over 15 years, and some forecasts that they could rise further, market participants should be wary of long-term discount rates sparking market risks that materially exceed our habitual expectations.

2. Our Outlook

Markets have not yet progressed to a clear post-inflation narrative.

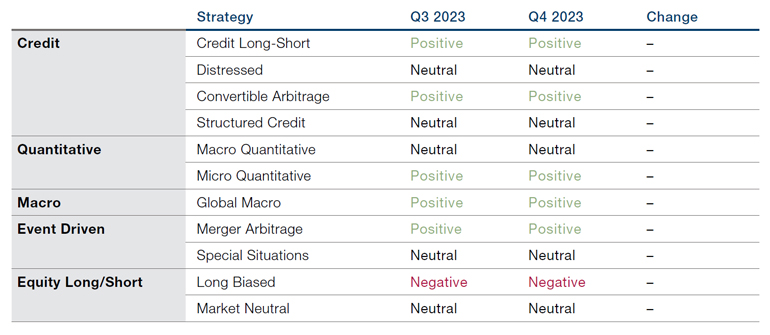

We have maintained our outlook in all areas for Q4 2023. This is unusual, but we feel that the landscape for opportunities and risks has remained similar over the past three months, partly due to the relative stasis in markets and economic data. Inflation has continued to fall in developed economies, but we feel that markets have not yet progressed to a clear post-inflation narrative. We continue to believe that the next 6-12 months represent a good environment for hedge fund alpha generation, with a key driver for much of the industry being structurally higher levels of dispersion across all asset classes. We feel that the current low levels of implied volatility in equity markets represents a level of complacency at odds with the broader economic uncertainty.

Figure 1. Q4 2023 Outlook Versus Q3 2023 Outlook

As a result, we remain positive in Credit Long-Short, Convertible Arbitrage, Micro Quant and Global Macro, and negative on Long Biased Equity Long-Short. We have also maintained our positive stance on Merger Arbitrage given the persistence of the wider spread environment, although this is an area that we are watching for possible destabilisation risks if volatility does increase materially.

3. The Details

3.1 Credit

We continue to maintain a positive view on Credit Long-Short, having upgraded the strategy in Q2 2023, and our Neutral view on Distressed, having upgraded the strategy last quarter.

We have seen a continued recovery in US credit markets since Q4 2022, with spreads still wider since the end of 2021 and underperformance by lower-rated credits (CCCs) relative to higher-quality names; presenting managers with ongoing long-short opportunities. Single-name and sector-level dispersion remains elevated despite relatively benign overall US High Yield credit spreads; as discussed in previous strategy outlooks, this is driven by varying impact of higher borrowing costs/inflation pressures on issuer fundamentals in terms of cost of debt/margins. In terms of the market composition, around 50% of US HY index names trade at < 300bps, around 10% at 501-800bps and around 10% at 800+ bps. This dispersion continues to offer a good environment for picking single-name credits on idiosyncratic expectations.

The refinancing environment remains challenging. There are higher than average opportunities for credit shorting in this environment.

The materially higher cost of capital and tougher capital market access means that the refinancing environment for many issuers remains challenging. There are higher than average opportunities for credit shorting in this environment, as well as easier access to short positioning for liability management and hedging. Furthermore, we continue to see ongoing dislocations within capital structures, offering opportunities for capital structure arbitrage trades for Credit Long-Short specialists. Default levels are increasing, with $60bn of defaults through August 2023 vs $48bn in 2022. The par-weighted rolling 12-month US high yield default rate reached 2.4% in August 2023, vs a record low of 0.3% at the end of February 2022. We note the significant uptick in US high yield and leveraged loan maturities through 2025 and 2026, and expect that if rates remain elevated, we see growing concerns about the ability of issuers to refinance.

Despite the positive outlook for credit hedge fund managers, we note that broad-market US high yield spreads remain firmly below historic median levels, and that we could see significant spread widening from current levels in a severe economic downturn, leading to more opportunity for hedge funds over the longer term, but a chaotic short-term picture. In such an environment, we remain mindful of the risks posed by basis risk between stressed single-name credit longs and index portfolio hedges.

We retain a favourable view of Convertible Arbitrage, with good opportunities in security selection in the current environment, particularly in volatility-sensitive names and event optionality. The opportunity set remains idiosyncratic as broad markets are trading close to estimates of fair value, therefore long-only exposure to convertible bonds represents an implicit play on the expected path of markets and/or volatility from here. The alpha opportunity is driven more by credit selection, as well as engaging with issuers around liability management transactions. Managers are also positioning overweight to higher-quality convertible bonds which should benefit from any pick-up in market volatility. Primary markets in convertible bonds remain active, with span>$52bn of issuance through August 2023, versus $40bn for 2022.

