1. Introduction

In our Q3 outlook, we warned that the macro outlook remained challenging; we believe that this view has been validated over the past three months.

More than a decade of extreme monetary and fiscal policies has led to occasional extreme volatility in asset prices. But today we are seeing that markets are not only volatile; they are also fragile. This is best illustrated by the safest and most liquid instruments surprising investors with their sudden volatility, as UK government bonds did in September (prompting an emergency intervention by the central bank).

Our focus remains on offering investors diversification through liquid alpha-focused strategies.

It is important to reiterate that we are not trying to forecast markets; our focus remains on offering investors diversification through liquid alpha-focused strategies. In this current market environment, we especially concentrate on risk managing our portfolios and identifying risks in our invested managers. That is how we intend to generate alpha for our clients. Encouragingly, through this market turmoil, the hedge-fund strategies we monitor have behaved as we expected. We are therefore not making many changes to our outlook, and are pleased that our invested managers have delivered the liquid and high-alpha diversification that we seek for our clients. Figure 1 shows that the pattern of hedge-fund performance has not changed significantly over the summer, with systematic strategies generally continuing to enjoy success while some discretionary managers struggle. It’s in the systematic area where we have upgraded our outlook.

Figure 1. YTD Returns of FRM Peer Groups

Problems loading this infographic? - Please click here

Source: Man FRM database of hedge funds; as of 31 August 2022. The returns of Macro Quant and Global Macro are normalised to have volatility equal to the average volatility of the other peer groups.

Even after a prolonged drawdown in most traditional markets, there are still plentiful challenges ahead for investors.

While we believe that hedge funds have in aggregate proven their worth in a difficult year, we should not overlook the dispersion evident between and within sectors in Figure 1. Even after a prolonged drawdown in most traditional markets, there are still plentiful challenges ahead for investors: not least persistently high inflation, synchronised tightening of monetary policy, the risk of recession, and renewed volatility from a possible escalation of the war in Ukraine. We aim to be part of the solution to these challenges through diligently constructed portfolios, emphasising risk management and partnership with clients.

2. Our Outlook

2.1. Current Outlook

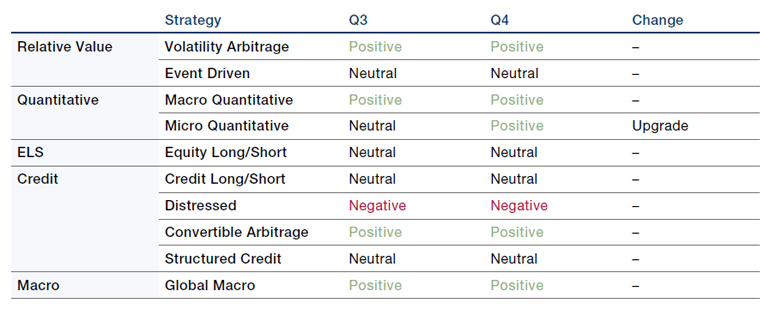

Figure 2 shows our stance on different hedge-fund strategies for the fourth quarter.

Figure 2. Q4 Outlook Versus Q3 Outlook

2.2. New and Notable

We expect more dispersion in equities and credit, which should fuel returns for micro quantitative managers.

We have upgraded our outlook on micro quantitative strategies to positive. This is in part environmental: we expect more dispersion in equities and credit, which should fuel returns for micro quantitative managers. Furthermore, we are excited about new high-quality managers in this area; these strategies will be a focus of our due diligence for the rest of 2022.

3. The Details

3.1. Relative Value Strategies

We continue to have a positive view of volatility arbitrage strategies with a net long vol bias, as these are well positioned to generate uncorrelated returns in the current dynamic volatility environments. Cross-asset strategies in particular can rotate into attractive tactical themes – and there are many potential geopolitical scenarios at the moment that could sustain or even accentuate volatility regimes.

We continue to maintain a neutral outlook for more opportunistic event-driven strategies. Although announced corporate events can offer attractive non-correlated return streams, longer-dated catalyst trades in particular are not immune to market directionality. There are certainly compelling pressures leading corporates to make their structures more efficient and unlock value potential, but catalysts materialise more predictably in more stable environments. This is particularly the case for softer catalysts. Our neutral outlook is also reflected in the lower observed exposure levels of investment managers, potentially awaiting better entry opportunities. Some growing opportunities include ADR arbitrage trades, which benefited from a US-China agreement in principle regarding accounting treatments, as well as other actively implemented relative-value trades in Asia.

Our neutral outlook on event-driven strategies is also supported by the environment for merger-arbitrage trades. We’re acutely aware that in this shorter-dated strategy both the opportunities and risks can fluctuate quite rapidly. We see this highlighted in merger spreads, which tightened during Q3 compared with the dislocated wides seen late in Q2. However, recently spreads have spiked again in response to market weakness. Deal completion risks are nevertheless often idiosyncratic, and currently there are attractive risk/reward opportunities in fairly priced transactions with strong strategic rationales. Deal flow is vital for merger arbitrage, and recent activity levels have been decent, particularly in the US. This flow is trending to smaller to mid-sized deals, while larger deals, often led by private equity and requiring significant debt raises, are under pressure from fast-rising rates. Antitrust sentiment continues to be a challenge for this space in multiple jurisdictions, but recently there have been encouraging deal approvals. Antitrust risks appear to be somewhat more predictable and priced in by the market, however.

Overall, while fragility has decreased since Q2, disappointing or unexpected developments around announced catalysts are often followed by contagion in related transactions. Conversely, calmer markets, successful deal closures, predictable regulators, wider spreads to reflect rising rates, and strengthening deal calendars would bolster these strategies. Disciplined, experienced and well researched investment managers with differentiated tactical trading opportunities should be well placed to benefit.

3.2 Quantitative Strategies

The approaching winter season may offer opportunities in the energy sector.

Our outlook for quant strategies is positive overall. We feel our strong bias towards macro quantitative strategies, like trend and quant macro, is sensible for Q4, as they are well poised to navigate the volatile rate, inflation and FX environments. Similarly, we have confidence in our quant commodity strategies and believe the approaching winter season may offer opportunities in the energy sector. As discussed above, we have also upgraded our outlook on micro quantitative to positive.

Looking further ahead, we are enthused by recent developments in China that will soon allow managers to trade futures more cost effectively and increase capacity. However, many systematic managers must still complete the required legal work to benefit from the changes.

Lastly, futile prospecting has moderated our entry into quantitative crypto funds and highlighted challenges in sourcing managers of institutional quality that also offer the best investment talent. Ultimately, we are confident this is an attractive new area, but we feel there is no great rush either. On the contrary, digital assets are increasingly being adopted by many of our managers at a sensible pace anyway. And rather than be heroic in what seems like a minefield of adverse selection today, we err on the side of patience. Our goal is to keep an active network and a keen eye for gems, while allowing nature to take its course and, through survival of the fittest, weed out some of the weaker players. Volatility in cryptocurrencies and the collapse of excessive leverage have likely accelerated this development.

3.3 Equity Long/Short

Our outlook on equity long/short (ELS) remains balanced. While lower equity valuations may eventually represent an attractive entry point, we do not think this is the time to make a beta bet. Rather, we feel that low beta and tactical ELS managers are more attractive against a backdrop of an uncertain macroeconomic climate.

We have previously noted decreased risk-taking across ELS funds and this trend has continued. At the high level, this can be seen in reduced gross and net exposure levels. Beneath that, portfolio composition suggests some hesitancy from ELS funds as well. Single-name turnover is low, with fewer new long positions being established during market selloffs. At the same time, there has been an uptick in index-level hedges relative to single-name shorts. We also note increased use of options and tail-risk hedges. Heading into Q4, managers are clearly focused on preserving capital rather than playing offence.