In Structured Credit, we remain neutral and note that diversified exposures across residential and consumer sectors still makes sense as spreads and loss-adjusted yields remain historically attractive despite recovering in recent months. Recent housing data in the US has been promising as national home prices, after declining for several months from a peak in the middle of last year, have turned positive during Q3. This is in part driven by favourable supply/demand technicals and lack of existing homes on the market as borrowers that locked in low rates prior to last year have no incentive to refinance. Increasing underlying leveraged loan defaults for CLOs as well as higher delinquencies/defaults across CRE/CMBS are expected to result in higher dispersion in these sectors, thus requiring detailed loan/CUSIP-level work as well as more targeted exposures across the capital stack and vintages.

3.2 Quantitative Strategies

The market is less macro driven now - good for the importance of fundamentals in valuing companies.

We remain positive in our outlook for Micro Quantitative strategies. As we discuss in our comments on Equity Long-Short below, we feel the market is less macro-driven now and this is good for the importance of fundamentals in valuing companies. In a similar vein, macroeconomic uncertainty can disrupt Micro-Quant strategies like equity statistical arbitrage. We are positioning for an environment where dispersion between companies helps to aid smaller relative-value opportunities that are popular with equity and credit managers, as these also create opportunities for quantitative strategies, either by playing similar themes in a more systematic manner or providing liquidity to stock pickers who are less sensitive to temporary price discrepancies. We continue to see opportunities to allocate to high-quality capacity in hedge fund managers who are spinning out of platforms and multi-strategy funds, and are watching carefully how the competition for talent in this area develops.

In Macro Quantitative strategies, we maintain our neutral stance. We expect the strategy to perform well if macro-economic volatility increases and note that the current short bond positioning does offer investors the most direct exposure to any further inflationary economic risks (which may be difficult for discretionary investors to stomach, given the high cost of carry and testing of historic levels). However, we feel there is a risk that we are approaching an inflection point in the post-inflation scare environment, and as such discretionary macro managers may be able to navigate the market uncertainty better than trend-following machines. We continue to see interesting opportunities for more niche exposures in the Macro Quant space though, with a positive outlook for alternative trend strategies that focus on less liquid markets, particularly those with exposure towards commodities, where we expect to see continued high levels of volatility and opportunity over the next few years.

3.3 Macro

We maintain our positive outlook for Global Macro strategies. As economies transition to a regime characterised by higher-for-longer policy rates, we expect regional divergence and uncertainty associated with investors’ growth and inflation outlooks to generate mispricing opportunities for macro managers to exploit.

As we embark on the path towards rate cuts, market participants and policymakers must both grapple with a wide range of possibilities. Investors have broadly adjusted their positions to align with policy rates staying in ‘restrictive’ territory for a prolonged period to bring inflation back towards target levels. Meanwhile, pricing suggests little recession risk at this juncture, implying an expectation from investors that price stability can be restored without major disruption to economic activity or the labour market. While many markets are priced for a ‘soft landing’ there remains a risk that something might break before the cycle ends, and indications of softer growth in the coming months are likely to exacerbate these concerns. Recent moves in longer-term yields and term premia have further complicated the growth outlook, amid increased scrutiny on government deficits and expectations of higher bond issuance to finance future fiscal costs associated with carbon reduction and initiatives to increase economic independence. Further upwards pressure on term premia is expected from quantitative tightening, while a policy shift in Japan is likely to have repercussions on other developed market yield curves.

Of course, further rate hikes cannot be ruled out, with core inflation proving sticky in many economies. Alongside inflation risk coming from commodity prices, debate around where the ‘neutral’ real interest rate, or ‘r-star’ in economic parlance, currently resides is adding to macroeconomic uncertainty. There is a growing suggestion that the short-term r-star has increased in many economies to levels that render current policy rates merely restrictive, even expansionary in some cases, which may partly explain the trend of upward growth revisions by economists throughout this year.

The trajectory of economies continues to deviate. Developed market central banks have signaled they are approaching the end of their cycles, their messaging shifting from how high they hike policy rates, to how long they hold them at higher levels, though Japan remains the anomaly. Meanwhile, easing cycles have begun in certain emerging market economies, including China where policymakers face the difficult task of stimulating the economy while avoiding a significant depreciation of the currency or encouraging new asset bubbles.

Effectively diversifying portfolios by combining core macro themes with idiosyncratic stories and tactical trades should help protect portfolios during bouts of market volatility.