Given an uncertain economic climate and lower risk-taking, we view ELS as a form of mitigating downside risk rather than absolute return heading into the end of 2022.

3.4 Credit

The risk/reward for meaningful outright credit risk remains unattractive, in our view.

US credit markets have been volatile but somewhat rangebound over the past quarter as market participants grapple with ever-higher rates and increasing odds of a recession. Despite equities hitting new lows for the year, broad US high yield and CCC-rated credit spreads still remain around historical median levels, and well below recession levels. The risk/reward for meaningful outright credit risk remains unattractive, in our view, and as such we continue to favour credit long/short over distressed managers.

Increased dispersion by credit ratings and across sectors is leading to an improvement in long/short high-yield opportunities. Similarly, credit long/short managers are increasingly seeking to take advantage of capital-structure arbitrage opportunities driven by dislocations between debt and equity in volatile markets. There is still a lack of substantial defaults in the US and, as a result, managers generally want to maintain dry powder in case defaults pick up or spreads widen materially. Managers with a global focus, though, are increasingly evaluating and selectively allocating to the sizeable universe of emerging-market distressed/defaulted sovereigns and corporates.

Overall convertible bond market valuations, while cheaper this year, have held up much better compared with the significant dislocation of Q1 2020. However, as we discussed last quarter, there has been a meaningful pickup in the universe of busted convertible bonds of growth and technology-oriented companies. These securities tend to be somewhat orphaned by traditional long-only as well as volatility-oriented convertible arbitrage managers. We like the event optionality and idiosyncratic opportunity set in these credit-sensitive convertible bonds. A recent pickup in exchanges and refinancing-driven new issuance has been positive and it is expected to be sustained as issuers look to address short-dated maturities.

Spreads across most securitised-products sectors are little changed to modestly tighter since our last quarterly update, but remain meaningfully wider since the beginning of the year. This, coupled with ongoing repricing higher of interest-rate curves, has resulted in some of the highest loss-adjusted portfolio yields for structured credit managers in the post-Covid period. Managers have been deploying incremental capital with increasingly attractive convexity, seeking to take advantage of opportunities across the credit curves, but remain mindful of the elevated market volatility.

While underlying consumer credit and residential fundamentals have largely remained stable in the US, there is increasing uncertainty and a softening is anticipated and modelled by managers. Rising mortgage rates have led to reduced housing affordability and demand, resulting in an expected decline in home prices next year. A gradual rise in delinquencies and losses is expected, but ongoing cashflows should remain robust given the credit enhancement and curing as well as reduced loan-to-value ratios for somewhat seasoned securities.

As such, we look to add risk opportunistically, but there is no change in our overall balanced outlook given:

- The highly uncertain macroeconomic environment, and

- Unlike previous dislocations, the opportunity set should persist for longer given the lack of central-bank support for risk assets.

3.5 Global Macro

Macro managers opted for a more nimble, tactical approach over the summer to protect against whipsaws.

We are positive on discretionary macro, maintaining our preference for strategies that operate across multiple regions and asset classes in both directional and relative-value investing. After macro managers opted for a more nimble, tactical approach over the summer to protect against whipsaws, in light of growing momentum behind the ‘peak inflation’ narrative, we saw a healthy redeployment of risk in September. The hawkish rhetoric emerging from the Jackson Hole Economic Symposium put to rest any ambiguity around central banks’ primary focus – inflation – which restored a degree of synchronicity between policymakers and markets.

Now, the focus has returned to pricing global policy paths against a difficult backdrop of stubbornly high inflation, economic slowdown, an energy crisis in Europe, and dwindling central-bank credibility, while the impact of quantitative tightening and changes to the fiscal outlook and government bond supply are expected to create opportunities in longer-maturity instruments. We are also seeing themes positioned around volatile current account deficits, de-globalisation, and developing expectations for mortgage rates and housing markets.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.