Further stress is set to be exerted on the global financial system during a period of higher-for-longer rates, however we expect the impact will play out differently between economies. Distinct policy responses will be necessary, driving regional dispersion, while the risk of sudden policy changes will need to be considered once growth and/or inflationary pressures become more acute. Macro managers can use this as an opportunity to identify which economies are in better and worse shape to withstand tighter policy and position around the expected impact on policy paths and market pricing.

While uncertainty is a key tenet of the forward-looking opportunity set, it is also a risk that macro investing is not immune from. Managers need to be mindful that, in such a complex environment, market narratives can change quickly and see positioning washed out, as we saw during the regional banking crisis. Effectively diversifying portfolios by combining core macro themes with idiosyncratic stories and tactical trades should help protect portfolios during bouts of market volatility.

Managers must also be willing to challenge their assumptions from the pre-Covid era by being mindful of breakdowns in relationships that held in the old regime. In a similar vein, new relationships between assets and economies are forming, thus there is a greater risk of picking up unintended thematic exposures. FX Carry positions remain a prominent theme in the macro space. We see risk of a positioning unwind while growth in the global economy is poised to moderate over the next 6 to 12 months and intervention risk looms over popular shorts in Asia.

3.4 Event Driven

We have maintained our positive stance on Merger Arbitrage. The strategy is less dislocated than 3 months ago, but attractive spreads are still available, supported by a more predictable antitrust environment and an encouraging level of deal activity.

The reset of the antitrust environment has been the most positive development for the merger space, with more predictability in the review processes, the standards regulators apply, and the timelines. However, deal complexities remain high and case-specific, but that is welcomed by merger specialists, as more volatile transaction paths offer opportunities to create alpha in position sizing and active trading, including shorting. Deal activity has been trending up, particularly in small & mid-caps, mainly in the US, but also in Europe. Improved visibility of the cost of capital and available financing are both tailwinds.

In Special Situations we remain neutral; the environment has been more challenging this year, and that seems likely to continue. The timing drift of soft catalysts, the relative underperformance of mid-cap valuations, and the challenges in hedging have all played their part. That said, there appears to be a resilient pipeline of harder catalysts like spin-offs, rights issues and re-listings, and a rich opportunity set allows managers to remain more selective and apply a higher bar to enter trades.

There is a range of other smaller Event strategies on which we are positioned somewhere between neutral and positive. Event Credit and Capital Structure Arbitrage has benefited from the rise in the cost of financing, which has put a strain on lower-tier companies, and meeting stricter debt obligations can mean shifts of value from the equity to the credit side of the balance sheet, potentially leading to change of control situations. Equity Capital Market strategies note that the recent pick-up in IPO activity is indicative of a potential cyclical upturn in various related sub-strategies, like secondary block trading, increased corporate restructuring events, index rebalancing activities, as well as potential acquisition activity.

Elsewhere, the ongoing theme of corporate governance tailwinds to Japanese companies was further strengthened by the Japanese government’s proposed governance standards for mergers and acquisitions that would make it more difficult for boards of companies to reject reasonable takeover offers without justification. Catalysts can also be accelerated or triggered by effective, culturally aware activism, potentially leading to more sales of cross-shareholdings, or divestitures of non-core assets.

3.5 Equity Long-Short

We continue to hold a preference for low net Equity Long-Short managers and have maintained our neutral rating for Market Neutral Equity Long-Short and a negative rating on Long-Biased Equity Long-Short. Despite a slight pullback in August and September, global equity valuations remain elevated on a historical basis. This is not to say every market is overvalued – ex-US markets continue to trade at a discount to the US and within the US, small caps continue to look discounted. However, higher valuations without insight into future growth potential make it harder to justify net long positioning.

As markets discover a new post-inflation narrative we expect a lower impact of macro factors on equity indices, meaning company fundamentals matter more.

As markets start to discover a new post-inflation narrative around growth and expected paths of rates, we expect to see a reduction in the impact of macro factors on equity indices, which should mean that company fundamentals matter more, which is generally a better environment for stock picking. We note that the narrow market that defined the first half of 2023 has started to broaden. Dispersion has picked up and is seemingly dominated by single names rather than by sectors, themes, or factors. Also, the September earnings season was encouraging as share prices moved more alongside beats and misses.

We are no longer in an environment of ‘easy money’ as a higher interest rate and inflationary environment will continue for longer. Quality should continue to matter as companies with near-term debt maturities or weak balance sheets will be challenged for funding. Without positioning for one economic path, we do expect pockets of weakness even without a full recessionary period or reversal in the market. Like the above point around quality, companies with exposure to the low-end consumer and/or borrower and more cyclical areas of the market look more attractive for shorting. After a mid-summer de-grossing, we’ve observed a rebound in risk-taking in the fundamental space, notably as managers have been adding to their short portfolios.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.